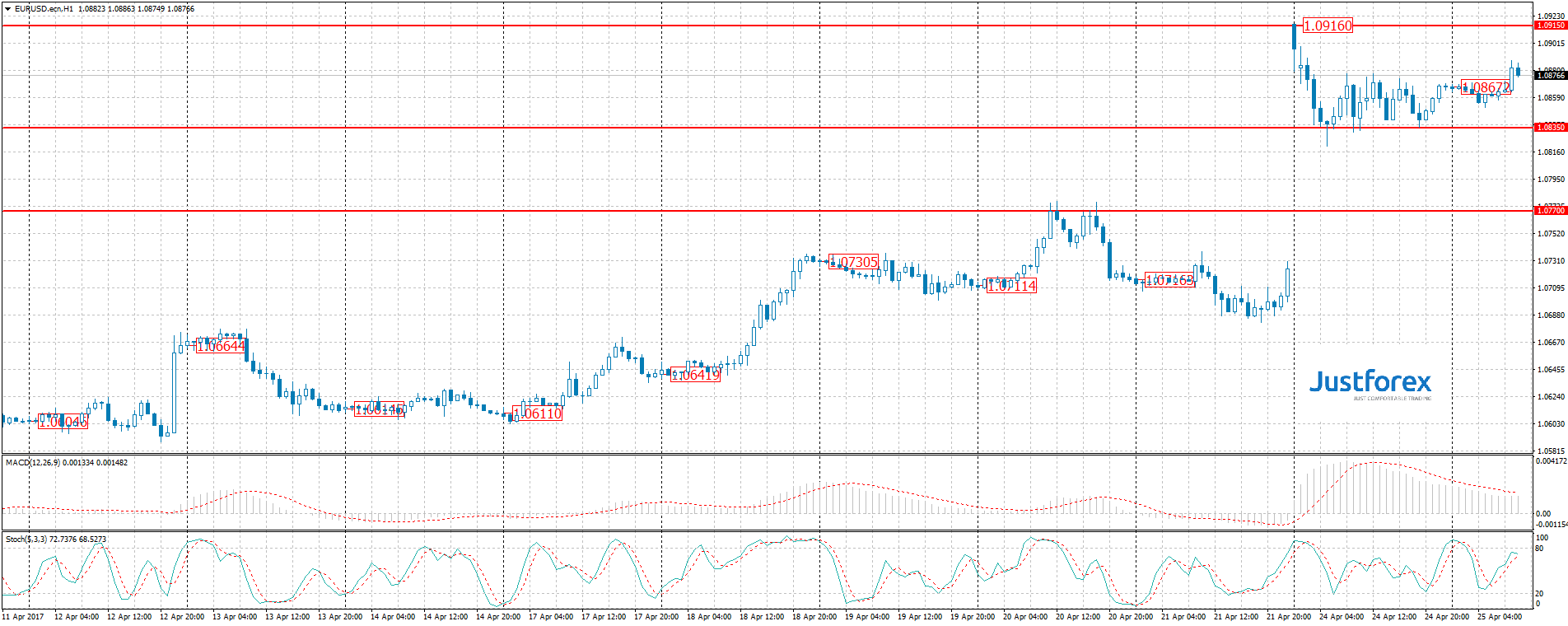

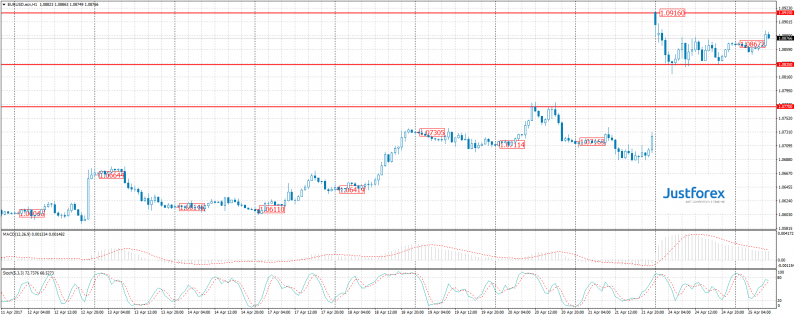

The forecast for the EUR/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.09160

Opening: 1.08672

Chg. % of the last day: -0.05

Daily range: 1.08502 – 1.08840

52-week range: 1.0366 – 1.1616

In the first round of the presidential elections in France, Emmanuel Macron won, what strengthened investors’ confidence. In the Asian trading session, the EUR/USD currency pair retained the local demand zone 1.08350-1.08600. The bullish sentiment prevails on the market. We are waiting for statistics from the USA.

