Following yesterday’s torrid 2.4% March opening rally, which resulted in the biggest S&P gain since January and the best first day of March in history on what was initially seen as very bad news, and then reinterpreted as great news, overnight futures have taken a breather, and erased a modest overnight continuation rally to track the price of oil lower.

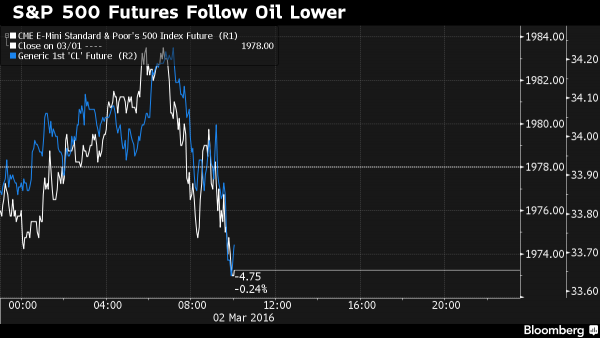

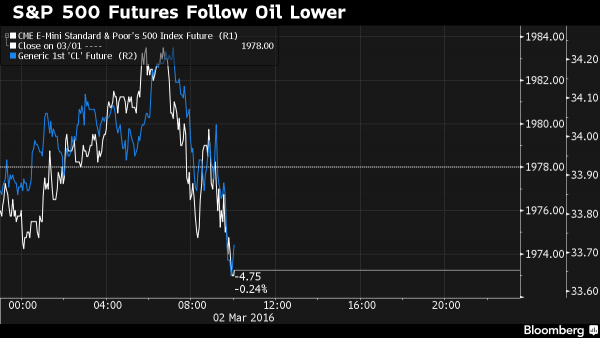

Futures on the S&P 500 expiring in March fell 0.2 percent to 1974, erasing an earlier rise of as high as 0.3 percent as Donald Trump and Hillary Clinton solidified their positions in the race to their parties’ presidential nominations following yesterday’s Super Tuesday primaries. As the chart below shows, the oil/equities correlation is once again dominant…

… which has meant an initial weakness for both the Emini and WTI following yesterday’s gargantuan API build. However, with official DOE data on deck in a few hours, all that will take for oil to jump higher is for the announced inventory build to be just fractionally less than the 9.9 million barrels the API reported, and the HFT algos will be off to the races again, chasing Brent and WTI higher.

AS Bloomberg notes in its Super Tuesday recap, Clinton dominated Democratic Party primary contests held on Tuesday, beating rival Bernie Sanders, and Trump boosted his chances of securing the Republican Party nomination. The impact on trading was muddied as global equities rebounded on the U.S. economic data and amid stability in China markets that spurred risk-taking.

The eighth year of a presidency typically ranks last in terms of equity returns, and the first half of an election year is often even worse. Add everything else that has been weighing on markets in 2016, from China to oil and the Federal Reserve, and few money managers see a return to the calm that reigned from 2012 to 2015.

Among the other top overnight news, fracking pioneer McClendon accused of rigging Oklahoma bids, Pimco’s Jon Short leaving to join Zwirn’s Arena hedge fund, Starbucks former COO Alstead permanently resigns from company, and China’s rating outlook was put on negative by Moody’s.

Global market snapshot:

Top News:

Looking at regional markets, as usual we start in Asia where equities took the impetus from the strong close on Wall St. where strong data and gains in the energy complex bolstered sentiment. Nikkei 225 (+4.1%) outperformed with exporters lifted by a weaker JPY and strong performances in automakers after encouraging US auto sales results, while the ASX 200 (+2.0%) was underpinned by the resurgence in the energy sector as well as better than expected domestic GDP data. Shanghai Comp (+4.3%) conformed to the upbeat tone as material names spurred the index after cement capacity reduction plans and several regional measures were announced to support the property industry. 10yr JGBs declined amid spill-over selling from USTs after firm US data bolstered risk sentiment and US economic confidence, to the detriment of safe-haven assets. As reported last night, Moody’s affirmed China’s Aa3 rating, but revised its outlook to negative from stable.

Top Asian News:

Leave A Comment