Following a rather busy week in Europe, the focus shifts back to the U.S. shores next week with the FOMC meeting in focus. The Fed’s meeting is likely to overshadow other central bank meetings such as the BoJ, SNB, and the BoE. Economic data from the UK will keep the British pound busy ahead of Thursday’s Bank of England’s monetary policy meeting.

The Euro and the other major currencies take a backseat. New Zealand’s first-quarter GDP is on the tap, while in the Eurozone, the final inflation figures for May will be due on Friday.

FOMC Meeting – Fed to hike rates, but what about outlook?

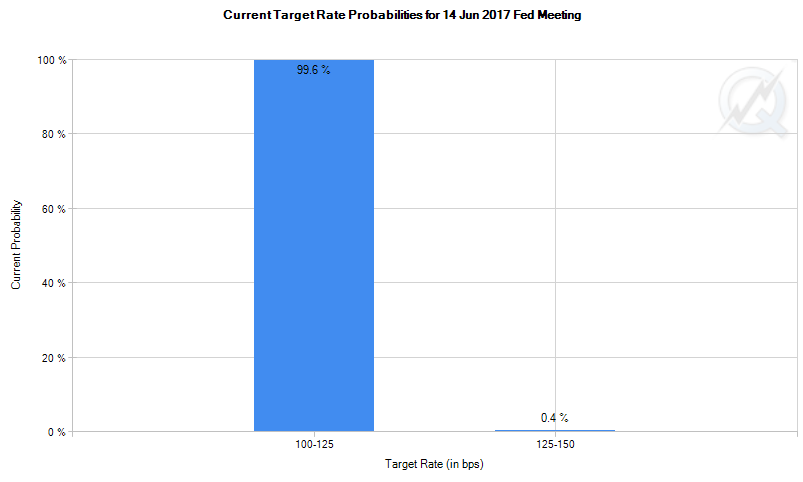

The Federal Reserve is all set to hike interest rates at this week’s monetary policy meeting with a 25-basis point increase. This will bring the short term fed funds rate to 1.0% – 1.25% window.

Fed funds futures Probability

Despite the rate hike which is widely expected, the Fed will also be holding a press conference along with releasing fresh economic forecasts and rate hike expectations for the remainder of this year.

With the rate hike a near certainty, the markets will be looking to what the Fed Chair, Ms. Yellen has to say about the economy. The recent jobs report continued to paint a mixed picture. The only bright spot was the fact that the unemployment rate fell to 4.3%. However, wage growth has remained steady at 2.5%. Inflation has also remained firm but below the Fed’s 2% target rate.

The Fed has so far maintained that there will be another rate hike this year. It is quite likely that the Fed will maintain the tone, given that officials will need to weigh and assess the U.S. economy with further data.

At the previous FOMC meeting, the Fed maintained that the recent string of weak jobs data suggested that it was only temporarily. But with the weak print in May, the possibility of the change in wording could send out a dovish signal.

The next rate hike is currently expected around September, although this could possibly be pushed down to December as well. At the FOMC meeting minutes, the Fed showed that officials were discussing the balance sheet.

Leave A Comment