Non-Farm Payrolls today and taking the risk here and calling my Dollar bullish case before the announcement….as I believe that technically we should expect Dollar to bounce….overall…and not in all pairs….

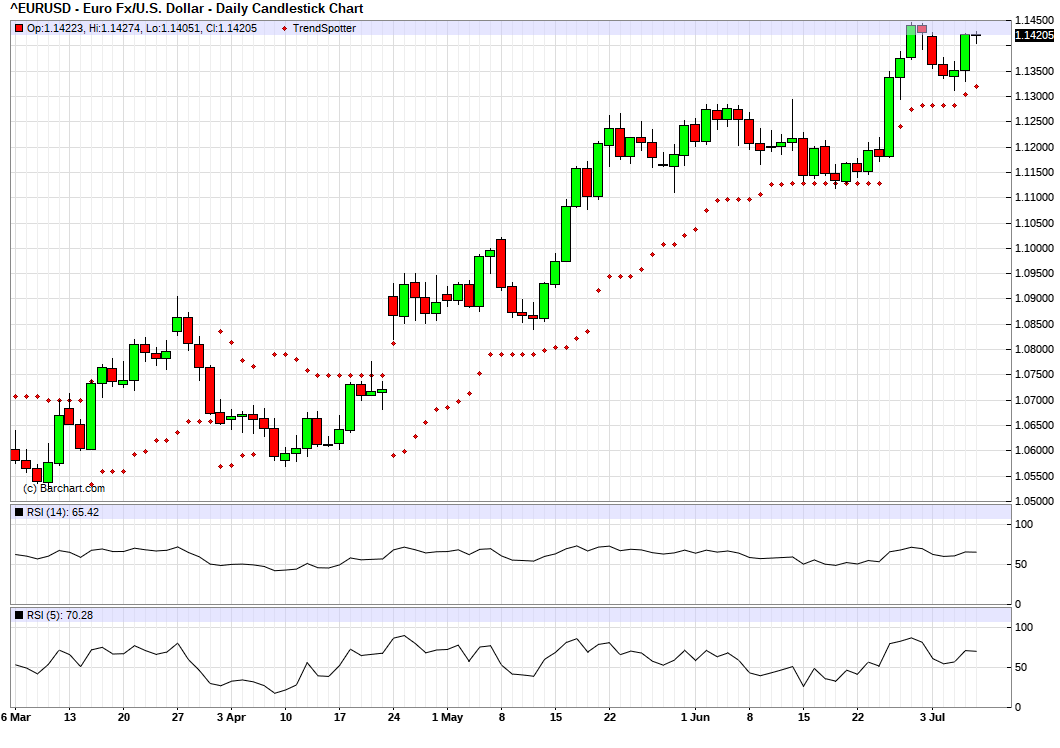

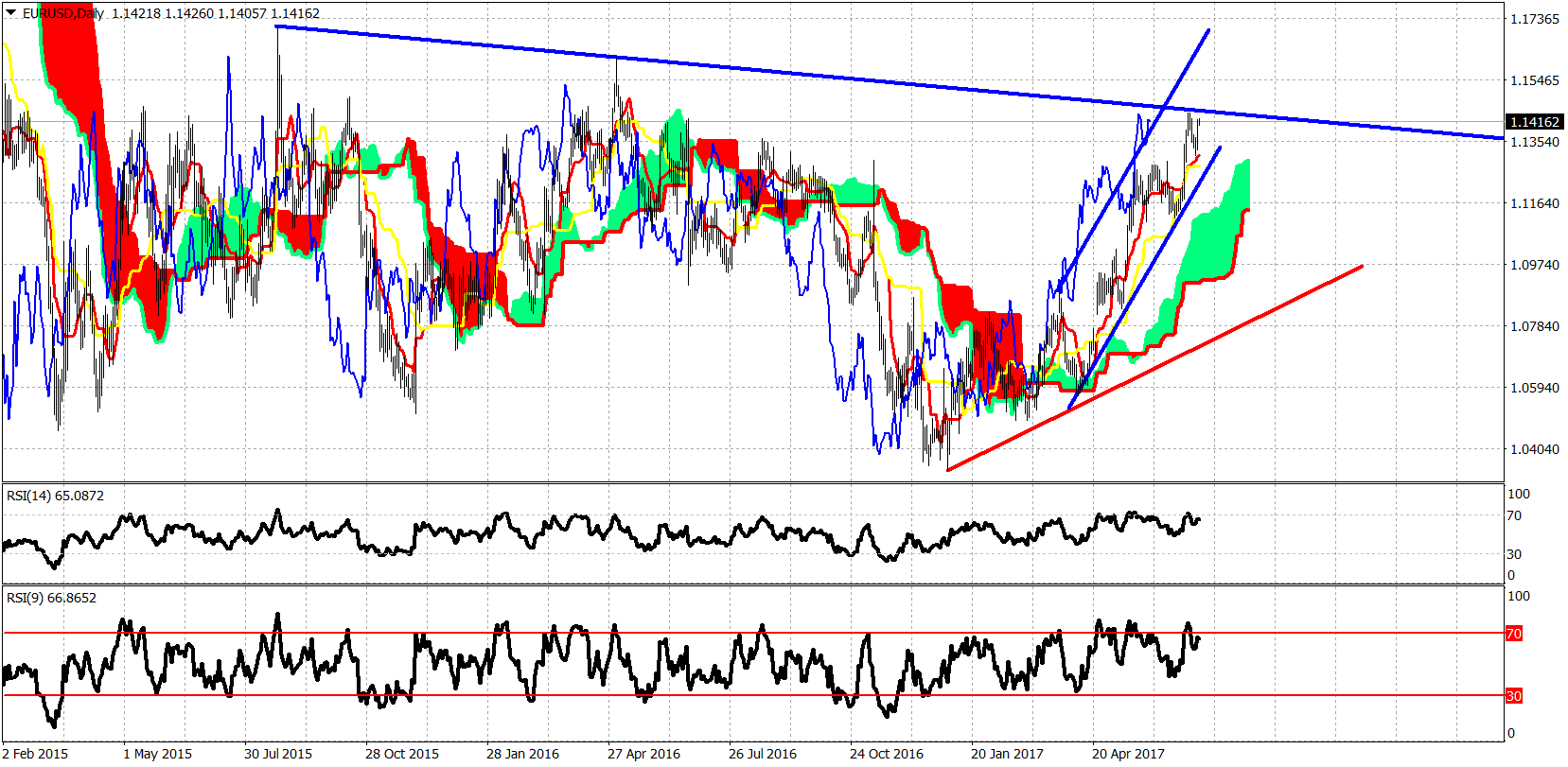

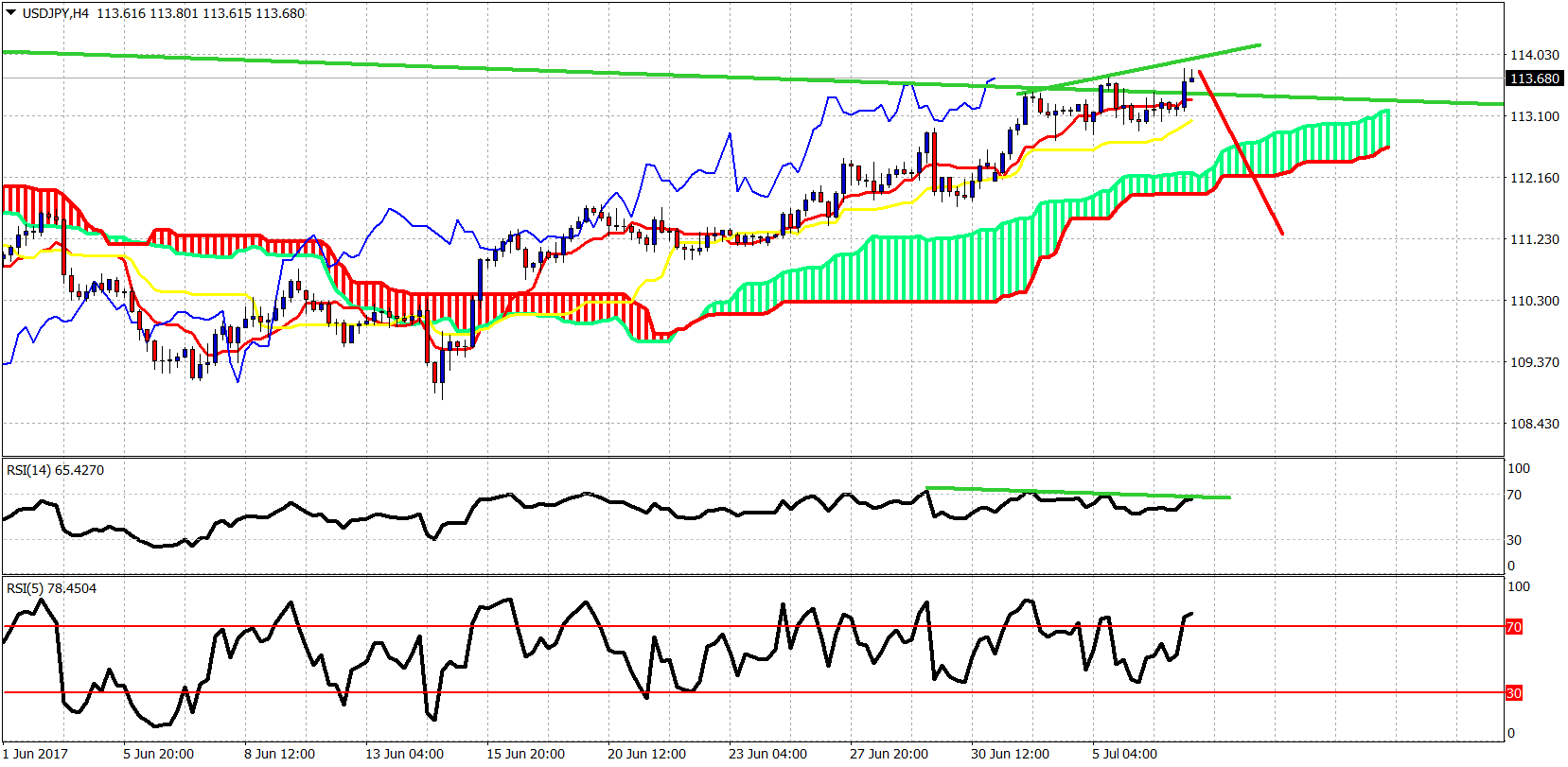

EUR/USD

First chart. 1.13 is critical trend support.

