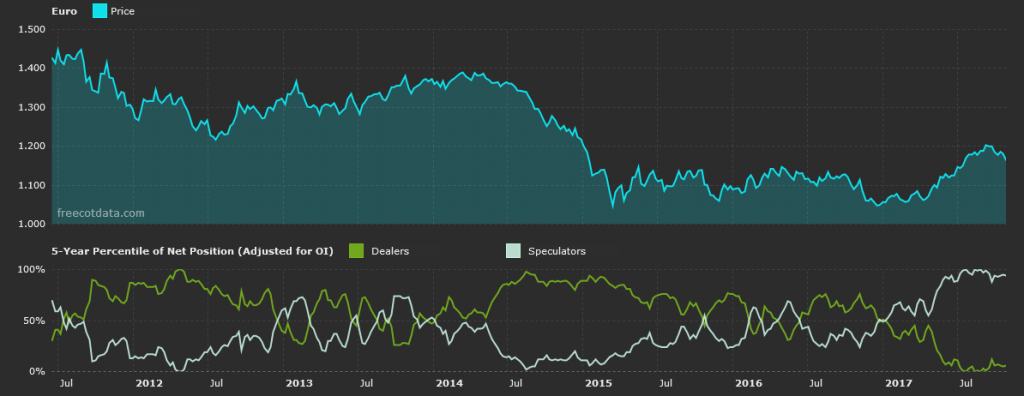

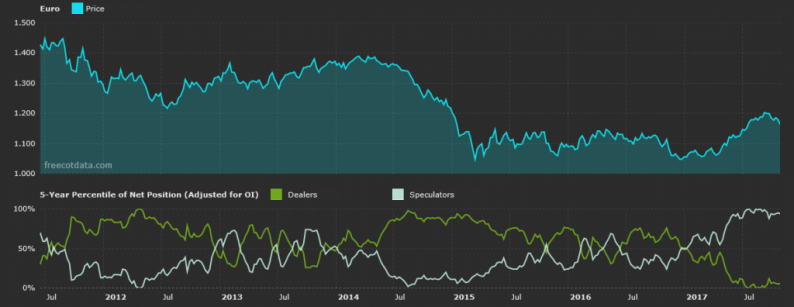

EUR/USD

Non-Commercials reduced their net long positions in the Euro last week selling 7k contracts to take the total position to 83k contracts. Long positioning has been reduced in recent weeks as investors adjusted their exposure ahead of last week’s ECB meeting. The market was visibly disappointed by Draghi’s tapering announcement which undershot expectations and saw EUR trading lower. Flows this week are likely to be driven by the appointment of a new US Fed chairman. On the data front focus will be on eurozone GDP data due on Tuesday, expected to have grown quarter on quarter alongside a flash inflation reading also due on Tuesday.

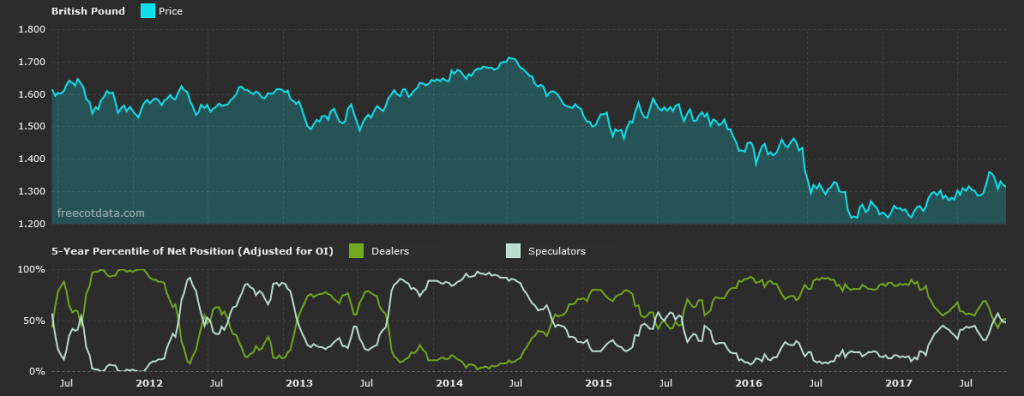

GBP/USD

Non-commercials reduced their net long positioning in Sterling last selling 6.5k contracts to take the total position to -1.4k contracts. After flipping positive in the prior week positioning, long exposure has now been reversed as Brexit uncertainty continues to weigh on investor sentiment outstripping hawkish expectations ahead of the BOE’s “Super Thursday” meeting this week. This latest shift in positioning comes despite clear signals by the BOE that it intends to hike rates before year-end, bolstered by continuing data strength.

