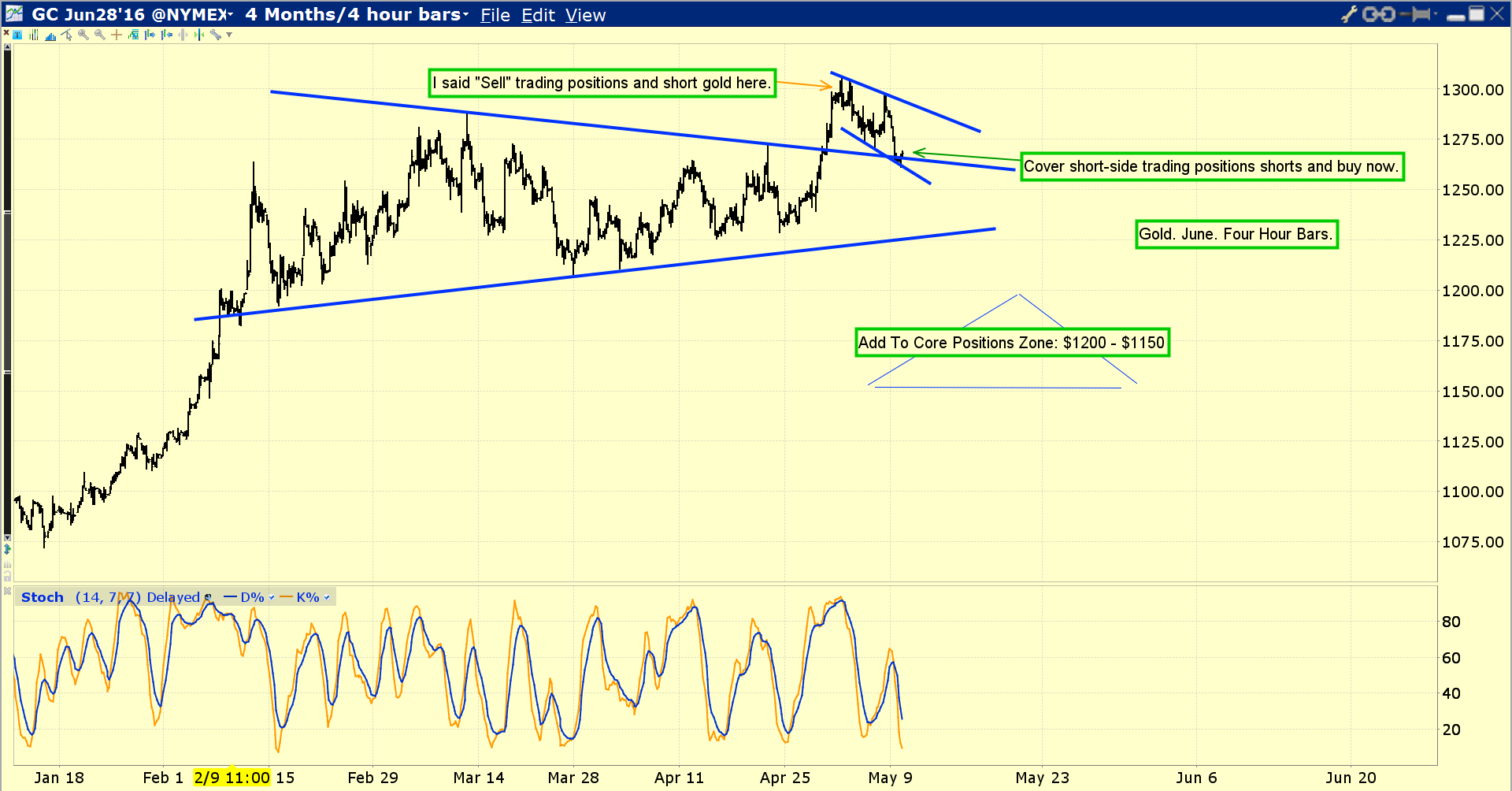

A week ago, gold rose towards key resistance. The resistance is defined by the 2013 price point of $1320 and the 2015 price point of $1307. It reached about $1306. As it did, I called the market a “profit booker’s delight”.

Gold price enthusiasts should not take my statements as a “top call”, and I just booked profit on a tranche of short positions. Traders can rebuy now, in hopes of a new price surge to above the $1300 area.

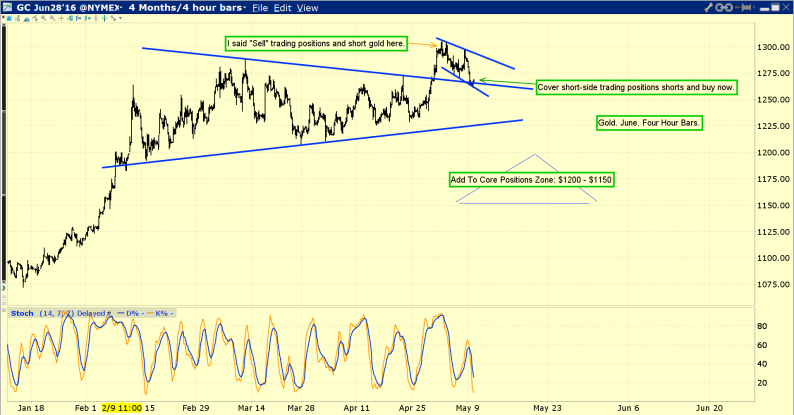

It’s possible that the next rally is delayed a bit, and gold drifts a bit lower, towards the apex of the large blue triangle I’ve annotated on the chart.

