US futures were slightly lower, with tech companies indicating declines as the AI-fueled rally showed signs of fading, even as tech funds had their largest weekly inflow on record, which Bank of America’s Michael Harnett said hints at “AI capitulation.” As of 8:00am ET, S&P futures were down 0.1%, with Nasdaq futures also in the red.

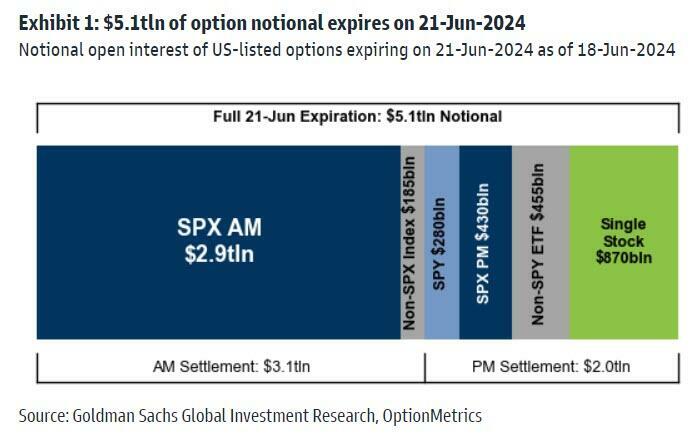

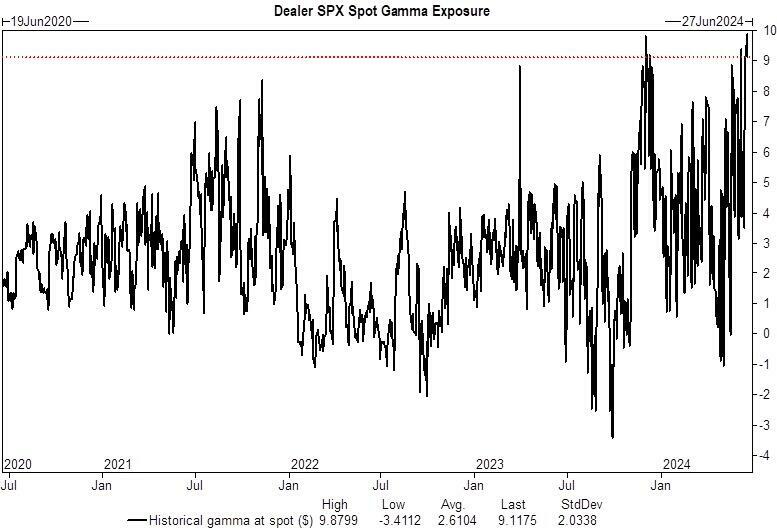

As previewed yesterday, Wall Street braced for the biggest triple witching option expiration day on record, where some $5.1 trillion worth of options tied to indexes, stocks, and ETFs mature…  … which could “unclench” record $10 billion in dealer gamma and spark sharp market moves as “pins” expire.

… which could “unclench” record $10 billion in dealer gamma and spark sharp market moves as “pins” expire.

