The week ahead will see a fresh set of economic data for the month of June. The economic releases coming out this week include the manufacturing PMI data from China, the UK, US, and the eurozone.

Later in the week, the FOMC meeting minutes are due followed by Friday’s non-farm payrolls report. Also this week, the RBA will be holding its monthly monetary policy meeting. Here’s a quick recap of this week’s forex events to watch for.

ISM Manufacturing PMI, FOMC Meeting, Nonfarm payrolls

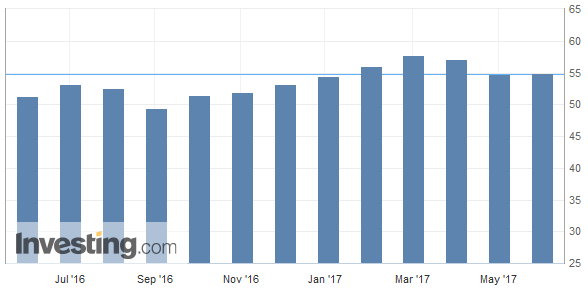

A busy week for the US dollar, data starts off on Monday with the Institute of Supply Management’s manufacturing PMI. The manufacturing PMI has been steadily declining since April after the index touched 57.2 the month before. Since then, the ISM index had fallen to 54.9 last month.

US ISM Manufacturing Index May 2017 (54.9 vs. 54.5) (Source: Investing.com)

Mid-week, the FOMC meeting minutes will be released. The minutes will be from the early June Fed meeting where interest rates were hiked by 25 basis points. More information is likely to come out on the individual views of other policy makers.

Any signs of dovishness could potentially keep the markets biased to the downside as far as the US dollar is concerned.

The US economic data ends with a bang with Friday’s nonfarm payrolls report. Investors will be looking at the wage growth trends as well as the number of jobs created during the month of June.

A surprise beat on the estimates could potentially see the markets turn bullish and maintain the hawkish stance from the Fed.

The US dollar weakened last week following the hawkish comments from the ECB, BoE, and the BoC governors. Therefore, a positive string of data could potentially see the markets re-price the bullishness.

Eurozone manufacturing and services PMI’s

From the Eurozone data, this week will see the Eurozone composite manufacturing and services PMI data being released. A continued uptick in the PMI’s could potentially keep the hawkish expectations aligned with the markets.

Leave A Comment