The MACD histogram is in the positive zone and continues to rise, indicating further EUR/USD growth.

Stochastic Oscillator is located in the neutral zone, the %K line is above the %D line, which also signals the purchase of EUR/USD.

There are no important economic reports from the EU today. We recommend you to pay attention to the reports from the USA:

– consumer confidence index of CB (17:00 GMT+3:00);

– new home sales (17:00 GMT+3:00).

Trading recommendations

Support levels: 1.08350, 1.07700

Resistance levels: 1.09150

We still expect EUR/USD to grow. We recommend considering purchases to around 1.09250-1.09500. When tracking a position, it is better to use a trailing stop.

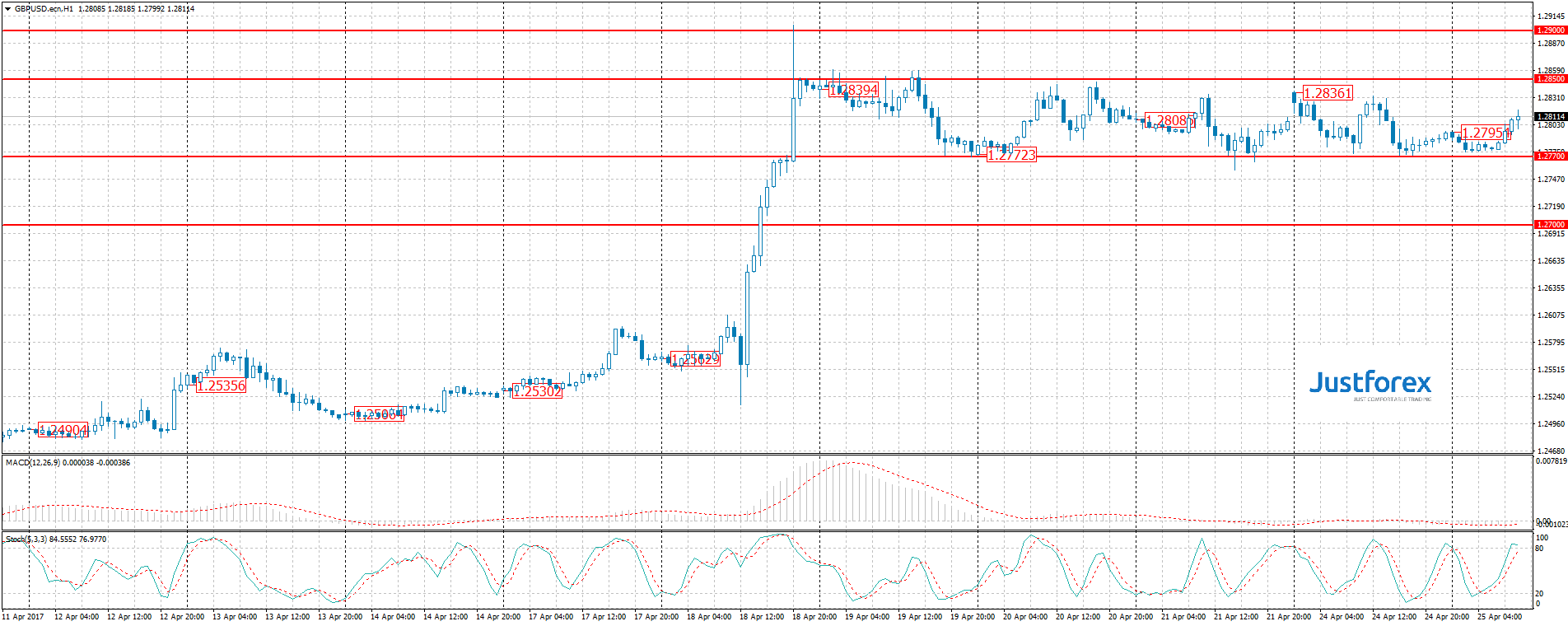

Forecast for the GBP/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.28361

Opening: 1.27954

Chg. % of the last day: -0.23

Daily range: 1.27748 – 1.28188

52-week range: 1.1986 – 1.5020

Yesterday, the pound continued to test key support and resistance levels: 1.27700 and 1.28500, respectively. At the moment, the technical pattern on the GBP/USD is mixed. The market is waiting for additional drivers.

Indicators do not send accurate signals. The MACD histogram has fixed near the 0 mark.

Stochastic Oscillator has reached the overbought zone, the %K line has crossed the %D line. There are no signals at the moment.

Leave A Comment