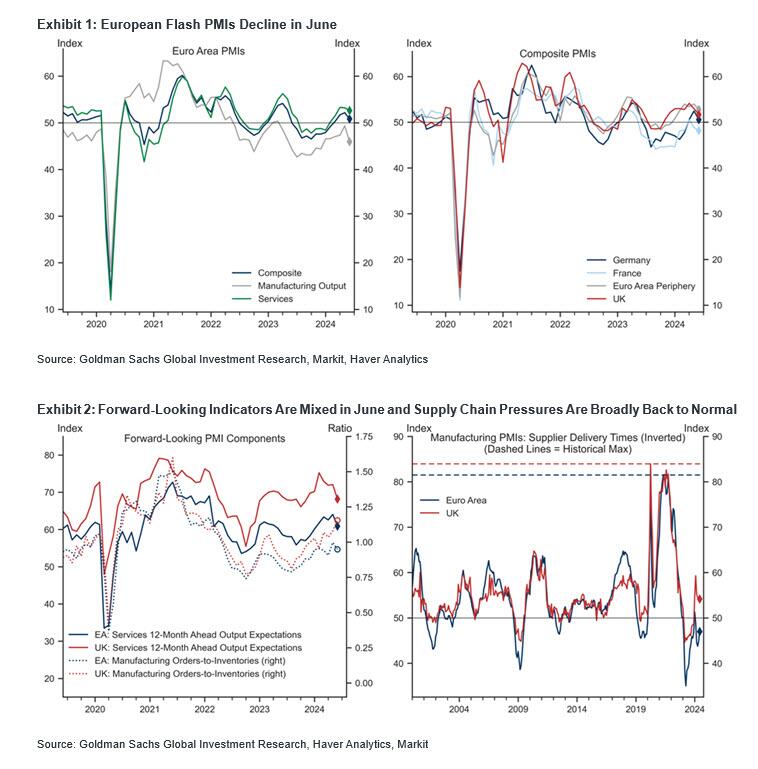

Bond yields are 2-4bp lower this morning, reversing a move higher, after Europe’s ugly PMI prints (see below) which also pushed the EUR lower and the USD higher. Commodities are mixed; oil is modestly lower; base metals are higher. Today’s macro focus will be the flash PMIs at 9.45am ET; consensus expects a mfg print of 51.0 while the PMI-Srvcs is seen printing 54.0 survey vs. 54.8 prior.In premarket trading, tech names are mostly lower: NVDA -1.8%, QCOM -71bps, MSFT -25bps and AAPL -23bps. Spirit AeroSystems jumped 4% after Reuters reported Boeing is nearing a deal to buy back the aircraft-parts supplier. Here are the other notable premarket movers:

Risk-off trades were also in vogue in Europe, where the fallout from French President Emmanuel Macron’s decision to call a snap election continued to make itself felt in the region’s economy. The yield on Germany’s benchmark 10-year bonds tumbled seven basis points after manufacturing and services PMI readings for Europe’s two biggest economies fell short of expectations. The rate on US Treasuries also declined, while the dollar held near a 2024 high after the PMI data, which underscored how French political risk is dragging on growth. Traders now see a second ECB cut by October and an 80% chance of a third this year, up from about 65% on Thursday.

Key numbers:

- Euro Area Manufacturing PMI (June, Flash): 45.6, missing consensus 47.9, last 47.3.

- Euro Area Services PMI (June, Flash): 52.6, missing consensus 53.4, last 53.2.

Macron’s shock call for a vote has stoked volatility in the region’s markets and left investors worried that an economic rebound could be snuffed out by far-right leaders, should they prevail in elections. European stock funds suffered their fifth week of outflows, according to Bank of America strategists, citing EPFR Global data.“The most important problem for us is the economic outlook for the euro zone,” said Benoit Peloille, chief investment officer at Natixis Wealth Management. “It really poses a risk.”And speaking of European stock markets, the Stoxx 600 was on course for its worst day this week, dropping 0.7%, with banks the worst performers, with construction and tech also falling. Here are the most notable European movers:

Earlier in the session, Asian stocks traded lower, led by losses in Hong Kong, as a global tech-driven rally showed signs of fatigue, while concerns persist over China’s economy. The MSCI Asia Pacific Index fell as much as 0.6%, with TSMC, Samsung and Tencent among the biggest drags. Declines were also notable in South Korea and Taiwan, while a tumble in the Philippines’ main benchmark put it on course to enter a technical correction. For the week, the regional gauge is little changed.

Hong Kong’s Hang Seng dropped as much as 2% while mainland gauges also slid as Beijing is seen as reluctant to step up stimulus. US stocks fell overnight as the high-flying tech group led by Nvidia came under pressure amid signs of overheating.Canada’s Prime Minister Justin Trudeau is preparing potential new tariffs on Chinese-made electric vehicles to align the nation with actions taken by the US and European Union, Bloomberg reported. The government still has to make final decisions on how to proceed, but it’s likely to announce soon the start of public consultations on tariffs that would hit Chinese exports of EVs into Canada, according to officials. In May the US announced a plan to nearly quadruple tariffs on Chinese-manufactured electric vehicles, up to a final rate of 102.5%, while the European Union said last week it plans to increase tariffs to as high as 48% on some vehicles.In FX, the Bloomberg Dollar Spot Index was little changed, pulling back from near this year’s high ahead of fresh data later today. Dollar demand over the Tokyo benchmark fix saw spot offers attached to 159 strikes — worth a collective $2.05 billion and expiring between today and June 26 — get taken out, according to an Asia-based FX trader. European political and fiscal risk, an easier stance from BoE and a steady slide in JPY have countered the recent run of softer US data, Tim Riddell, director of strategy at Westpac Banking Corp. wrote in a note. “Despite remaining contained within its range, the sharpness of recent DXY moves suggests that a directional move may be developing.”

