?

?

This data references the period ending Tuesday, July 18th

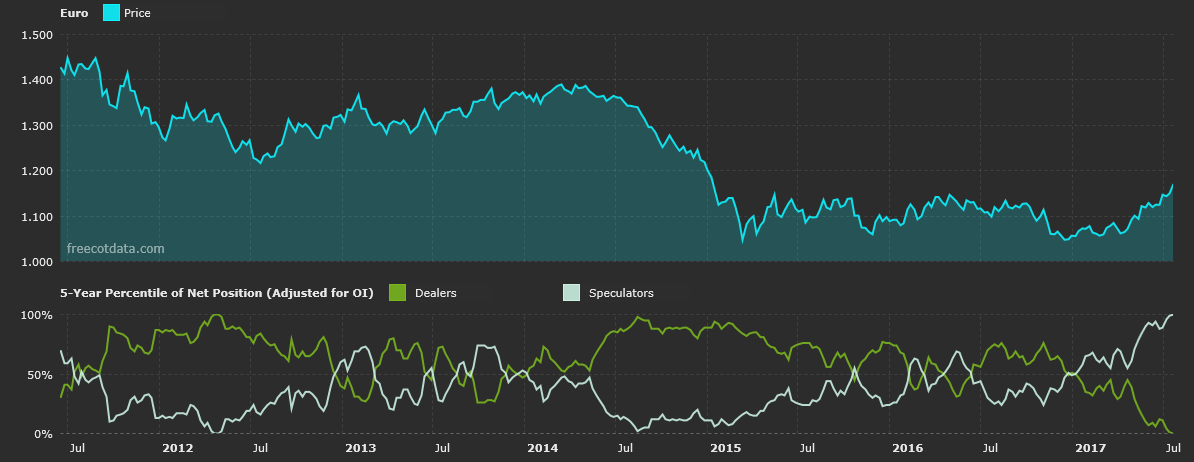

EUR/USD

?

?

Non-Commercials increased their net long positions in the Euro last week buying a further 7.5k contracts to take the total position to 91k contracts. The Euro has been steadily bought over the last month as markets continue to shift their perspective in line with the ECB. Recent commentary from ECB chief Draghi has stoked market expectations that the ECB are on the verge of announcing further tapering measures. However, at the bank’s recent July meeting the ECB seemed to take a small step backward highlighting that the ECB will remain in the market for a long time as early tightening would jeopardize the recovery and although risks are broadly balanced, inflation pressures remain weak.

Given the sharp rally over recent weeks following Draghi’s comments at the Sintra forum it is possible that the bank is trying to temper the markets view to prevent further aggressive appreciation in the exchange rate. Nevertheless, it seems that markets mostly responded to Drahi’s comment that a decision on QE would come at the autumn meeting, which saw EUR rally sharply once more as investors continue to expect further tightening by the bank in the near future.

On the USD side, the key focus this week will be the FOMC although with the event being statement-only, markets are not expecting the Fed to alter its fed funds’ target range. Instead, focus will be on the guidance given by the central bank specifically with how they reference the recent fall back in inflation and whether the bank will initiate a reduction in bond reinvestments as outlined on June 14th.

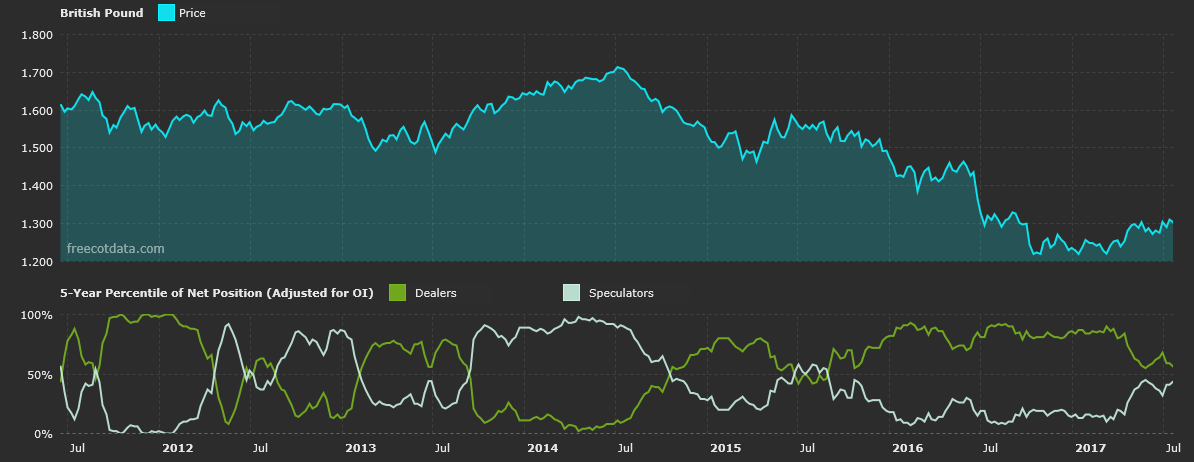

GBP/USD

?

?

Non-Commercials reduced their net short positions in Sterling last week buying 7.5k contracts to take the total position to -16k contracts. This latest adjustment marks the third consecutive week of purchases in GBP as short-covering continues to dominate flows.GBP bulls were left somewhat disappointed this week as a miss in June CPI saw a tempering of rate-hike expectations which have increased recently in line with comments from BOE’s Carney who said that removal of stimulus may be necessary soon. This week the key data focus will be 2Q GDP due on Wednesday which is forecast to have fallen back to 1.7% from 2% prior.

Leave A Comment