Forecast for the EUR/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.07163

Opening: 1.09160

Chg. % of the last day: +0.10

Daily range: 1.08207 – 1.09173

52-week range: 1.0366 – 1.1616

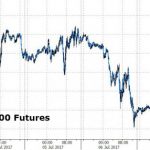

According to preliminary data, in the first round of the presidential elections in France, Emmanuel Macron (24% of the vote) and Marine Le Pen (22% of the vote) are leading. Both candidates go forward to a second round of voting, which will be held on May 7. There is a significant increase in demand for the euro. The EUR/USD currency pair opened with a gap up (more than 150 points). The key trading range is 1.08350-1.09150.

The MACD histogram has fixed in the positive area and above the signal line, which indicates the strength of the buyers at EUR/USD.

Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are signals at the moment.

The news line on 04.24.2017:

– the IFO business climate index (11:00 GMT+3:00);

– a speech by FOMC member Kashkari (18:30 GMT+3:00).

Trading recommendations

Support levels: 1.08350, 1.07700

Resistance levels: 1.09150

If the EUR/USD quotes consolidate above the 1.08800 mark, we recommend you to look for entry points to open long positions. The nearest target for fixing profits is 1.09150-1.09250.

Forecast for the GBP/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.28085

Opening: 1.28361

Chg. % of the last day: -0.01

The daily range: 1.27735 – 1.28379

52-week range: 1.1986 – 1.5020

The British currency continues to be in a rather continuous flat. Unidirectional movement is not observed. The key support and resistance levels are 1.27700 and 1.28500, respectively. At the moment, GBP/USD is testing the lower limit of the trading range.

Leave A Comment