In rates, treasuries hold an advance that was led by core European rates, with German bonds outperforming after soft PMI data across Europe and US PMIs due later Friday. US long-end tenors lag slightly, extending the recent steepening in 5s30s spread beyond Thursday’s highs. German 10-year yields fell 6bps to 2.38% while treasury yields were richer by 2bp to 4bp across the curve with front-end- and belly-led gains steepening 5s30s spread by around 1bp on the day; 10-year yields trade around 4.225%, richer by 3bp vs Thursday’s close with bunds outperforming by 4bp in the sectorIn commodities, oil prices decline, with WTI falling 0.2% to trade near $81.15 a barrel. Spot gold rises ~$6 to $2,366/oz. Bitcoin continues to slip and now sits beneath USD 64k, with Ethereum also slipping below USD 3.5k.Looking at today’s calendar, US economic data slate includes June S&P Global manufacturing and services PMIs (9:45am) and May Leading index and existing home sales (10am). No Fed officials scheduled to speak during the session

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of NewsquawkAPAC stocks were mostly rangebound with sentiment subdued after the lacklustre handover from Wall St where tech underperformed and risk appetite was sapped as participants reflected on higher yields and soft data releases ahead of quad-witching. ASX 200 was rangebound with upside restricted after weak Australian flash PMI data including a steeper contraction in manufacturing. Nikkei 225 traded indecisively after softer-than-expected National CPI data and weakening PMIs. Hang Seng and Shanghai Comp. were pressured with underperformance in Hong Kong as the local benchmark dipped beneath 18,000 amid losses in property and tech, while the mainland conformed to the glum mood amid ongoing trade-related headwinds with Canada also preparing a tariffs plan on Chinese electric vehicles.

Top Asian News

European bourses, Stoxx 600 (-0.4%) are lower across the board, though with price action fairly rangebound, and generally unreactive to the downbeat EZ PMI data. European sectors are mostly lower, and hold a slight defensive bias, with Utilities and Healthcare towards the top of the pile, whilst Banks are towards the bottom of the pile, alongside Tech. US Equity Futures (ES -0.1%, NQ -0.1%, RTY -0.1%) are very modestly lower, continuing some of the losses seen in the prior session, and in fitting with the broader sentiment in Europe.Top European News

