Talking Points:

Fundamental Forecast for GBP: Neutral

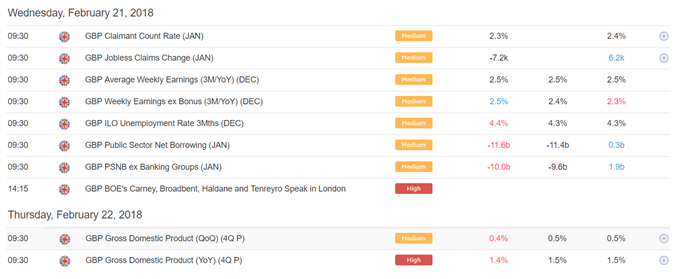

We continue to recommend a neutral stance on Sterling although we note that the UK currency has gathered some strength despite a poor run of economic data. Next week’s economic calendar has little in the way of market moving releases on the slate while the main Brexit event of the week will be UK PM Theresa May’s ‘Road to Brexit’ speech on Friday. We expect GBP to remain range bound but will we will watch the market closely if any sell-off occurs for an opportunity to enter into a long GBP position.

This week’s two main UK data releases both disappointed with unemployment unexpectedly ticking up and the second look at UK Q4 GDP missing expectations and turning lower.

Both events would normally have prompted a small sell-off in Sterling, yet the UK currency remains relatively unchanged over the course of the week. Both events would normally see markets paring back their expectations of higher UK rates, one of the main drivers of Sterling’s strength over the last month. In the background however, the ongoing EU/UK post-Brexit trade talks have been taking place with less negative headlines than normal being made, adding to currency’s resilience. The government’s Brexit committee met late Thursday and commentary out Friday seemed to indicate that internal divisions had been put aside, for the time being at least, and that the UK was clear about what it wanted in the upcoming EU/UK trade talks. To this end UK PM May will give a speech next Friday outlying the UK’s demands, although partial leaks of her comments may hit the screens earlier in the week.

A look at the GBPUSD chart shows the pair bouncing off a 1.3800 weekly low and heading into a cluster of EMA’s just under 1.4000. Any sell-off back to near this week’s low may present a buying opportunity but all Brexit commentary should be closely parsed before making any trading decision.

Leave A Comment