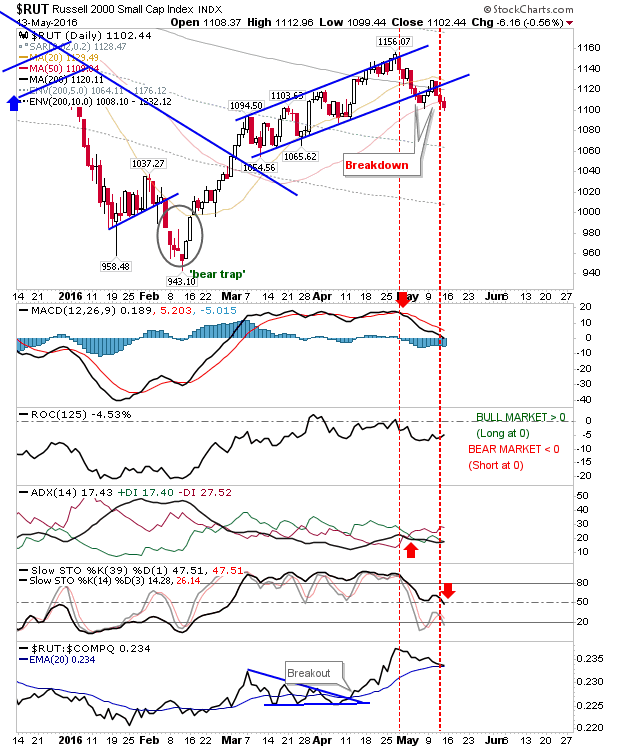

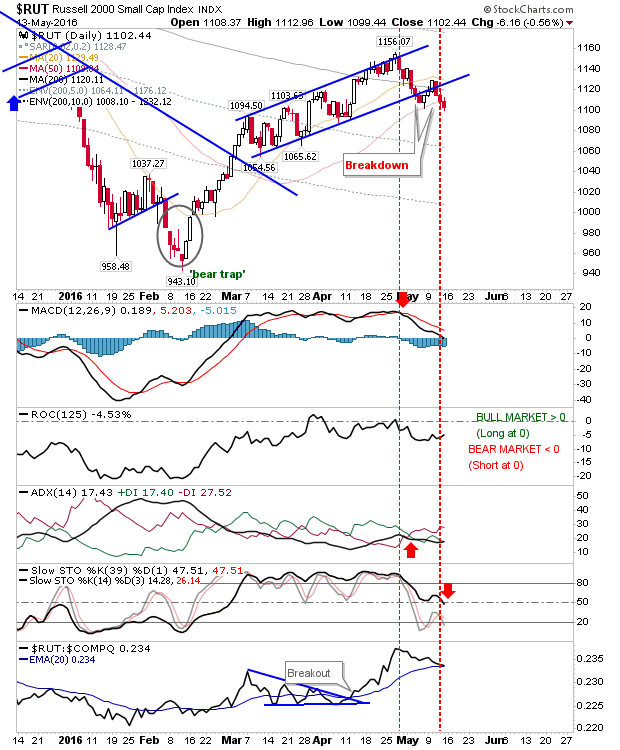

The Russell 2000 experienced a third day of loses to push below the 50-day MA with technicals net bearish following the loss of stochastics [39,1] below the mid-line. Relative performance (against the Nasdaq) has also been in a downward trajectory since late April and is on the verge of a bear cross.

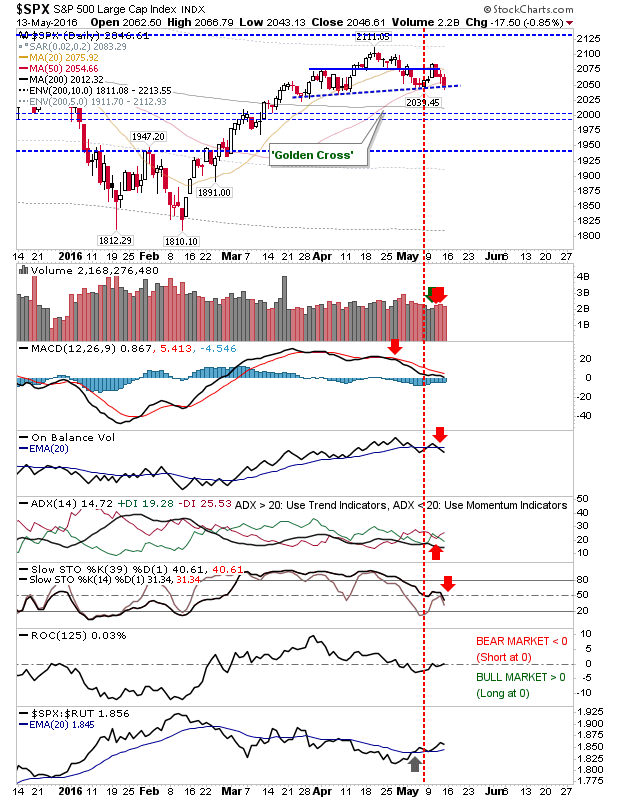

The S&P also saw its technicals turn net bearish. Rate-of-Change is holding to a possible swing low as the index finished Friday on the neckline of a potential head-and-shoulder reversal pattern. Buyers don’t have a whole lot of room to maneuver if these factors are to play as support – look for a positive open.