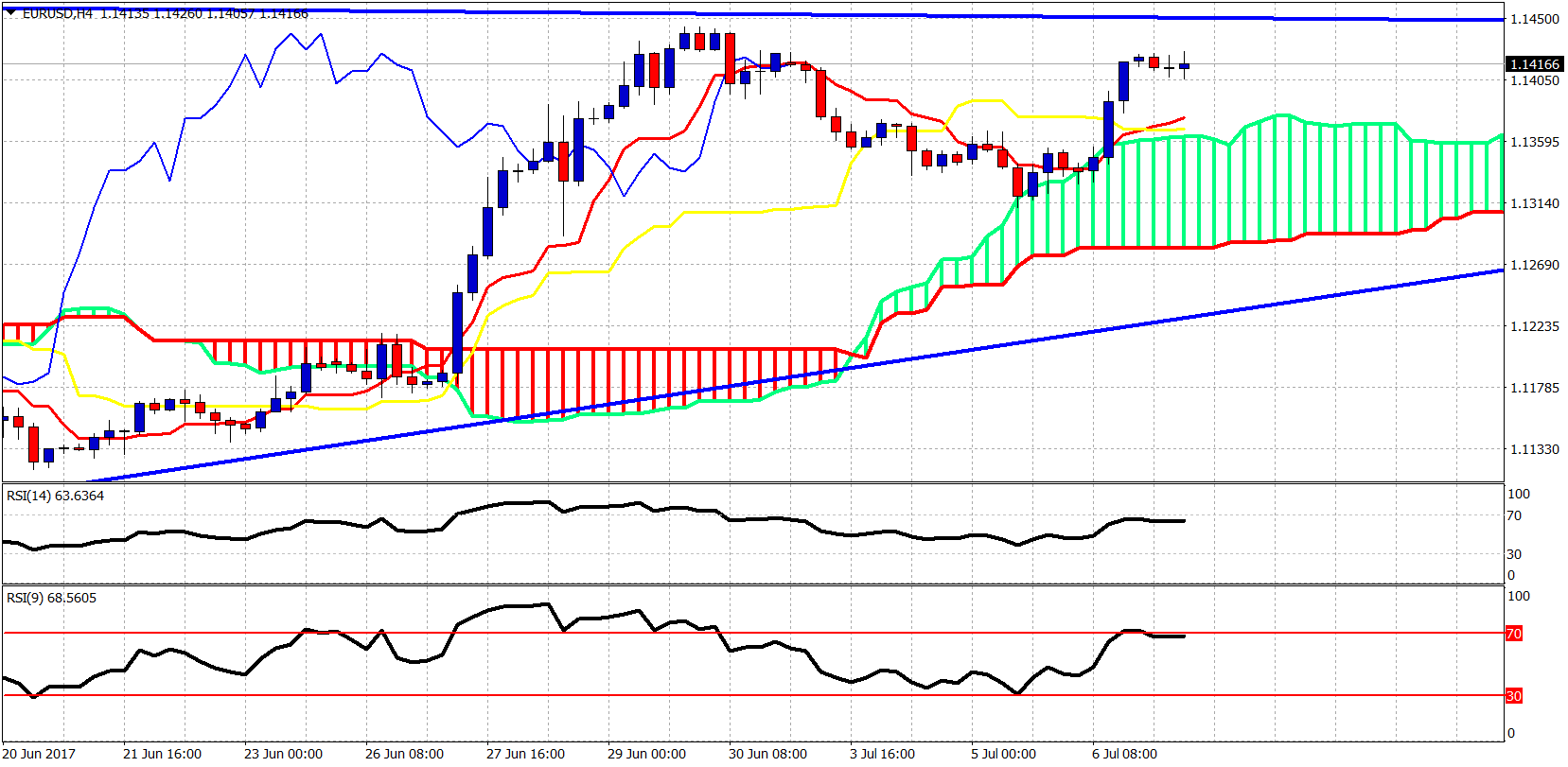

4 hour chart shows how price respected the Kumo support and bounced off it. Cloud support is between 1.1360-1.13. Inside it we are neutral. Breaking below it we turn bearish agreeing with the above chart.

Daily trend line resistance has been reached and already got rejected once. Will we break it or get rejected again. If the rejection comes as I expect….we will also break 1.13 support and move towards 1.10.

There is no confirmed reversal signal. There are indicators showing overbought and diverging signs. We are at very important resistance levels. I prefer to look for the bearish side of this pair.