European PMIs

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

- June S&P Global US Manufacturing PM, est. 51.0, prior 51.3

- June S&P Global US Composite PMI, est. 53.5, prior 54.5

DB’s Jim Reid concludes the overnight wrapNot to depress you but enjoy today while you can if you’re in the northern hemisphere as tomorrow will have a little less daylight as a slippery dark slope to Xmas begins. I’m currently writing this on the longest day in Watford in the middle of a large longstanding annual 2-day DB Macro conference. Maybe we should have held it at Stonehenge this year given the date.On that theme it feels like you have to go back to the Neolithic period to find a day when the US significantly underperformed Europe but that’s what happened yesterday. The S&P 500 (-0.25%) opened around a third of a percent higher and above 5500 for the first time before slipping as the session progressed with even Nvidia, on its first day as the largest company in the world, slipping from +3.82% at the day’s early highs to close -3.54% and losing its largest company crown back to Microsoft . The recent rally in US stocks has been very narrow with only 2% of the 503 constituents currently at all-time highs and 7% at one-month lows. So we are seemingly in the hands of tech and particular Nvidia at the moment.Over the other side of the Atlantic, sentiment was helped by a strong bond auction in France , suggesting that investors were still willing to buy OATs despite the political uncertainty. But on top of that, there was growing hope among investors about the chance of rate cuts ahead, as the Swiss National Bank marginally surprised markets by cutting rates for the second time this year, and the Bank of England made some dovish noises as well. So that offered fresh signs that the global monetary policy cycle was turning, with further rate cuts on the horizon.That narrative got going after the SNB’s decision, where they delivered a 25bp cut in their policy rate to 1.25%. A narrow majority of economists in Bloomberg’s survey had expected them to remain on hold. They also lowered their inflation forecasts compared to March, which now see it falling from 1.3% in 2024, to 1.1% in 2025, and 1.0% in 2026. In turn, the Swiss Franc weakened by -0.80% against the US Dollar yesterday, making it the worst-performing G10 currency on the day.That was then followed up by a dovish hold from the Bank of England. They kept the Bank Rate at 5.25% as expected, and the decision was split 7-2 with the two preferring a 25bp rate cut. But even though 7 wanted to stay on hold, the statement pointed out that for some of that group, “ the policy decision at this meeting was finely balanced ”, and investors dialled up the chance of a rate cuts in response. For instance, the chance of a cut by the next meeting in August rose from 34% the previous day to 62% by the close. That helped gilts to outperform, with the 10yr yield down -1.1bps on the day to 4.055%.European markets got a further boost from the situation in France, where the Treasury raised €10.5bn in an auction of 3-8yr debt. That auction had been in the spotlight, as there were concerns about how much demand there’d be given the political uncertainty. But in reality it went smoothly, and the Franco-German 10yr spread came down by -2.2bps on the day to 77bps. That supportive backdrop helped French equities to recover as well, and the CAC 40 (+1.34%) posted its strongest daily performance since January.That strength was echoed across European equities, where the STOXX 600 (+0.93%), the DAX (+1.03%) and the FTSE MIB (+1.37%) all posted solid gains. Over in the US, the S&P 500 (-0.25%) weakness after the holiday was driven by the information technology sector (-1.60%). The NASDAQ (-0.79%) and the Magnificent 7 (-0.85%) in turn posted sizeable declines. In addition to Nvidia’s reversal, Apple fell -2.15%, allowing Microsoft (-0.14%) to sneak back in as the world’s most valuable company. The equity mood was slightly more positive otherwise, with 58% of S&P 500 constituents higher on the day. Energy stocks led on the upside (+1.86%), amid a boost from the latest rise in oil prices, with Brent crude (+0.75%) closing at a 7-week high of $85.71/bbl.The US session was punctuated by largely weaker data releases yesterday. For example, the continuing jobless claims were up to 1.828m in the week ending June 8 (vs. 1.810m expected), which is their highest level since January. And the initial jobless claims were at 238k over the week ending June 15 (vs. 235k expected), which pushed the 4-week moving average up to a 9-month high of 232.75k. However, note that claims can be distorted this time of year by the timing of the end of the school year so we’re not yet reading too much into the recent climb. At the same time though, data also showed that housing starts fell to an annualised rate of 1.277m in May (vs. 1.370m expected), which is their lowest rate since June 2020. But even with the weaker data, the Atlanta Fed’s GDPNow estimate only ticked down a tenth in the latest update, and now points to annualised growth in Q2 at +3.0%.That subdued data failed to stop sovereign bond yields from moving higher yesterday, which took place on both sides of the Atlantic. Indeed, yields on 10yr Treasuries were up +3.7bps to 4.26%, whilst those on bunds (+2.8bps), OATs (+0.6bps) and BTPs (+0.8bps) all moved higher as well. The only major exceptions to that were in the UK (-1.1bps) and Switzerland (-5.0bps), who both had dovish-leaning central bank decisions yesterday.Asian equity markets are mostly trading lower this morning with Chinese stocks the major underperformers. The Hang Seng (-1.72%) is leading losses while the CSI (-0.60%) and the Shanghai Composite (-0.40%) are also edging lower. Elsewhere, the KOSPI (-0.88%) is also drifting lower in early trade with the Nikkei 225 (-0.12%) swinging between gains and losses after Japan’s inflation data (more on this below). S&P 500 (+0.02%) and NASDAQ 100 (+0.08%) futures are slightly higher.Coming back to Japan, consumer prices ex fresh food accelerated for the first time in a couple of months, advancing +2.5% y/y in May (v/s +2.2% in April, +2.6% consensus) even if it was slightly below consensus. Headline consumer inflation also advanced at a faster pace in May, rising +2.8% y/y (+2.9% expected) and compared with the +2.5% recorded in April, partly due to higher energy bills. However, the core-core CPI, which strips away both energy and fresh food, increased +2.1% y/y in May (v/s +2.2% expected) down from a +2.4% gain in the previous month.Separately, reports showed that Japan’s factory activity expanded for a second straight month in June but the pace of growth eased. The au Jibun Bank flash manufacturing PMI came in at 50.1 in June slightly down from 50.4 in May. Meanwhile, services sector activity contracted in June for the first time in about two years amid subdued new business as the flash services PMI slipped to 49.8 in June from 53.8 in May.In FX, the Japanese yen (+0.03%) is trading around 159 versus the dollar, its weakest level in two-months and near the lows again, thus ramping up expectations that the authorities will again intervene in the FX market. Meanwhile, Masato Kanda, the top currency diplomat, reiterated that the authorities are prepared to take necessary measures if there are any highly volatile moves in currency markets.To the day ahead now, and the main data highlight will be the flash PMIs for June from the US and Europe. Otherwise in the US we’ll get existing home sales for May and the Conference Board’s leading index for May, and in the UK there’s retail sales for May. From central banks, we’ll hear from the ECB’s Nagel and Simkus.More By This Author:WTI Extends Gains After Surprise Crude Inventory Draw; Pump-Prices Set To SoarJapan To Issue Bonds With Shorter Maturities As BOJ Begins Tapering QEEthereum Spikes After SEC Drops Investigation

Leave A Comment