Welcome to my “Strength and Comparison” article for the coming week.

For analyzing the best pairs to trade looking from a longer term perspective the last 3 months Currency Classification can be used in support.

This was updated on 7 August 2016 and is provided here for reference purposes:

Strong: USD, JPY, NZD. The preferred range is from 6 to 8. Average: CHF, AUD, CAD. The preferred range is from 3 to 5. Weak: EUR, GBP. The preferred range is from 1 to 2.

______________________________________

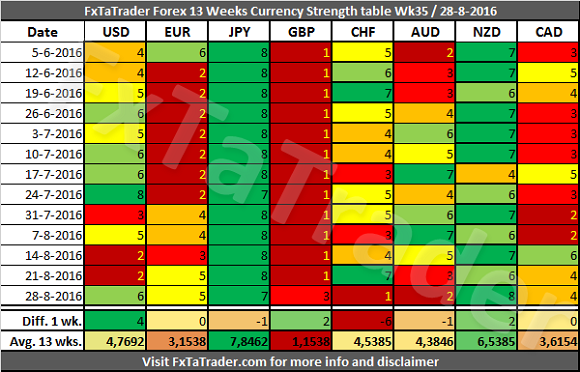

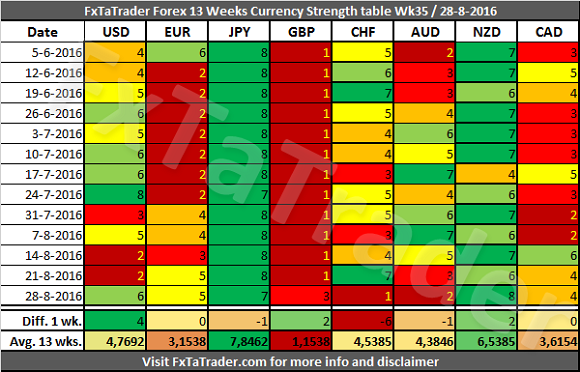

13 Weeks Currency Score Strength

The 13 Weeks Currency Strength and the 13 Weeks Average are provided here below. This data and the “3 months currency classification” are considered for deciding on the preferred range. Because it is not ideal nor desired to change the range for a currency every single week, we perform several checks to avoid this.

_____________________________________

Putting the pieces together

Based on the last “3 months currency classification” and the “Currency Comparison Table” the most interesting currencies for going long seem to be the:

NZD, JPY and the USD.

These are strong or average currencies from a longer term perspective when looking at the last “3 months currency classification”.

For going short the same analysis can be done and the following currencies seem to fit best:

CHF, AUD and the GBP.

These are weak or average currencies from a longer term perspective.

Currencies with a high deviation seem less interesting to trade because they are less predictable. These currencies are at the moment e.g. the:

EUR and the CHF.

Unless these currencies offer a clear opportunity based on the longer term they are avoided. However, these currencies may offer opportunities for the short term trader.

Some of these pairs comply for a longer term trade based on the Daily and Weekly chart. We will look at these ones here in a bit more detail.

Leave A Comment