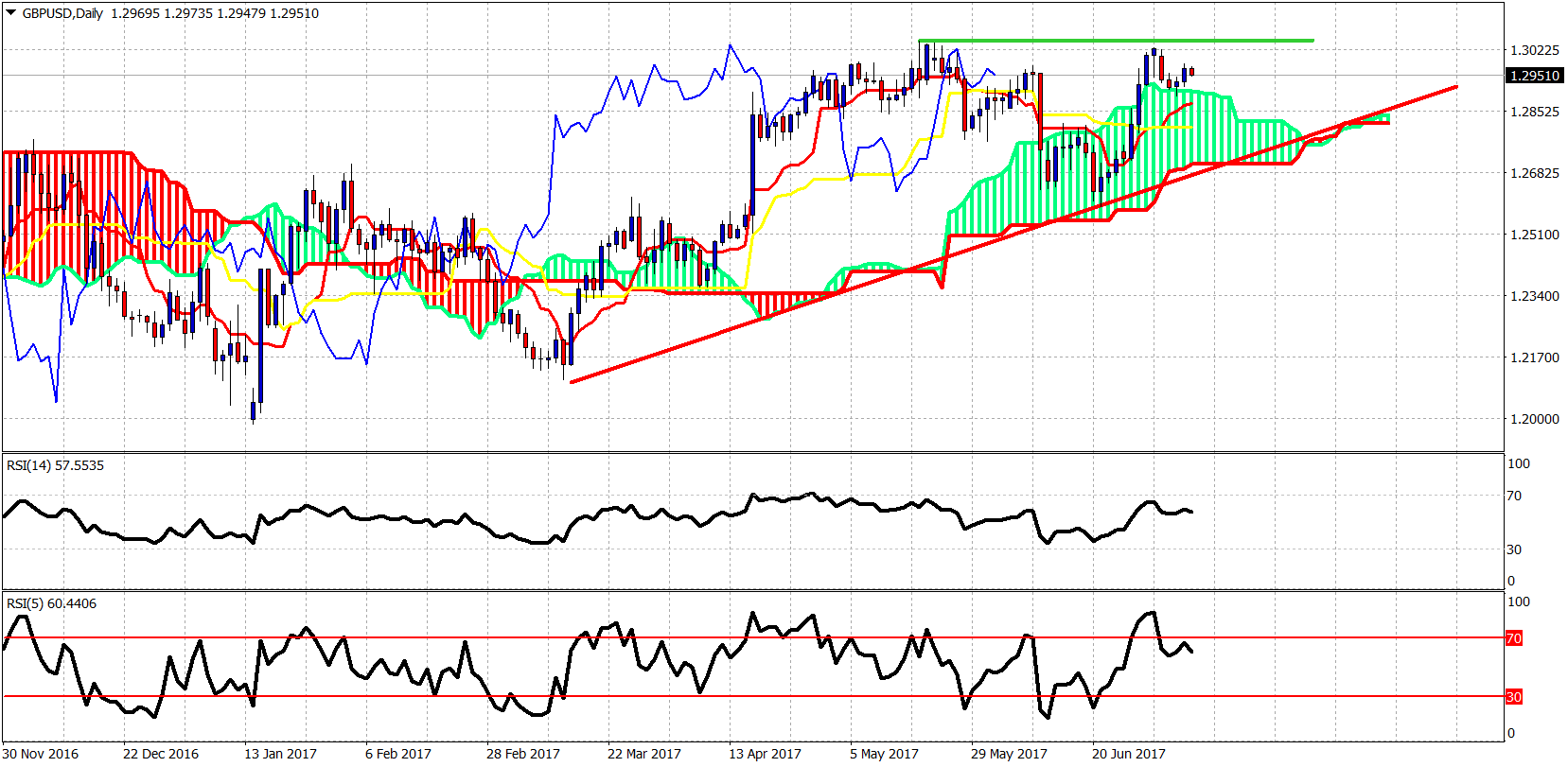

GBP/USD

Right above the cloud support. Double top?A rejection here will bring price back towards the red trend line support. Good risk reward for being short with a stop at the Green trend line highs.

