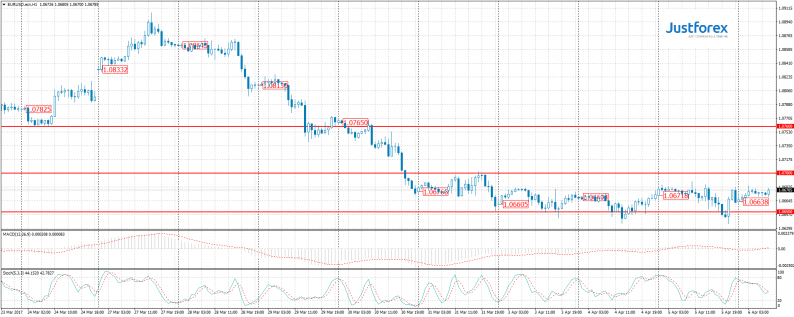

Forecast for the EUR/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.06718

Opening: 1.06638

Chg. % Last day: -0.10

Day range: 1.06617 – 1.06842

52-week range: 1.0366 – 1.1616

During yesterday’s trading, the unidirectional trend was not observed. The EUR/USD currency pair was in a flat with a range of 35 points. The key trading range is 1.06500-1.07000. The attention of financial market participants is focused on tomorrow’s report on the labor market in the US.

The MACD histogram has started to rise and moved into the positive zone, indicating “bullish” moods on the EUR/USD currency pair.

Stochastic Oscillator is in the neutral zone, the %K line crossed the %D line. There are no signals yet.

News background:

– the ECB president Draghi`s speech (10:00 GMT+3:00);

– publication of the ECB meeting minutes on monetary policy (14:30 GMT+3:00);

– the number of initial claims for unemployment benefits in the US (15:30 GMT+3:00);

– speech by FOMC member Williams (16:30 GMT+3:00).

Trading recommendations:

Support levels: 1.06500

Resistance levels: 1.07000, 1.07600

We expect the EUR/USD correction. If the price consolidates above the round level of 1.07000, one should consider buying. The potential for movement – 1.07400-1.07600.

Forecast for the GBP/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.24398

Opening: 1.24827

Chg. % Last day: +0.34

Day range: 1.24730 – 1.25009

52-week range: 1.1986 – 1.5020

Yesterday, purchases prevailed on the GBP/USD currency pair. The currency of Britain rose by more than 50 points. Support was provided by positive data on business activity in the services sector. At the moment, the pound is testing a local resistance of 1.24950.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy GBP/USD.

Leave A Comment