EUR/USD

Non-Commercials reduced their net long positions in the Euro last week selling 1k contracts to take the total position to 126k contracts. EUR upside exposure has been reduced heading into an important week for euro area politics. The upcoming Italian elections on March 4th have the potential to cause disruption for eurozone stability with the anti-EU party the Five Star Movement currently expected to take the lead according to the latest polls. 5SM has currently declared its intention to hold a referendum on continued eurozone membership though recent comments by the party’s leader have dialed back this rhetoric.

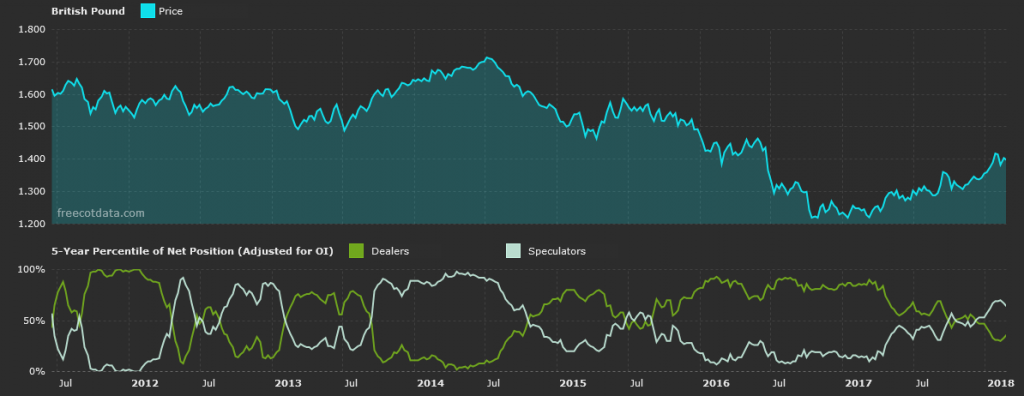

GBP/USD

Non-Commercials reduced their net long positions in Sterling last week despite rate hike expectations, selling 7k contracts to take the total position to 8k contracts. GBP upside exposure has now been reduced by over 50% in the last few weeks as sentiment seems to have soured on the currency. Although investors have been cutting their long positions, expectations for the BOE to raise rates in the coming months remain intact. Although the latest data showed some labor market weakness, comments from the MPC last week have strengthened this view. This week traders will be watching Manufacturing PMIs due on Thursday, which is expected to have increased over the month.

USD/JPY

Non-Commercials reduced their net short positions in Japanese Yen last week buying 7k contracts to take the total position -108k contracts. While JPY short positions have seen some covering recently, expectations for early BOJ tightening have lessened somewhat given recent JPY strength, alongside weakness in equity markets. It is worth noting, however, that the latest CPI reading came in stronger than expected on both the headline and core readings. On the data front this week, the main focus will be on Capex which is due on Thursday. It is expected to have increased along with industrial production which is due on Wednesday and is expected to have decreased.

Leave A Comment