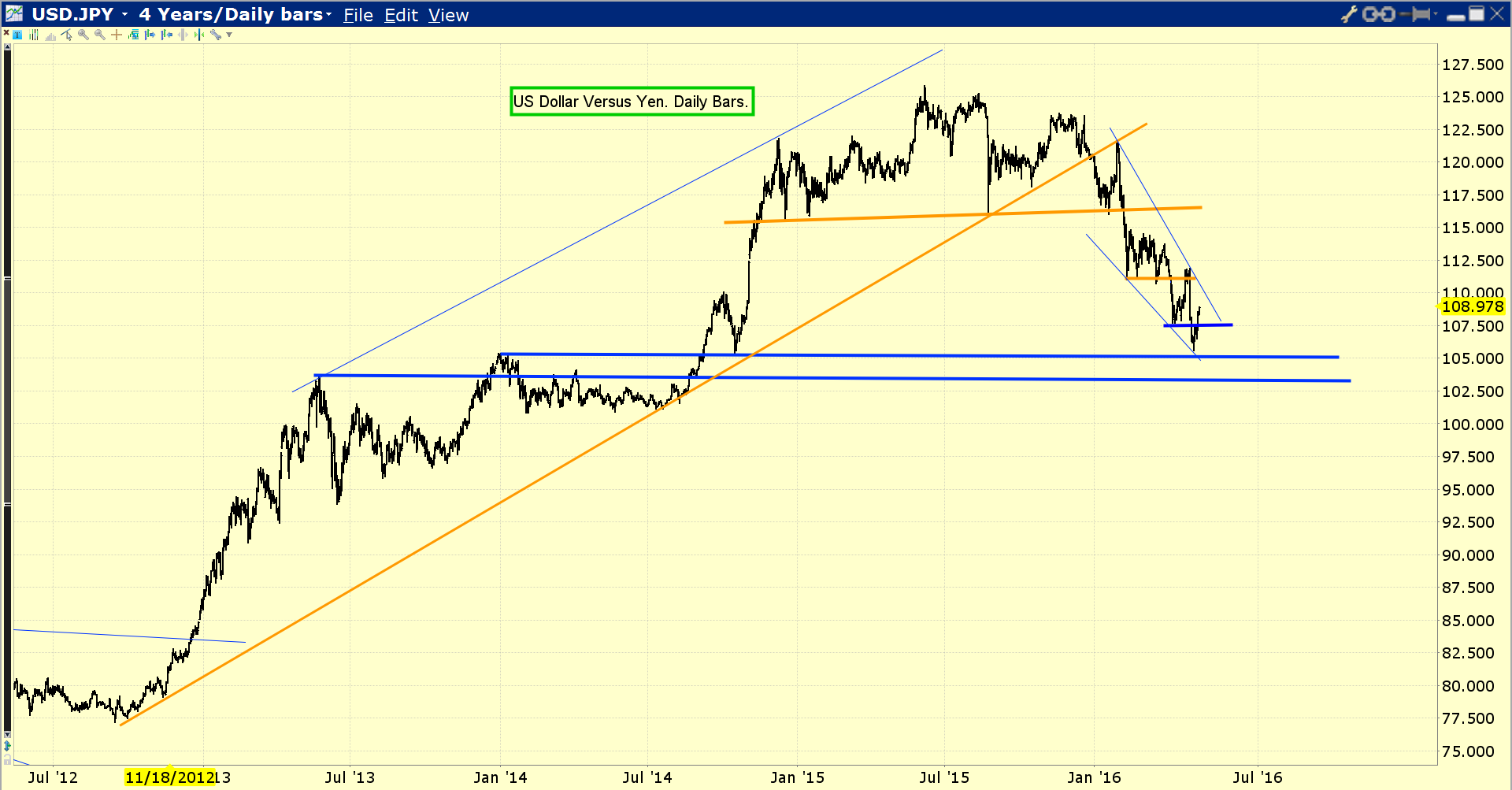

That’s because the Bank of Japan is apparently trying to scare the market that it will sell the yen against the dollar.

The dollar has declined substantially in 2016 against the yen, and a rally of some size is to be expected after such a decline.

A dollar-yen rally can put some additional pressure on gold in the short term, but the interventionists may find that their plan to rally the dollar backfires, or doesn’t even get off the ground.

