Heading into Tuesday, there was just one thing traders wanted to know: how the 10Y cash Treasury would open after Monday’s US holiday and after last week’s rout which sent yields to multi-year highs (even as the 0.3% drop in the TLT ETF suggested more weakness for US rates). They didn’t have long to wait as the yield on the 10Y TSY promptly rose to a fresh 7-year high as soon as trading resumed, touching on 3.26% in early trading.

30-year TSYs dropped for a fourth day, sending yields to the highest since July 2014, ahead of the government selling a combined $38 billion of longer-maturity Treasuries this week, with futures volumes running at more than 200% of normal.

As yields rose, sentiment quickly reversed the tepid optimism that emerged in Asian trading, with U.S. futures and Asian shares falling as European equities gave up an early gain, leading to another sea of red for global stocks. JPMorgan summarized the trader mood best: “risk sentiment is in a foul mood and stocks are sinking everywhere.”

Strength in oil stocks on higher crude prices and a rise in banking stocks on increased global borrowing had initially lifted Europe’s STOXX 600 index, but it was back near a 6-month low as the early momentum faded as fears over rates and Italy returned.

As yields crept above 3.25%, both S&P 500 futures and the Stoxx Europe 600 Index were poised for a fourth day of declines. Earlier in Asia, stocks in Shanghai rose fractionally after the biggest sell-off in more than three months on Monday.

The yuan gained in onshore trading after sliding a day earlier, even though the PBOC briefly allowed the currency to slip past the 6.90 “redline.” China’s central bank fixed its yuan rate at 6.9019 per dollar on Tuesday, breaching the 6.9000 barrier and leading speculators to push the dollar up to 6.9120 in the spot market.

“With Chinese economic momentum continuing to weaken alongside increasing pressure from the United States, currency weakness is the obvious release valve,” JPMorgan warned. “A lurch through the 7.0 level by year-end is possible.”

While a stronger yen put Japanese stocks under pressure, the currency ultimately pared its advance. Japan’s Nikkei fell 1.3% hurt in part by a rise in the safe-harbor yen and as yields on Tokyo’s government bonds tested the 0.15% cap the Bank of Japan effectively has on them. Pakistan’s rupee slumped about 5 percent in an apparent devaluation ahead of what looks likely to be another IMF program.

“It all feels like it’s quite nervous here over whether things going to break (out of ranges) or not,” said Saxo Bank’s head of FX Strategy John Hardy. He pointed to the rising U.S. and Japanese government bond yields which tend to set the bar for borrowing costs globally as well as the latest pressure on China’s yuan.

And with US Treasuries set for more losses, the next question was whether Italian assets would find a bid; alas it was not meant to be and Italian bonds extended declines, led by the 10-year sector, after finance minister Giovanni Tria didn’t give investors the reassurance they were hoping for in relation to growing tensions with the European Union over the nation’s budget plans.

Italy’s benchmark 10-year government bond yield also moved toward a 4-1/2-year high as Economy Minister Giovanni Tria struck a resolute tone on his controversial budget plans in Rome’s parliament. Tria said the country’s low growth doesn’t allow for a cut to debt-to-GDP, adding that “the outlook is not positive” referring to global growth during a parliamentary hearing in Rome. The 10Y Italy yield rose above 3.70%, the highest since February 2014 while the BTP-Bund spreads widened to 311 bps…

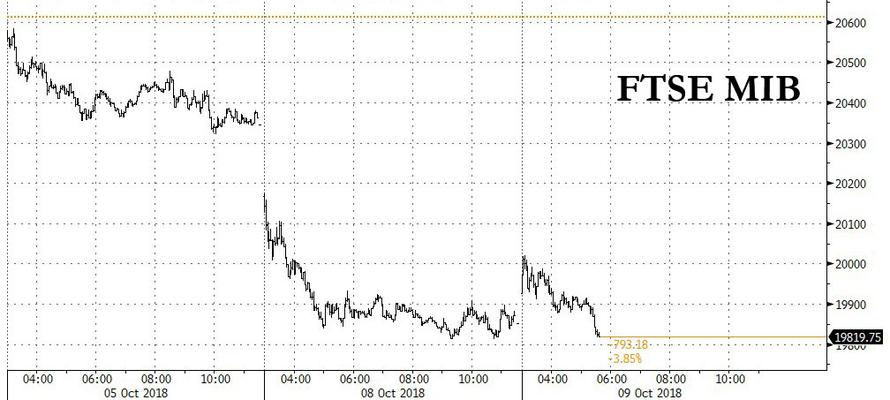

… with Italy’s FTSE MIB paring initial gains, and falling 0.4%, after gaining as much as 0.9% in early trade. Italy’s stock market is now getting close to bear market territory, down 19% since its high on May 7.

As the selling returned in Italy, it promptly spread to other European assets, with the Stoxx Europe 600 falling 0.4% and dragging the EURUSD to session lows below 1.1450.

The gloomy mood that has spread across markets did not get any help from the latest IMF report released overnight. The fund reduced its outlook for global growth for the first time since 2016, due to growing trade tensions between the world’s two largest economies. Meanwhile, China’s RRR cut announced this weekend, which failed to stabilize Chinese stocks which plunged more than 3% one day later, will inevitably put pressure on the yuan, with weakness of the currency threatening to further aggravate the trade tensions in a vicious circle that could prompt more Chinese easing.

“If the trade confrontation continues, the Chinese currency will go lower and that will create a whole host of problems for the global economy,” said Alicia Levine, chief strategist at BNY Investment Management. So far there is no sign at all that the trade war has any likelihood of easing.

The global risk-off mood meant more demand for safe havens like the US dollar, and the Bloomberg Dollar Spot Index advanced a second day to rise 0.2% to a six-week high as U.S. long bonds extended their recent decline. The pound came under pressure as investors started to lose hope that a Brexit agreement was imminent.

The greenback gained against all G-10 peers as the U.S. 10-year yield touched a new seven-year high; traders kept their focus on large expiries Tuesday in the majors as a thin data calendar makes case for gamma traders to control price action until New York cut off.

Leave A Comment