Never let a Crisis go to Waste

As is well known, the EU’s socialist centralizers and “harmonizers” have always fully expected the adoption of the euro to lead to a crisis that would allow them to push through policies that would otherwise never have seen the light of day. Italian socialist and former EU Commission president (i.e., chief commissar) Romano Prodi told the Financial Times in 2001:

“I am sure the euro will oblige us to introduce a new set of economic policy instruments. It is politically impossible to propose that now. But some day there will be a crisis and new instruments will be created.”

(emphasis added)

Montgolfière – engraving by Claude-Louis Desrais, 1783

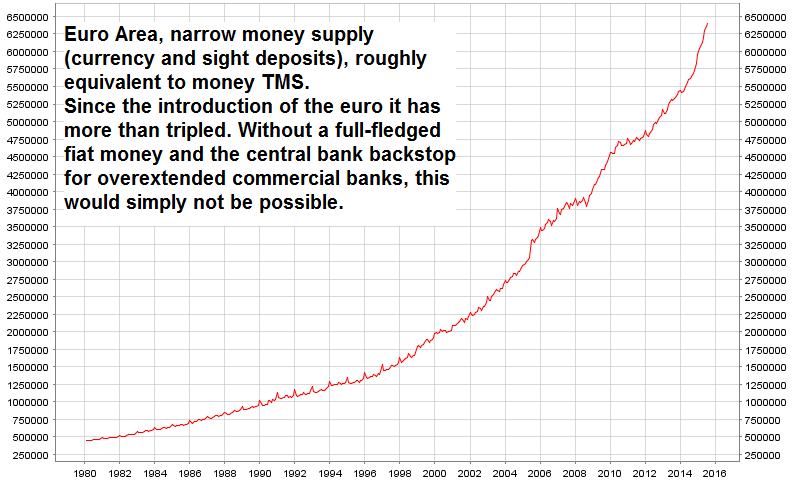

Of course it wouldn’t be a problem for the EU to use a common currency if it consisted of a sound, market-chosen money. It is only a problem and was always likely to produce a crisis because it is a central bank-administered fiat money the supply of which can and has been expanded willy-nilly.

Click on picture to enlarge

The current rate of expansion of the euro zone’s true money supply has hit nearly 14% annualized. This is utterly crazy, particularly when considering what happened after the last major money and credit expansion – via ECB

Once the predictable crisis inevitably broke out, a flurry of centralization measures indeed ensued. A number of governments which had either spent money beyond their means or experienced soaring deficits due to the economic bust effectively lost their fiscal sovereignty, while tax payers across the euro area had to pick up the tab.

In the course of all this, one of the battle cries continually repeated ad nauseam by the political elite was “we need more Europe!” – by which they mean, more political power must be centralized in Brussels. Not surprisingly – in view of the historical record – the proposals of French socialists have gone the farthest.

Never mind that voters appear increasingly convinced of the exact opposite – even in Austria, which has sidestepped the crisis relatively unscathed (apart from a few rather staggering bank insolvencies), a recent citizen’s initiative in favor of exiting the EU gathered more then 260,000 signatures to everybody’s vast surprise. This forces the country’s parliament to discuss the issue and although absolutely nothing will come of it, it shows that the serfs are getting increasingly antsy.

Leave A Comment