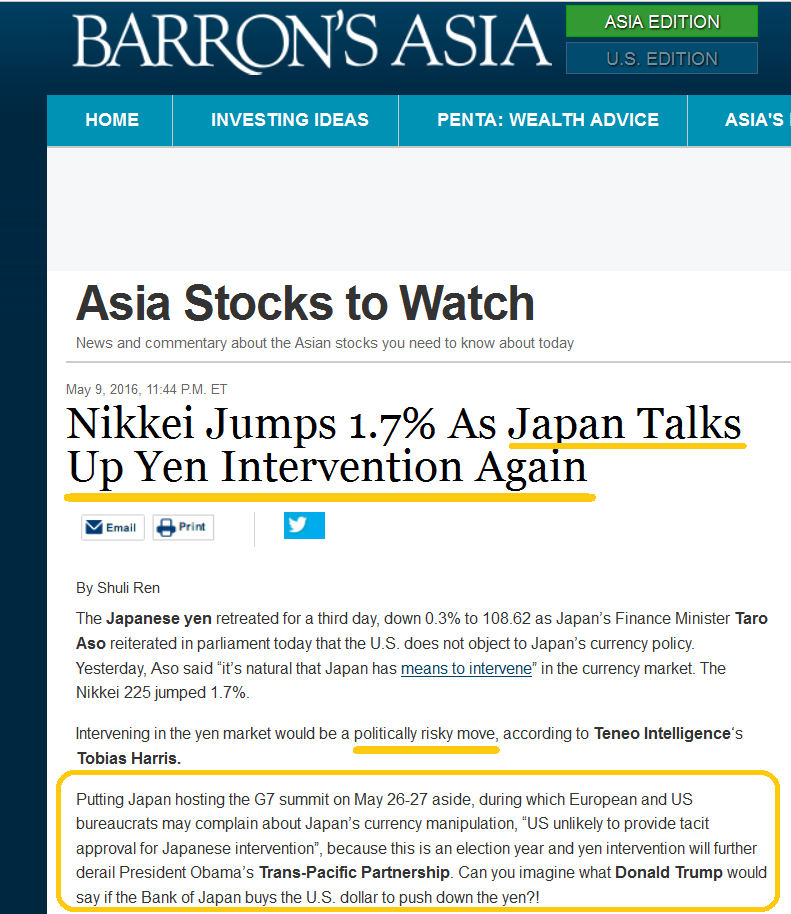

An attempt by the Bank of Japan to buy dollars now could provoke a huge outcry from politicians in America.

Donald Trump is an avid fan of a lower dollar, and the Democrats would not be happy to see the US trade deficit spike higher because of a dollar rally, as the US election approaches.

Tactics? Investors can buy some gold now, and more if it declines to the triangle apex zone of about $1250.

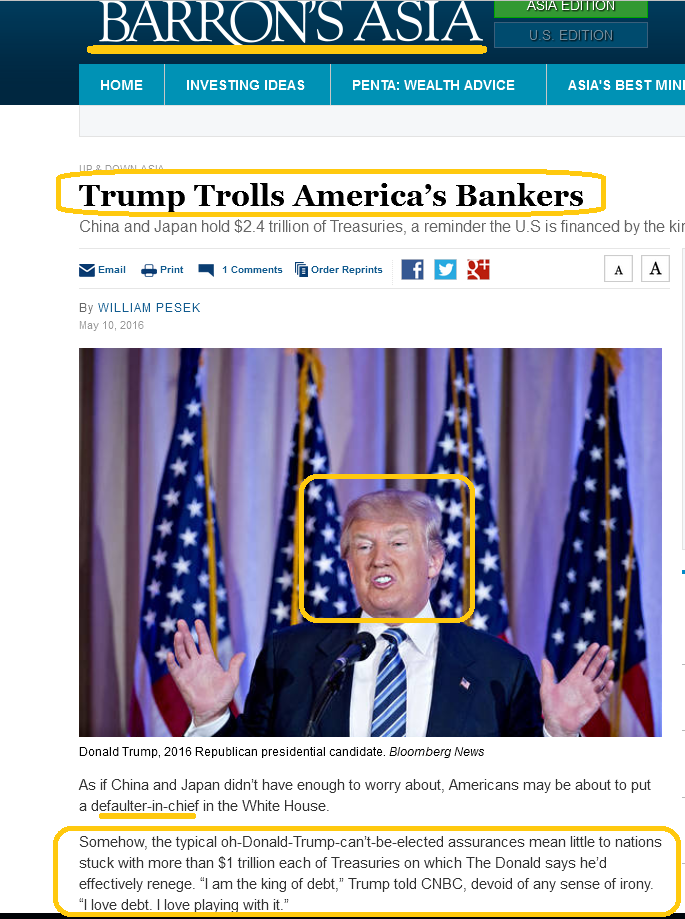

In the big picture of American gold price discovery, the potential election of Donald Trump is starting to get taken very seriously by some of the world’s most respected business publications.

They are suggesting his policies could be extremely positive for the price of gold.

I find this news to be tremendously positive for the price of gold.

In a nutshell, as the world’s largest empire of debt enters its twilight years, its citizens may elect a president known as “The king of debt” to stiff all their creditors.

Leave A Comment