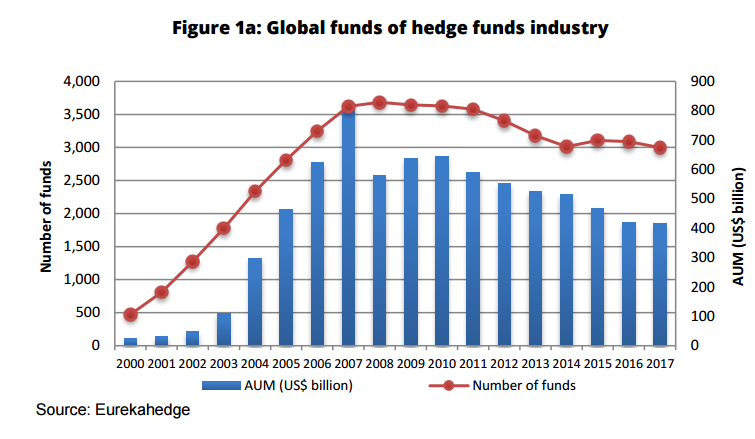

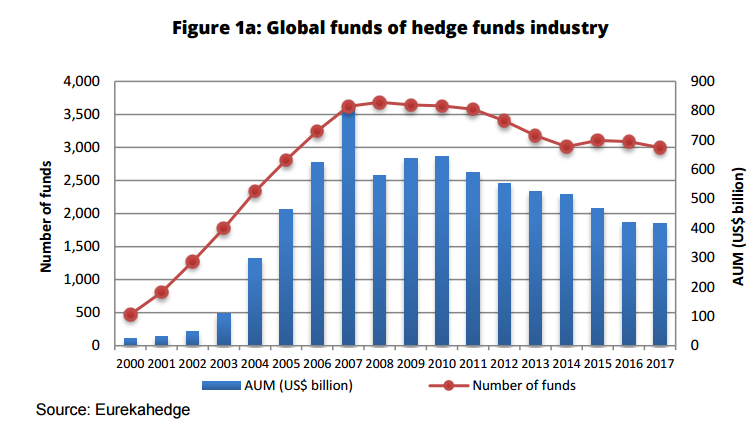

The fund of hedge funds business – the manager of managers, hedge funds that invest in other hedge funds — has witnessed significant growth from 200 to 2008 as well as a leveling off of hedge fund inflows, a May Eurekahedge report notes. From its participation peak in 2007, when over 3,700 individual fund of funds shared over $800 billion in assets under management, the 2017 landscape sees near 1,800 fund of funds, with smaller funds bearing the brunt of the reduction. The overall Hedge Fund of funds business has seen significant asset declines while investments in the underlying managers has risen.

Asset declines: $46.4 billion pulled from Hedge Fund of funds

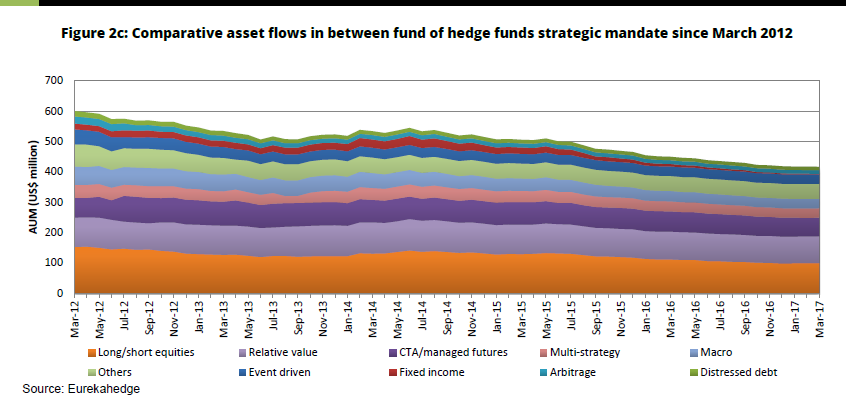

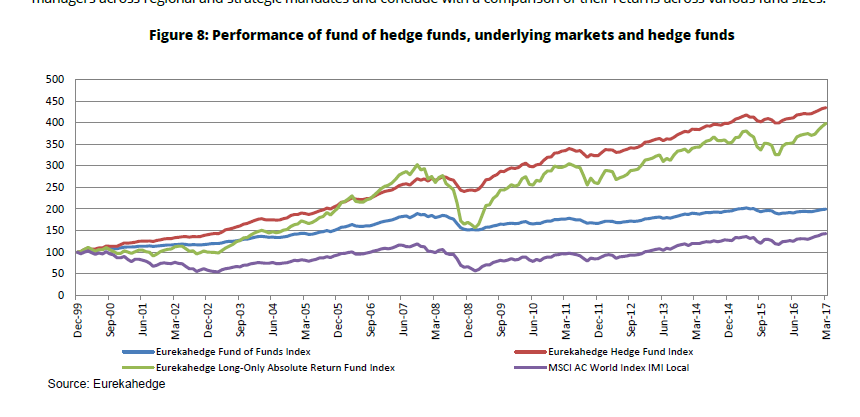

In 2016, investors pulled $46.4 billion from fund of funds investment structures as the Eurekahedge Fund of Funds Index lost -0.12% on the year, underperforming their hedge fund and long-only counterparts who gained 4.50% and 7.65% respectively.

“Recently investors have questioned the viability of investing into a funds of hedge funds given single digit returns from underlying hedge funds and the double fee structure inherent to the multi-manager model,” the Eurekahedge report noted, pointing to competition from liquid alternative products and hedge fund replication products, some of which are categorized as “smart beta.”

The fund withdrawal has hit smaller funds without significant negotiation power or advanced technical prowess the hardest. “Investors have increasingly shunned the smaller funds of hedge funds and sought direct exposure into hedge funds instead.” To wit, 98% of the fund of funds that closed their doors managed less than $500 million in assets.

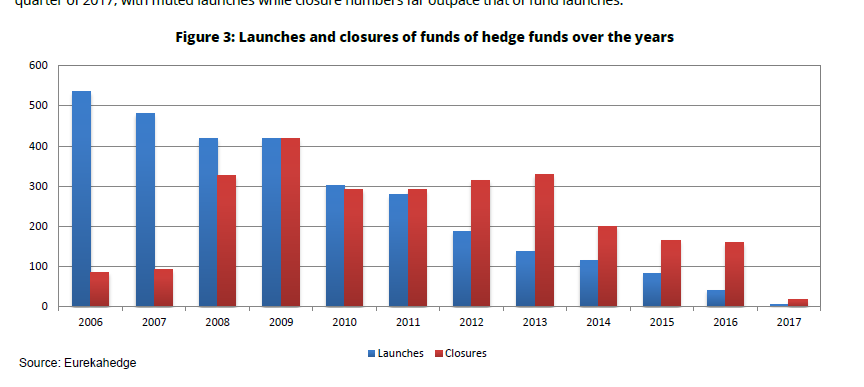

Hedge Fund of funds – Less Launches every year

“The larger players in the funds of hedge funds industry continue to retain and attract investor allocation given their sound pedigrees, access to elite hedge funds, negotiating advantage on fees and the subsequent cost economies that can accrue to investors,” the report noted.

Leave A Comment