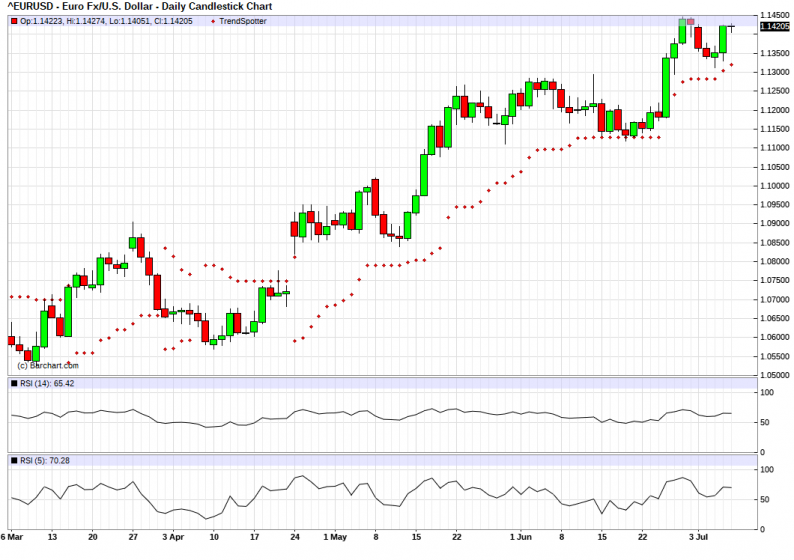

USD/JPY

The only pair where I’m not Dollar bullish. 3 drive pattern in play and bearish divergence signs. Price is trading around the long-term trend line resistance. No clear breakout above it yet. A rejection here will open the way for a move lower.