The Nasdaq finished Friday above the May swing low. Of the lead indices it has the most bearish technicals, but also the most oversold. While it isn’t trading near price support, and has converged 20-day, 50-day and 200-day MAs overhead, it may be best placed to post a gain on Monday.

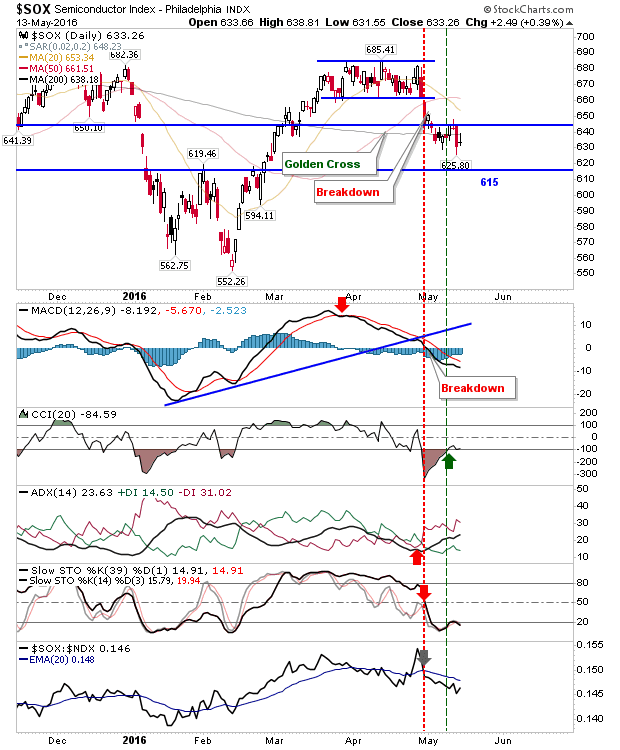

The Semiconductor Index finished with a bullish harami cross. Technicals remain mixed with the index trading below it 200-day MA. The Nasdaq shouldn’t be too negatively influenced by Semiconductors on Monday.

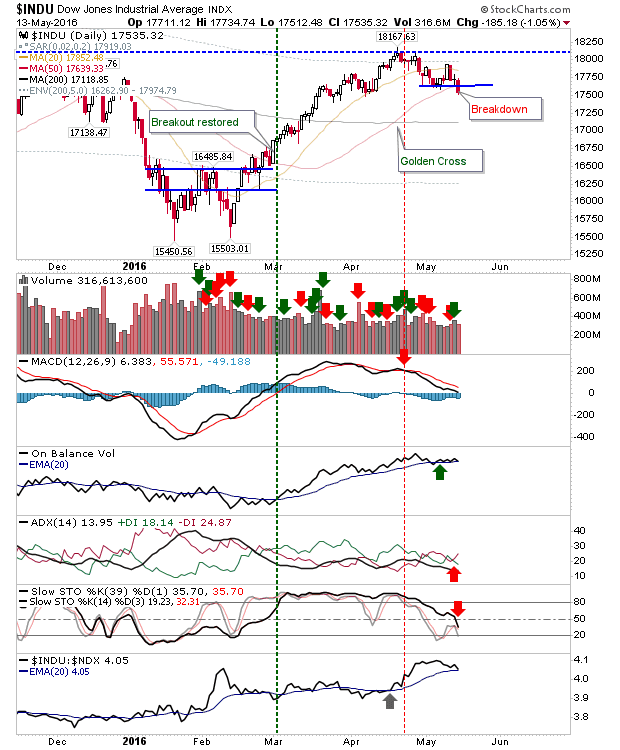

Bears can keep an eye on the Dow Jones Index. It suffered a clear loss of May support along with the 50-day MA. Technicals are a little mixed with stochastics [39,1] cutting below the mid-line into bearish territory, while On-Balance-Volume is net bullish.

In the near term, bulls can look to the S&P and Nasdaq. while bears have the Dow to track. Long term, markets are in neutral territory.

Leave A Comment