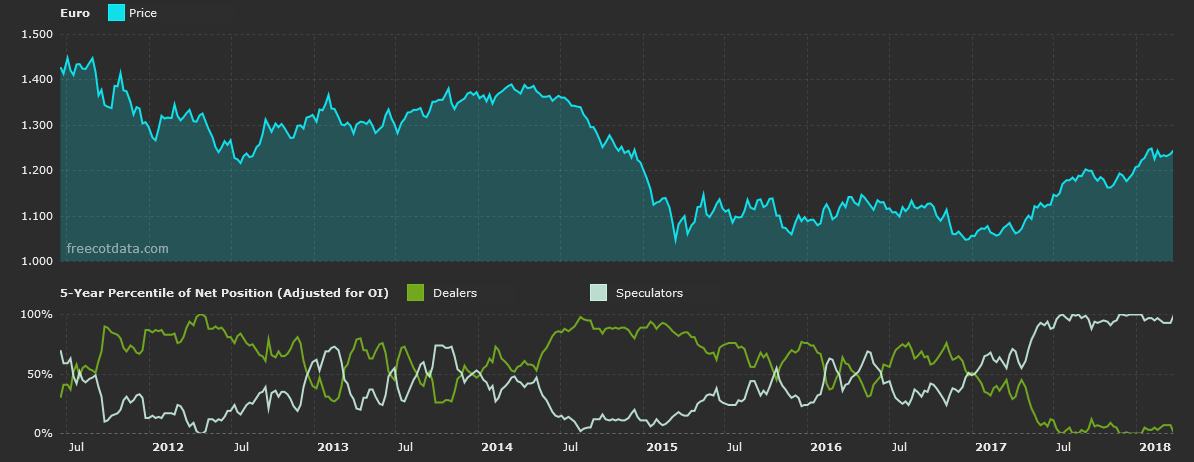

EURUSD

Non-Commercials reduced their net long positions in the Euro last week selling 14k contracts to take the total position to 133k contracts. This latest reduction in long positioning comes amidst the first sign of moderating economic activity in the Eurozone. Trading is expected to be light this week ahead of the Easter holidays. The demand seen in response to the ECB’s recent shift away from an easing bias has kept EUR supported. Recent data weakness, however, has somewhat curbed investor appetite. Incoming data will continue to attract investor focus as the market seeks to gauge the ECB’s next steps.

GBP/USD

Non-Commercials increased their net long positions in Sterling last week buying a further 16k contracts to take the total position to 24k contracts. This latest wave of GBP buying comes as the UK and EU have finally reached an agreement for a 21-month transition period for the UK’s departure from the EU. Alongside this development, we have also seen stronger wage growth which has cemented expectations for a hike at the Bank of England’s May meeting. The market is pricing only one BOE hike this year, so traders will be keen to hear the bank’s latest economic forecasts and inflation outlook for any clues as to whether these current projections are likely to shift.

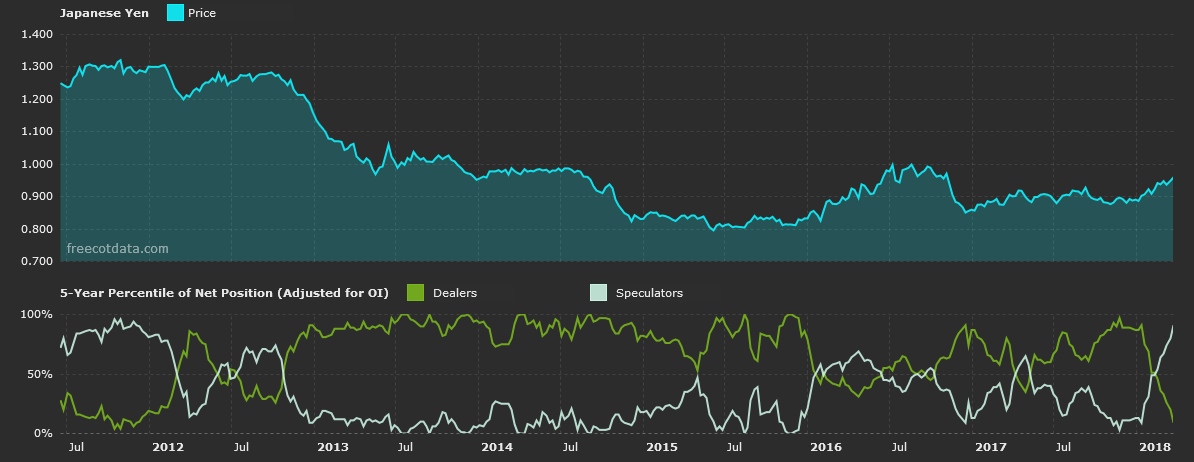

USD/JPY

Non-Commercials reduced their net short positions in the Japanese Yen last week buying 57k contracts to take the total position to -22k contracts. The record JPY Short Position is Down that built up over last year after being reduced by 80% as the market responds to the BOJ’s shifting policy outlook. In recent comments, BOJ’s Kuroda said that the BOJ will consider dismantling its ultra-loose monetary policy by the end of fiscal year 2018.

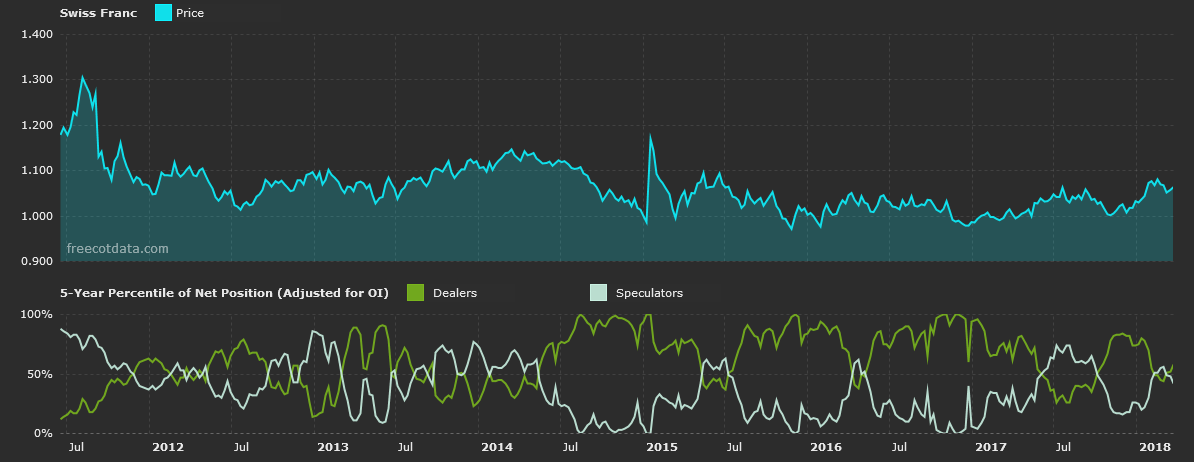

USD/CHF

Non-Commercials increased their net short positions in the Swiss Franc last week selling 2k contracts to take the total position to -8k contracts. Short positions in the Franc had been reduced over prior weeks as the market anticipated a shift in SNB policy over the coming year. However, SNB chief Jordan has recently warned that Trump’s protectionist trade policies have the potential to cause excessive strengthening in the Franc due to safe haven demand and as such the SNB will remain active in the market.

Leave A Comment