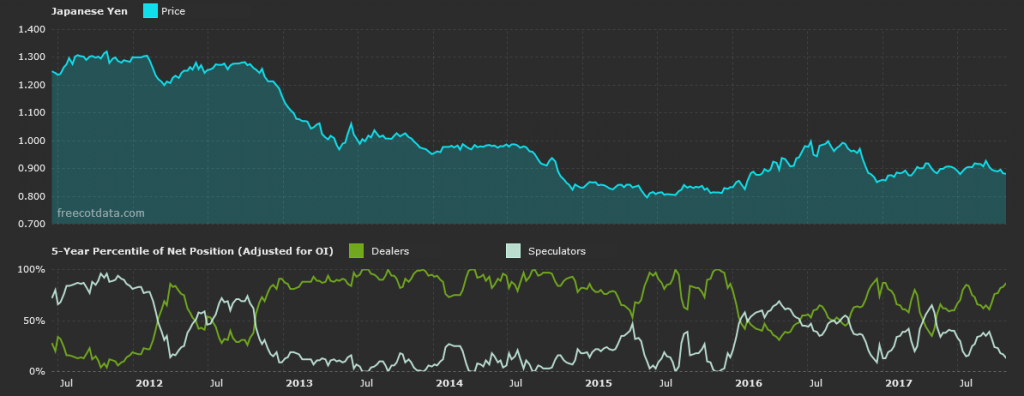

USD/JPY

Non-Commercials increased their net short positions in the Japanese Yen last week selling a further 15k contracts to take the total position to -116k contracts. Short exposure is now sitting just above record lows as the recent snap elections saw PM Abe consolidating his power in a landslide victory. Abe’s victory is viewed as fuel for further JPY downside as it increases the likelihood of BOJ policy remaining the same. At its upcoming meeting this week, the BOJ is expected to leave policy unchanged. However, the market will be keen to see whether new, dovish member Kataoka dissents again and proposes further easing measures.

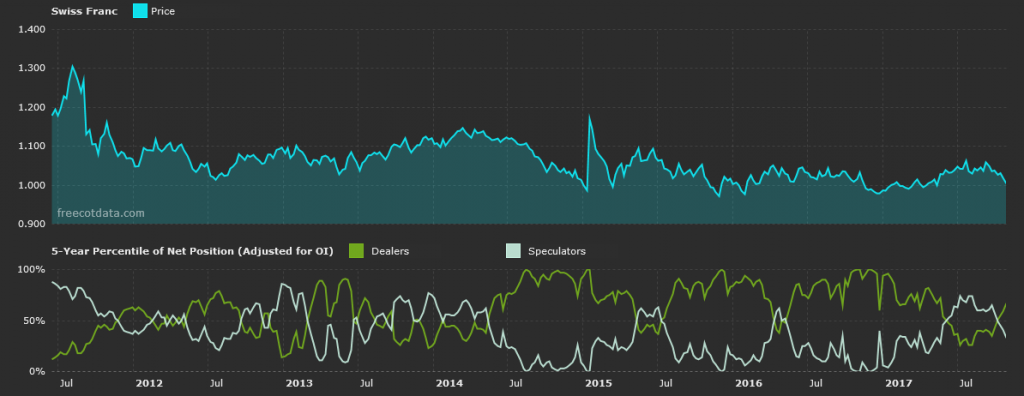

USD/CHF

Non-Commercials increased their net short positions in the Swiss Franc last week selling a further 7K contracts to take the total position to -12k contracts. CHF has been continuously sold over the last month as equity markets continue to appreciate and EUR upside persists. On the data front this week, the focus will be on retail sales and consumer confidence due later in the week.

Leave A Comment