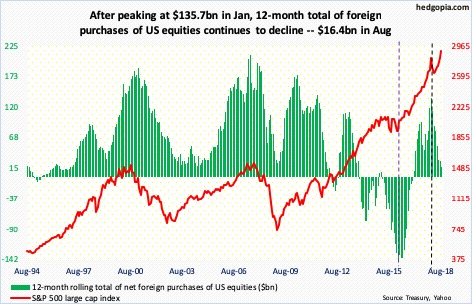

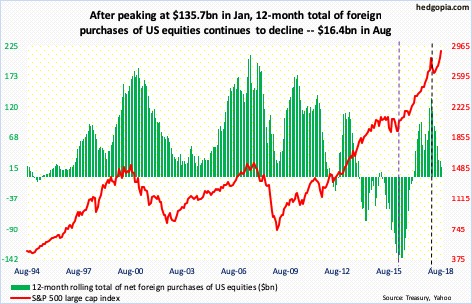

US stocks had a good August. The S&P 500 large cap index jumped three percent in that month to 2901.52. Foreigners did not lend a helping hand.

Net purchases of US equities by foreigners were minus $16.9 billion in August. They have been net-selling for a while. In the seven months from February through August, there was one positive month – $6.1 billion in April, with the rest all negative.

Monthly data tend to be volatile for sure. On a 12-month rolling total basis, August purchases were merely $16.4 billion, down from peak purchases of $135.7 billion in January. The index also began to retreat in that month (black dashed line in the accompanying chart). The S&P 500 (2809.21) went on to surpass that high, but only to subsequently breach breakout retest.

It is worth recalling that back in February 2016 when US stocks reached a major bottom foreigners sold a record $145.3 billion worth, before reversing (violet dashed line). As the chart shows, the red line and the green bars do tend to move in sync. Their activity is worth watching. The data is published with a lag. August’s data came out Wednesday. September’s will be out in a month. Barring that, it is a useful series. Going by how October has turned out, foreigners in all likelihood have not yet warmed up to US stocks.

Leave A Comment