Politics continued to remain in the forefront for the month of October. This time, however, focus turned to Asia as the Japanese Prime Minister Shinzo Abe called for snap elections. Japan held the elections on the weekend of October 24 which saw the incumbent win with a strong majority.

In New Zealand, after a long wait, the election results threw a surprise as the Labor Party joined hands with the populist NZ First party to form the government.

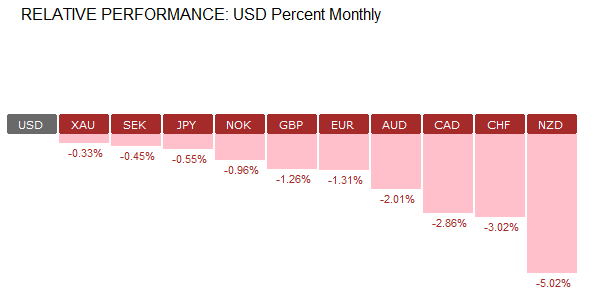

The New Zealand dollar fell sharply as the new government made its intentions clear that included making changes to the RBNZ’s price stability mandate. Full employment is also expected to be chalked into the central bank’s mandate. The NZ First party also announced its preference for central bank intervention and a weaker exchange rate for the New Zealand dollar.

In Europe, Spain dominated the news wires as the ongoing tussle between authorities in Catalonia and the Spanish government eventually resulted in Spain revoking the autonomous governance for Catalonia.

FX Markets Performance October 2017

The month ahead: November 2017

The month of November is expected to remain calm with the major central bank decisions set for December. The Federal Reserve’s meeting is expected to be a non-event although rumors of President Trump picking a new Federal Reserve chair continue to drive the markets.

The Bank of England will be the next central bank that is expected to hike interest rates, although this is expected to be a one and done deal in the near term. OPEC’s November meeting will put the focus back on the oil prices and the supply glut as member nations signal that production cuts will remain in place.

Here’s a quick preview of the main events to look forward to in November.

Bank of England set for a dovish rate hike (Nov 2nd)

The Bank of England will be the first central bank meeting early in November. According to a wide poll of economists, the BoE is expected to hike interest rates by 25 basis points this November. This will bring the interest rates in the UK to 0.5%.

Leave A Comment