Gartner, Inc. (IT – Free Report) is reportedly the world’s leading information technology research and advisory firm. The company offers rich domain expertise and technology-related insight necessary for informed decision-making process. Over the years, IT’s comprehensive services portfolio has enabled customers across the spectrum to research, analyze and interpret the business with greater precision, efficiency, and discipline. The top-line growth of the company is expected to benefit from improved end-market demand, new product roll-outs and market share gains.

However, some of IT’s services are cyclically sensitive. In addition, revenue from the federal government business is exposed to lengthy approval times and other austerity measures, which often increase operating risks. As the extent of competition is increasing over time, investors have been eagerly awaiting for the company’s latest earnings report. In the last four trailing quarters, IT has reported a positive average earnings surprise of 5.4%, beating estimates thrice.

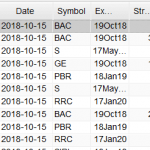

Currently, IT has a Zacks Rank #2 (Buy), but that could definitely change following third-quarter 2017 earnings report which was just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: IT beats on earnings. IT reported adjusted earnings of 65 cents per share, which exceeded the Zacks Consensus Estimate of 52 cents.

Gartner, Inc. Price and EPS Surprise

|

Revenues: Quarterly revenues beat estimates. IT recorded adjusted revenues of $891.7 million, well ahead of the Zacks Consensus Estimate of $853 million.

Key Stats to Note: IT has updated its earlier guidance for full year 2017 post the successful integration of CEB. The company currently expects GAAP revenues in the range of $3,257–$3,327 billion, compared with earlier expectations of $3,225–$3,320 billion, and adjusted EPS in the range of $3.39–$3.50, compared with $3.32–$3.49 expected earlier.

Leave A Comment