On Friday, the FTSE 100 (FXCM: UK100) slipped by 1.26% from Thursday’s close, but managed to fully recuperate its losses by the end of the session. The losses were recuperated as the U.S. monthly labor report marginally beat expectations and the ISM Manufacturing Index beat expectations by a wide margin.

The combination of a solid labor report, an expanding manufacturing sector and the Federal Reserve not being in a rush to hikes rates has soothed FTSE 100 traders and sent the S&P 500 to new 2016 highs.

The U.S. economy added 215K new jobs versus the +205K expected. The unemployment rate rose to 5.0% versus 4.9% expected, while wages gained +2.3% YoY from +2.2% in February.

The ISM Manufacturing saw a rise to 51.8 from 49.5, beating the expectations of 50.7. It is the first time since August 2015 in which the ISM Mfg. is above the 50 threshold and therefore implies that the manufacturing sector is in an expansionary phase.

The sector was one of the first to be mentioned as a trouble spot early last week in the U.S. economy by the Fed’s Janet Yellen in her speech ‘The Outlook, Uncertainty, and Monetary Policy.’

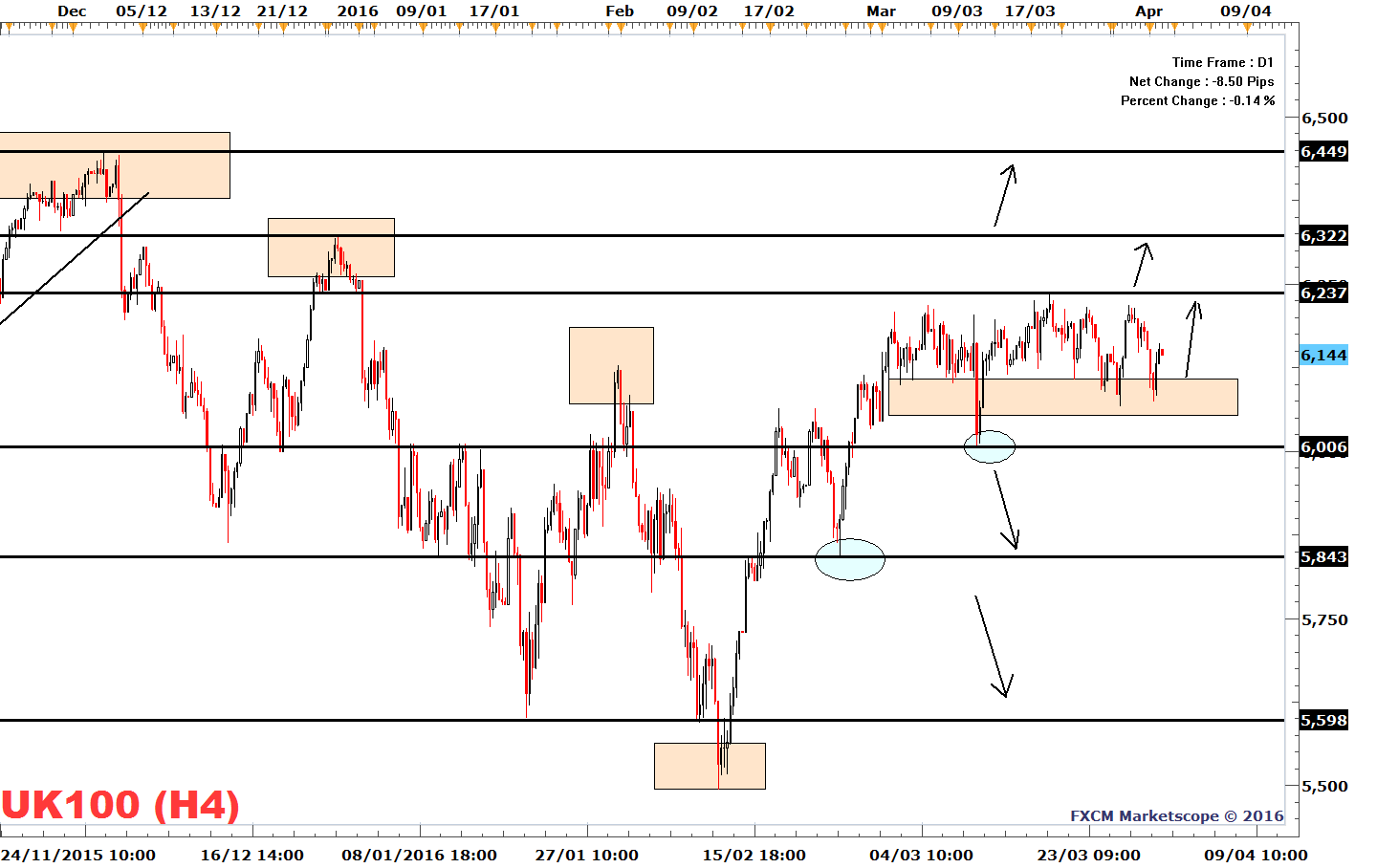

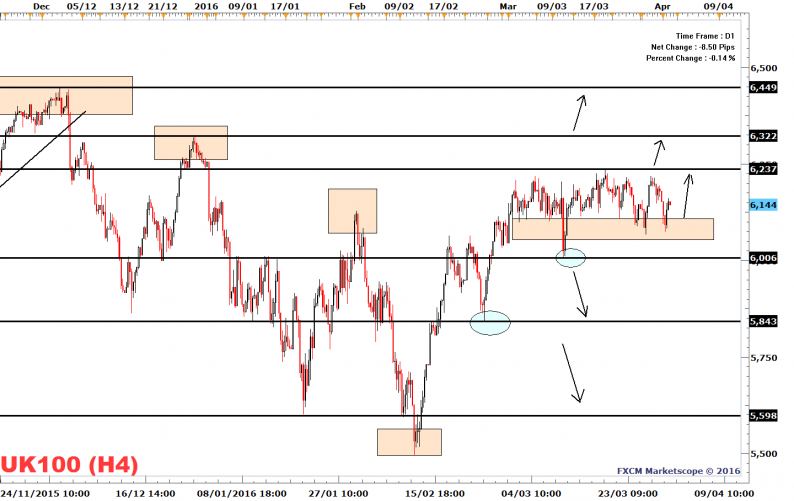

The FTSE 100 remains true to the same technical levels of last week. The March 10 low of 6006 is the nearest support level and the trend-defining low, as it is higher than the preceding swing low which is the March 24 low of 5843.

The March 18 high of 6237 is the nearest resistance level of importance followed by the December 29 high of 6322.

Markit/CIPS UK Construction PMI is on deck today and expected to rise to 54.1 from 54.2 in March (Bloomberg news survey). From the Euro-zone Sentix Investor Confidence and the Unemployment Rate is on deck. The afternoon is followed by U.S. Factory Orders and final Durable Goods Orders.

FTSE 100 | FXCM: UK100

Leave A Comment