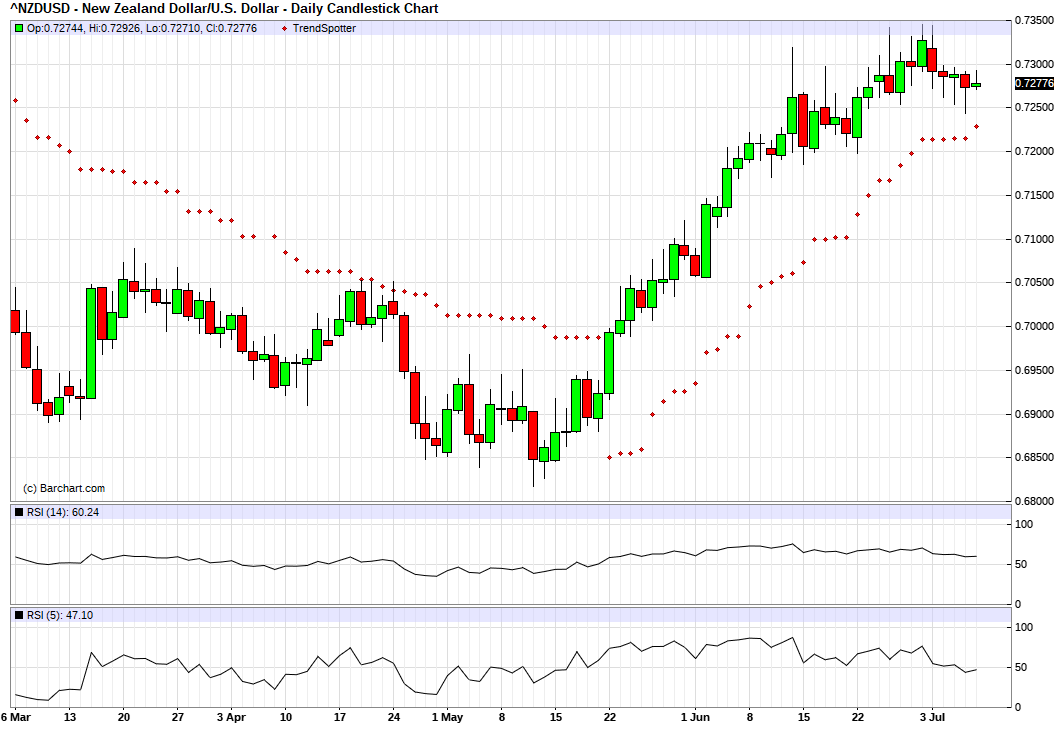

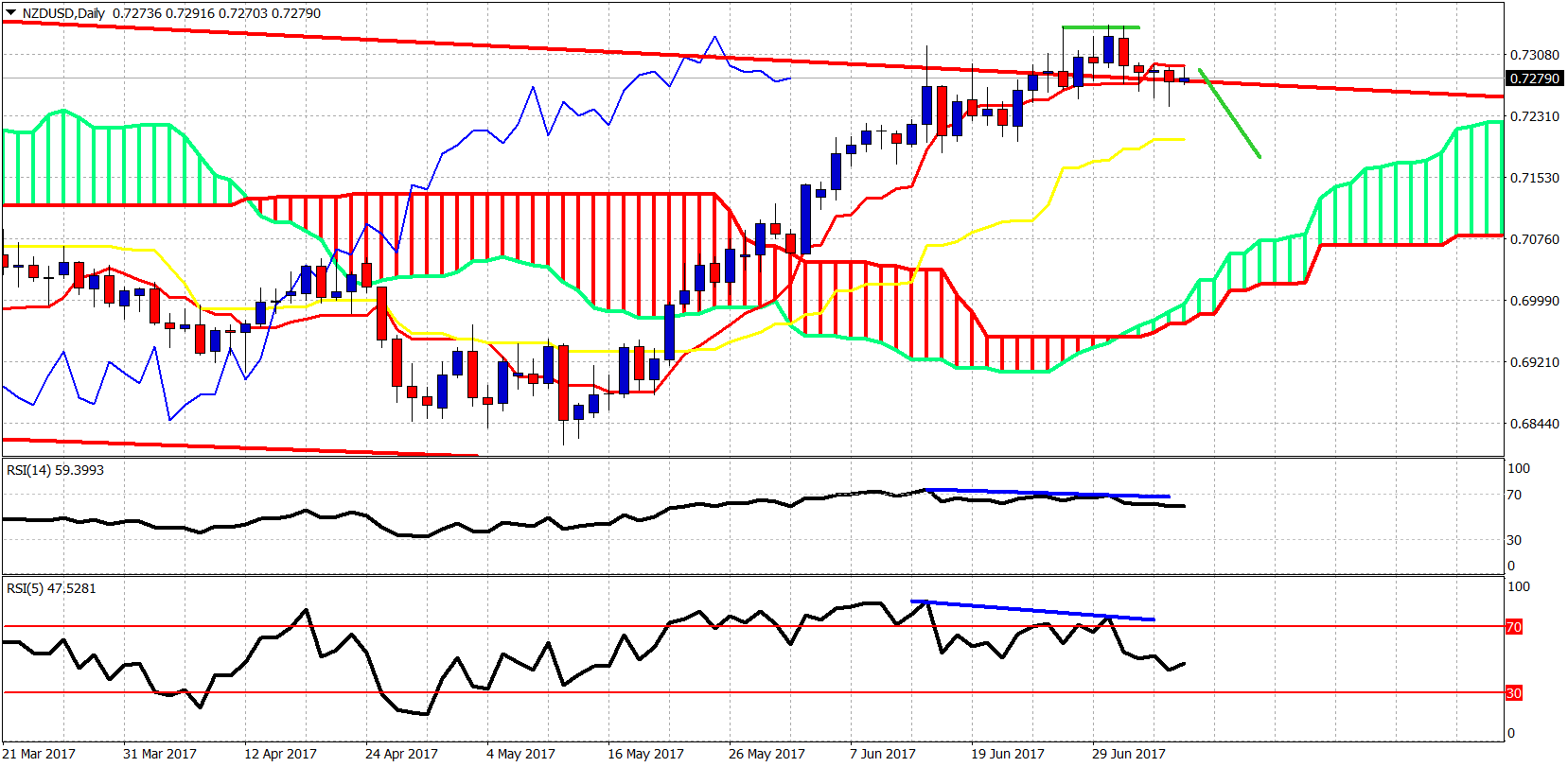

NZD/USD

0.7220-0.7240 is important trend reversal support area. If broken we have a new bearish signal.

For the past 3 days we have a close below the tenkan-sen. Combined with the bearish divergence signs, I expect selling to increase here and push price first towards the kijun-sen at 0.72 and most probably towards the daily Kumo at 0.71.

Leave A Comment