With European markets closed across the continent on Monday as the Easter holiday continues, overnight Asia was busy with the Shanghai Composite letting off some steam, and closing down 0.7% at session lows on concerns the Shanghai and Shenzhen home bubble have been popped prematurely by the politburo.

Japan was a different story with the Yen sliding following a report by the Sankei newspaper that Abe will announce in May his intention to delay the planned April 2017 sales tax hike from 8% to 10%, coupled with additional reports that Japan will unveil a major fiscal stimulus (and just on Friday Abe said he is “not thinking at all about supplemental budget” at this time).

This turned out to be nothing but the latest Japanese market trial balloon, because hours after the report, Abe reiterated that Japan’s sales tax will indeed be raised as scheduled in April 2017 “barring a crisis like the one caused by the collapse of Lehman Brothers”, while cabinet secretary Suga said there is no truth in the report that the government has decided to delay the sales tax hike. By the time these denials hit, however, the FX momentum algos were engaged, and the USD/JPY jumped, leading to seven straight days of Yen losses, the longest losing streak since October 23 and in the process sending the Nikkei higher by 0.8%.

And thanks to the low volume, illiquid futures market, U.S. equity index futures followed the Japanese rebound, with the E-Mini rising 0.3% to 2034.5 in the thin premarket trade. Dollar falls slightly, reversing earlier gains, while gold also declines. Oil rises for first day in 3. Traders are pricing in a 6% chance of a U.S. rate increase in April, and about 38% probability of a boost in June, according to Fed funds futures. Increasingly many strategists are concerned that the market is underplaying the risk of a June rate cut and as a result odds will have to rise substantially in the coming weeks so the Fed will avoid a “surprise.”

Markets Snapshot

S&P 500 futures up 0.3% to 2035

Stoxx 600 closed

MSCI Asia Pacific up less than 0.1% to 128

Nikkei 225 up 0.8% to 17134

Hang Seng closed

Shanghai Composite down 0.7% to 2958

S&P/ASX 200 closed

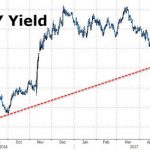

US 10-yr yield up less than 1bp to 1.91%

Dollar Index down 0.06% to 96.22

WTI Crude futures up 1.1% to $39.88

Brent Futures up 0.8% to $40.78

Gold spot down less than 0.1% to $1,216

Silver spot up 0.3% to $15.23

Top Global News

Japan’s NTT to Acquire Dell Units for $3.055b: NTT Data to acquire Dell Systems Corp. and other units related to IT services.

Sanders Says He’s Seized Momentum After Crushing Caucus Wins: Sanders received 73% in Washington state, day’s biggest delegate prize, 70% in Hawaii, 82% in Alaska.

Bull Market in U.S. Stocks Goes AWOL as History Rewards Patience: S&P 500 Index hasn’t seen a new high in 10 months, longest streak outside a bear market since 1995.

Avon Activists Near Deal to Call Off Proxy Fight: WSJ: Deal would allow Barington Capital, NuOrion Partners to approve new independent director.

Third Point Warns Seven & I Against Nepotism Deciding CEO: Seven & i CEO Toshifumi Suzuki, 83, is having chronic health problems; investors fear he may try to name his son, Yasuhiro Suzuki, to lead Seven?Eleven Japan, eventually become president of Seven & i, Loeb wrote.

Microsoft Said to Meet With Possible Yahoo Bidders Seeking Funds: MSFT met with possible bidders for Yahoo! such as Verizon, private equity firms, who may seek backing from the software maker for their offers.

Fed’s Williams Sees ’Huge Impact’ on U.S. From China, Brazil: “The real issue is the global financial and economic developments. There’s uncertainty about what’s happening around the world and how that feeds back to the dollar and the U.S. economy,” Williams, who doesn’t vote on monetary policy this year, told CNBC.

‘Batman v Superman’ Soars in Boost to Warner’s DC Franchise: Film opened with weekend sales of $170.1m in North American theaters, meeting estimates, giving studio a new foundation to build on.

Qlik Tech Said to Hire Morgan Stanley for Possible Sale: Reuters: Co. has begun exploring strategic alternatives.

Oil Halts Two-Day Slide After U.S. Rig Count Resumes Decline: Rigs targeting oil in the U.S. fell by 15 to 372, according to Baker Hughes.

Leave A Comment