The British Pound has rallied more than 4.7% against the Japanese Yen since the March lows with the advance now testing a key confluence resistance range. While the broader outlook does remain weighted to the topside, the rally may be at risk near-term while below this threshold.

GBP/JPY DAILY PRICE CHART

Technical Outlook: In this week’s Technical Perspective, we highlighted a confluence resistance zone in GBP/JPY around 152. The region in focus is 151.84-152.17 where the 61.8% retracement of the yearly range converges on the 2017 high-day close and slope resistance. The immediate advance is vulnerable while below this threshold.

GBP/JPY 240MIN PRICE CHART

Notes: A closer look at price action see’s GBP/JPY trading within the confines of a near-term ascending channel formation with the upper parallel further highlighting the 151.84-152.17 resistance zone. A breach above this region would likely fuel accelerated gains targeting 152.86, the 2017 high at 153.41 and the 78.6% retracement at 154.12.

Interim support rests at 150.60 with bullish invalidation now raised to the monthly open at 148.96– a break below this level would suggest a larger correction is underway targeting the low-day close at 145.84 (not the favored scenario).

Bottom line: Prices are testing up-trend resistance and a breach through this region would be needed to keep the immediate focus higher. That said, IF GBP/JPY is indeed heading higher, look for interim support within this near-term ascending structure on a move lower from here. Ultimately we’ll favor buying pullback’s targeting a breach of this critical resistance zone.

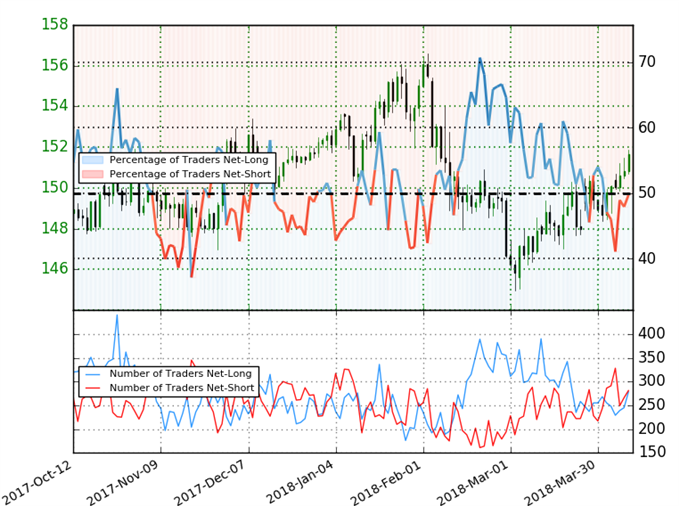

GBP/JPY IG CLIENT POSITIONING

Leave A Comment