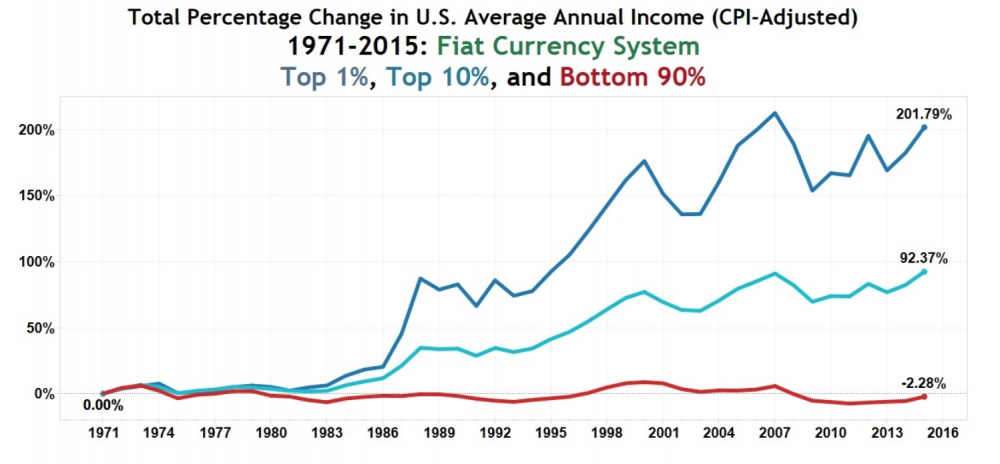

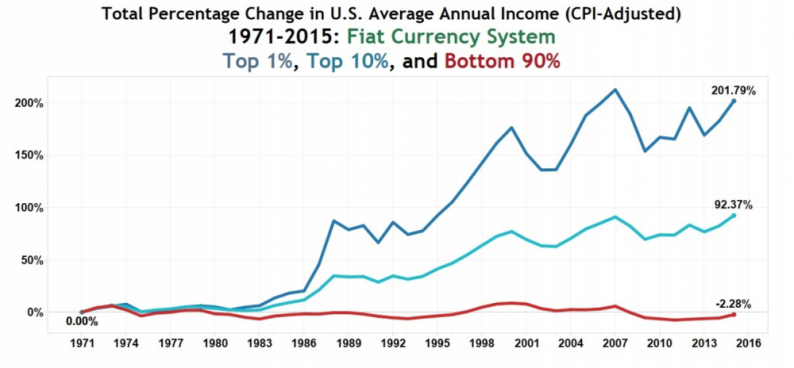

During the last 40 years, central banks have gained power they previously could only fantasize about. They were given full control over the currency supply and interest rates. These are the tools to plan booms and depressions. Thanks to such a great authority banks could create economic bubbles and their inevitable bursts. The result is one of the biggest capital migration in history from the middle class to 1% advantaged with access to particular data in advance.

Source. Zerohedge.com

Remnants of the gold standard limited bankers until 1971 but for 40 years they enjoyed free reign with no government nor society being able to meaningfully control them. You must have heard this line that a central bank “has to be fully independent” – by default, it has to be independent from the society.

The last link to the gold standard fell in 1971 and since investment banks and central banks have enjoyed an ever-growing influence. Careless actions and privileged position led to a drastic jump in risk and the first serious crisis in 1998. The first domino to fall was the bankruptcy of Long-Term Capital Management – an investment fund managed by two Nobel Prize winners. Instead of letting this institution fail, lobbyists pushed the government to save it. The message for senior executives on Wall Street was clear. It does not matter how big the risk is, someone will have to save us. At the end of the day, we are too important to be left behind.

As a natural consequence. crises in 2001 and 2007 followed previously laid scenario. The government saved bankrupted entities with taxpayer’s money while central banks lowered interest rates and showered capital markets with additional funds to gamble with. The reason behind the crisis became the bitter cure for financial disasters.

Every single time the economy was down, the danger drastically snowballed. After 2007 slump we saw a coordinated action of central banks aimed at lowering interest rates and printing additional currency at a scale unseen before. The difference between this meltdown and the previous one was that central banks were given free hand to battle the results of their own wrongdoing.

Before 2008 central banks’ responsibility was to deliver the capital to commercial banks. During the last crisis, respective governments took it upon themselves (or rather taxpayer’s back) to take over toxic assets and increased indebtedness to ‘stimulate’ the economy. To learn from other’s mistake it was sufficient to look at Japan’s case to understand how big of a failure this approach is. People learn only during crises and not proactively thus we see Abenomics spread all over the world.

Leave A Comment