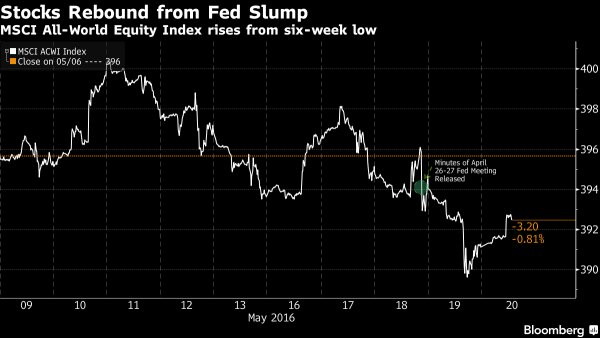

It will be fitting, not to mention symmetric, if stocks which yesterday closed at 7 weeks lows and red for the year, end the week the same way they started it: with a rally on no news, just more hopes that oil (which as recently as two years ago none other than Chair Yellen said said would be be “unambiguously good” if lower) will continue rising. While US markets ended yesterday’s trading on a sour note, that weakness has failed to spread to the rest of the world, and global shares rebounded from a six-week low as crude and commodity prices recovered, while the yen weakened on reduced demand for haven assets.

And just like on Monday, the rebound was once led by the commodity sector, where raw-materials producers and energy companies outperformed on the Stoxx Europe 600 Index as shares in the region rebounded from their biggest decline in two weeks. Crude rose toward a seven-month high and copper rebounded from levels last seen in February.

Concerns remained about the Fed’s June/July hike although the goal seeked narrative has bifurcated.

According to some, such as Thorsten Engelmann, a Frankfurt-based trader at Equinet Bank, the market has now priced in a summer hike: “After the losses of the last few days, bargain hunters are re-entering the market. The market seems to be able to deal with the Fed raising rates, and next week should be quieter now that the earnings season is over.”

Others, like David Gaud, a fund manager at Edmond de Rothschild Asset Management, told Bloomberg TV in Hong Kong, that there simply won’t be a rate hike in the first place: “There will be no rate hike in June, it’s probably a bit too early. The Fed will further prepare the markets for a hike probably in September and maybe a second one in December. That’s going to create more volatility, but more than anything that’s going to be a positive in the end for the markets.”

Meanwhile, the levitation in oil continues, even if WTI trades little changed as of this moment after paring earlier gain with focus moving to supply disruption. June contract expires today. “Supply disruptions” are back in focus, “the market has fairly quickly shrugged off the dollar strength that caused a bit of a stir yesterday and triggered some profit- taking,” says Saxo Bank head of commodity strategy Ole Hansen. “If we had supply disruptions from places like Canada, Nigeria, Venezuela and Libya like this 5 years ago we wouldn’t be up $5, we’d be up $25 – that is probably a testament to the oversupply still in the market.”

The MSCI All-Country World Index of shares rose 0.4 percent as of 10:57 a.m. London time, climbing for the first time in four days. In Europe, the Stoxx 600 climbed 1 percent and futures on the S&P 500 added 0.2 percent. The MSCI Emerging Markets Index rose 0.4 percent, paring its weekly decline to 1.4 percent. The gauge is headed for its fifth weekly drop in the longest run of losses since August. The Hang Seng China Enterprises Index of mainland companies listed in Hong Kong rose 0.7 percent.

Market Snapshot

Top Global News

Looking at regional markets, we start in Asia which managed to put the US concerns about a Fed rate behind it with risk-appetite improving alongside the gains in the energy complex. ASX 200 (+0.5%) traded higher as the index coat-tailed on oil after WTI crude futures rose above USD 49/bbl, while Nikkei 225 (+0.5%) was underpinned following a rebound in USD/JPY which edged above 110.00. Hang Seng (+0.8%) and the Shanghai Comp (+0.7%) conformed to the improving sentiment in the region after the PBoC returned to a net weekly injection of CNY 50bIn from the recent consecutive weekly net drains, with retailer earnings also boosting optimism. 10yr JGBs traded higher despite the risk-on sentiment seen in Japanese equities with the BoJ in the market to acquire around JPY1.2trl in government debt.

Leave A Comment