Fund Managers – Bearish Emerging Markets, Bullish On America

The Chinese economy seems in a tailspin. Fund managers surveyed by Merrill Lynch expect global growth to fall in the next 12 months.

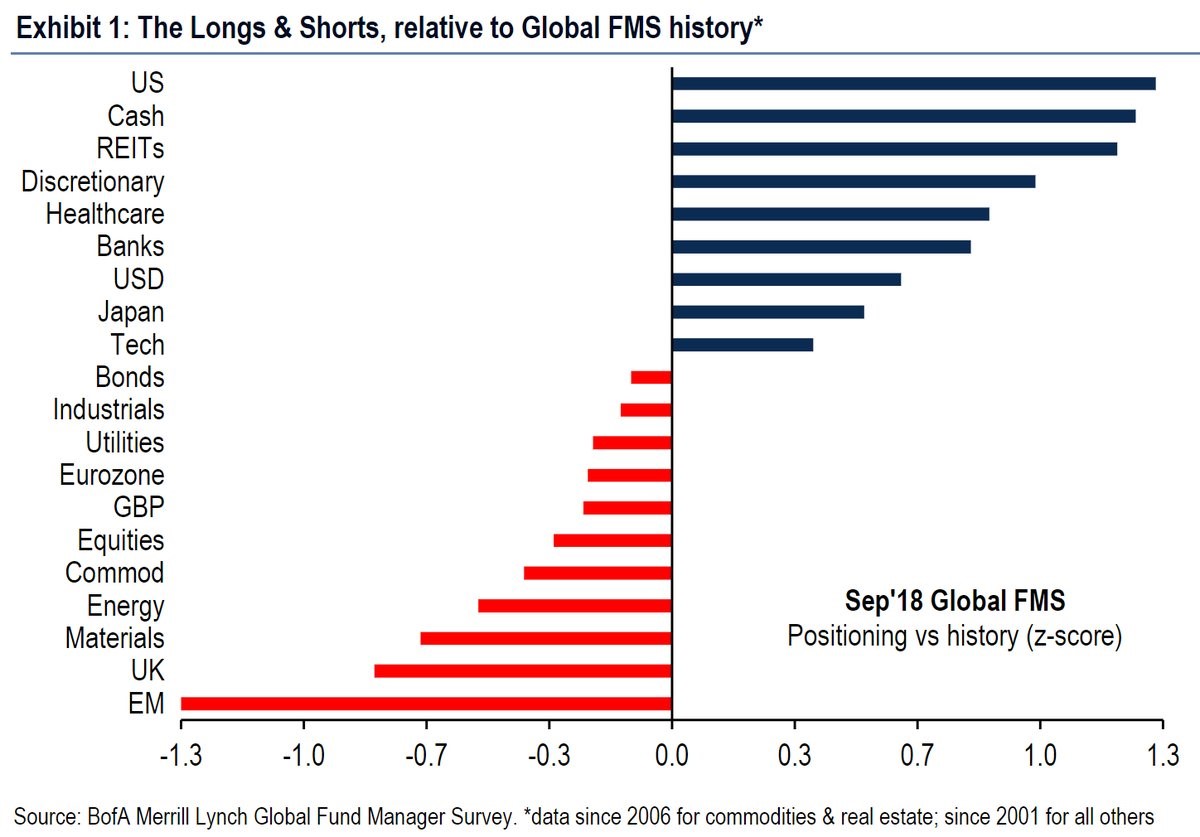

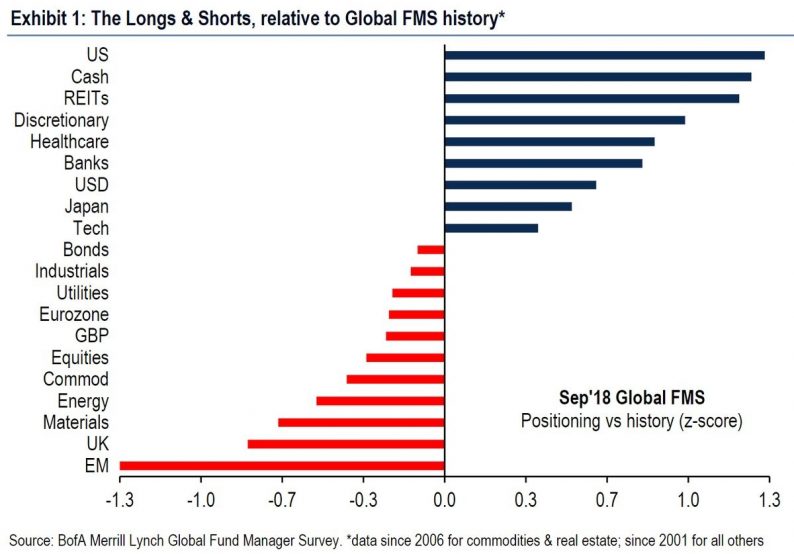

As you can see from the chart below, the September z-score on American stocks is the highest at 1.3. The recent sell-off in tech stocks has caused the tech z-score to go negative.

Emerging markets are the exact opposite of America as their z-score is -1.3. While it’s easy to claim American stocks are overbought and emerging markets are oversold, there’s a reason for this action.

There are few catalysts outside of the Fed raising rates too quickly.

A trade war that could end this bull market in American stocks in the next few months. I just discussed weak sales results from 4 firms. Clearly, that doesn’t determine where the market is headed.

I still expect good results in Q3. I’m watching Facebook, Netflix, and Tesla’s earnings the closest.

Fund Managers – Rising Rates Aren’t A Problem

The chart above shows bonds have a slightly negative z-score, but the American treasury selling is much worse as the 2 year has the highest yield of the cycle and the 10 year is near the cycle peak.

Don’t get confused between the Fed increasing the funds rate too much and treasury yields increasing. Fed rate hikes occurring too quickly could invert the yield curve, while the long bond yield increasing steepens the curve.

It has recently been steepening as the 10 year yield has stayed above 3%. The chart below shows the 10 year yield rising with the stock market. The key is for the 10 year yield to rise more because of improved growth expectations than because of increasing inflation expectations.

Fund Managers – Slight Weakness In The Empire Fed Report

In August there were mixed regional Fed manufacturing reports, a ridiculously strong ISM PMI, a weakening Markit PMI, and moderate growth in the hard data industrial production report.

Leave A Comment