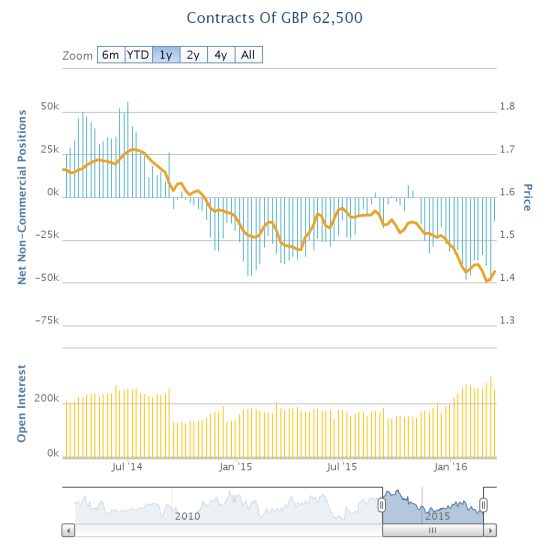

A bottom for the British pound just got more likely. The latest data from the CFTC shows that net speculators beat a major retreat from net short positions against the British pound:

Bearish sentiment is suddenly in major retreat on the British pound (FXB)

Source: Oanda’s CFTC’s Commitments of Traders

The chart shows that speculators have not held such small net short positions since the surge began in early November. I consider this change significant enough to assume that the British pound has printed a bottom for now. I addressed other catalysts last week in “The British Pound Finally Attempts A Comeback.” Accordingly, I doubt another pound-specific catalyst strong enough to break recent lows will arrive before the June 23rd referendum on the UK’s membership in the European Union (EU). I am particularly referring to the bottom holding against the U.S. dollar.

Speculators may have confirmed the 50-day moving average (DMA) breakout for GBP/USD.

Source: FreeStockCharts.com

Of course, a revival in policy divergence or a major reversal in tone from the Fed could send the dollar soaring again, but I am expecting neither. In fact, the U.S. dollar index is breaking down from its 200-day moving average (DMA).

The U.S. dollar index is breaking down. It now sits at a 5-month low.

Source: FreeStockCharts.com

The yen’s strength may become sufficient to break the recent low. However, if GBP/JPY also manages a 50DMA breakout, I will quickly drop my short on this pair.

GBP/JPY continues to linger under 50DMA resistance.

Source: FreeStockCharts.com

The latest Oanda’s CFTC’s Commitments of Traders included some other big moves:

Leave A Comment