With much of Europe and Asia, including the U.K., France, Germany and China markets closed for Labor Day, Asian stocks and the dollar rose buoyed by news that Congress had reached a deal to keep the US government funded through the end of September. S&P futures are up 4 points or 0.2%. Oil declined as rigs targeting crude in the U.S. rose for a fifteenth week and output from Libya rebounded.

What’s happening this morning? Not a whole lot. The two big incremental headlines concerned China (the Apr PMIs were underwhelming) and US gov’t spending (as was widely expected a deal was reached to fund the gov’t until Sept 30 although a shutdown this fall, along w/a debt ceiling battle, remain distinct possibilities). Otherwise it was a relatively quiet weekend/morning. Note that a lot of the world (other than the US) is closed Mon 5/1 for Labor Day/May Day holidays (including HK/mainland China and Europe/London).

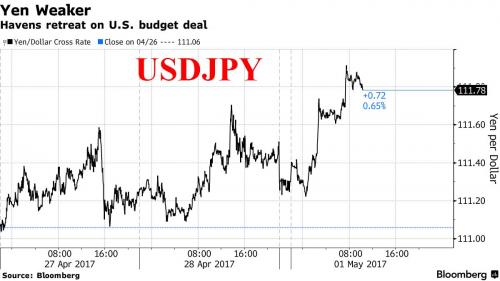

The Yen declined for a fifth day in six, while Treasuries retreated with gold.

The MSCI All Country World Index edged higher, after capping a sixth straight month of gains on Friday. Japan’s Topix rose to the highest level since March after its best week of the year. Trading volumes were lower than average due to holidays in most of Europe, China, India and Mexico, and a forthcoming three-day break in Japan.

MSCI’s index of Asia-Pacific shares outside Japan rose 0.1%. Japan outperforming on upbeat earnings, with Japan’s Nikkei climbing 0.4%, with high-tech blue chips gaining on strong earnings.

Asian shares initially took their cue from Wall Street, which dipped on Friday after data showed the U.S. economy grew at its weakest pace in three years in the first quarter. The mood brightened however, on news that U.S. congressional negotiators hammered out a bipartisan agreement on a spending package to keep the federal government funded through Sept. 30, thus averting a government shutdown. Asian markets were little fazed by China’s official manufacturing survey on Sunday which showed growth in the country’s factories slowed more than expected in April to a six-month low.

Pointing to a higher open for the main market later in the day, E-minis gained about 0.2% while 10-year Treasury yields rose after three successive days of declines.

“It is hard for markets to make big moves with holidays in so many places today, and people are just waiting for more information to come out,” said Harumi Taguchi, principal economist at IHS Markit in Tokyo.

“The main focus of the broader markets this week will be on the United States, with the Fed’s May 2-3 policy meeting and the jobs report on Friday,” said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management in Tokyo. “While many of the indicators in the first quarter were weak, the jobs data could confirm that labor market conditions continue to improve and lift the dollar and U.S. yields.”

In currencies, the greenback was up 0.2 percent at 111.750 yen edging back towards a four-week peak of 111.780 reached last week. The euro handed back earlier modest gains and was flat at $1.0891. The common currency had been lifted on Friday after euro zone inflation data rose more than expected and returned to the European Central Bank’s target. The euro was still in range of the 5-1/2-month high of $1.0951 struck early last week on relief over the first round of the French presidential elections. The pound was 0.3 percent lower at $1.2907 after climbing to a seven-month high of $1.2957 on Friday, when traders were seen to have closed off bets against the pound ahead of Britain’s long bank holiday weekend.The Australian and New Zealand dollars were slightly lower at $0.7483 and $0.6856, respectively.

In commodities, crude oil prices slipped amid lingering concerns that an OPEC-led production cut has failed to significantly tighten an oversupplied market.U.S. crude shed 11 cents to $49.22 a barrel, heading back towards a one-month low of $48.20 plumbed late last week and Brent LCOc1 was down 16 cents at $51.89 per barrel. Oil was weighed by news that US rigs targeting crude in the U.S. rose for 15th week while output from Libya rebounded. The number of oil rigs operating in U.S. fields advanced to most since April 2015, according to Baker Hughes. Libya’s crude production rebounded to more than 700k b/d as the OPEC member’s biggest oil field and another deposit in its western region resumed pumping after halt. “Higher prices will attract American producers to ramp up production, especially in profitable areas like the Permian basin, and the conflict in Libya was already winding down last week,” says Sheldon Laliberte, a Rotterdam-based crude oil analyst at commodities trader Cofco International Ltd. “I’m structurally bearish oil right now.”

DISH Network, Advanced Micro Devices, Cardinal Health among companies scheduled to publish results. It is another busy week for earnings with 131 S&P 500 companies reporting and 85 Stoxx 600 companies reporting. Among those reporting are Apple, BP, BNP Paribas, Facebook, Merck, Tesla, Time Warner, Pfizer, HSBC, BMW, Shell and VW.

Market Snapshot

Leave A Comment