Earlier today, the greenback moved lower against the Canadian dollar, which pushed USD/CAD below the December high and the previously-broken resistance zone. Is it enough to trigger further deterioration?

In our opinion the following forex trading positions are justified – summary:

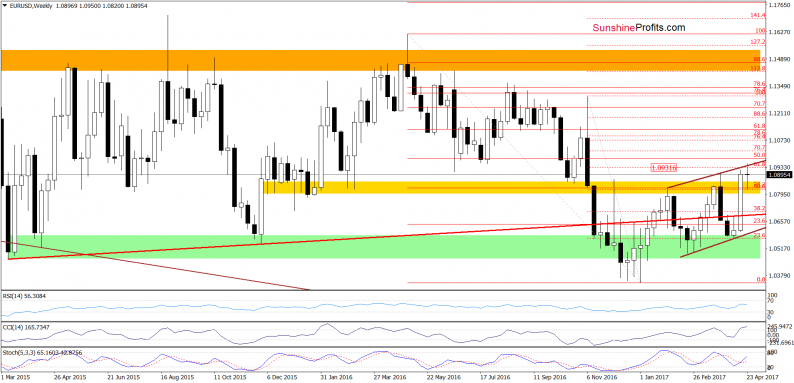

EUR/USD

Looking at the charts, we see that although EUR/USD rebounded slightly yesterday, this “improvement” was very temporary and currency bears pushed the exchange rate lower earlier today. Thanks to this drop the pair came back under the March high, which means that our previous commentary on this currency pair is up-to-date:

(…) EUR/USD tested the strength of the upper border of the brown rising trend channel, the 61.8% Fibonacci retracement (both marked on the weekly chart) and the 112.8% Fibonacci extension (seen on the daily chart), which resulted in a comeback below the March high. Additionally, the sell signal generated by the RSI remains in place, supporting currency bears. On top of that, the CCI and the Stochastic Oscillator are very close to generating sell signals, which suggests that reversal and lower values of the exchange rate are just around the corner.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at 1.1052 and the initial downside target at 1.0521) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

Leave A Comment