After several months of significant reserves liquidations by China (specifically by its Euroclear proxy “Belgium”) which tracked the drop in China’s reserves practically tick for tick, in October Chinese+Belgian holdings were virtually unchanged according to the latest TIC data, as China moderated its defense of its sliding currency. Of course, putting this in context still shows a China which has sold $600 billion of US paper since 2014, as this website was first to note over half a year ago.

And while we expect a prompt resumption of Treasury selling in the coming months following China’s recent aggressive devaluation of its currency, what was more notable in today’s TIC data was the consolidated total change of all foreign US Treasury holdings.

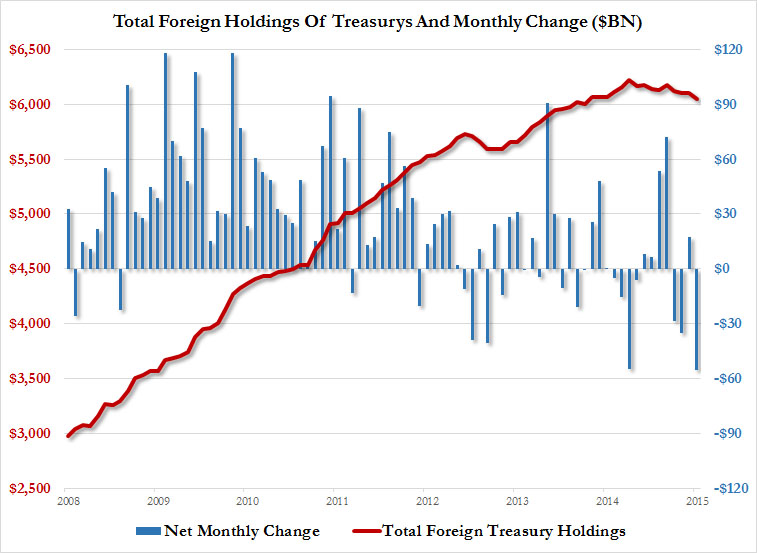

As shown in the chart below, following an increase of $17.4 billion in September, foreign net sales of Treasuries hit an all time high of $55.2 billion, surpassing the previous record of $55.0 billion set in January. In absolute terms, October’s total foreign holdings by major holders declined to $6,046.3 trillion the lowest since the summer of 2014.

What is the reason? There are two possible explanations, the first being that foreigners are unloading US paper (ostensibly to domestic accounts) ahead of what they perceive an imminent Fed rate hike which would pressure prices lower, or more likely, the ongoing surge in the dollar and collapse in commodity prices continues to pressures foreign reserve managers to liquidate USTreasury holdings as they scramble to satisfy surging dollar demand domestically and unable to obtain this much needed USD-denominated funding, are selling what US assets they have.

Should this selling continue or accelerate in the coming months and if it has an adverse impact on TSY yields, it may also force the Fed’s tightening hand if, as some expect, the liquidation of foreign reserves becomes a self-fulfilling prophecy and leads to a material drop in Treasury prices.

Leave A Comment