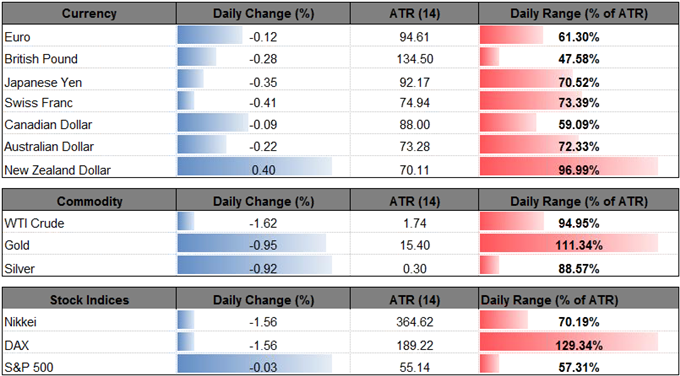

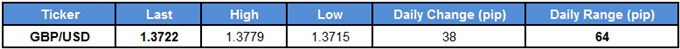

GBP/USD remains under pressure despite the lackluster developments coming out of the U.S. economy, and the pair remains at risk of staging a larger pullback over the near-term as it preserves the series of lower highs & lows from earlier this week.

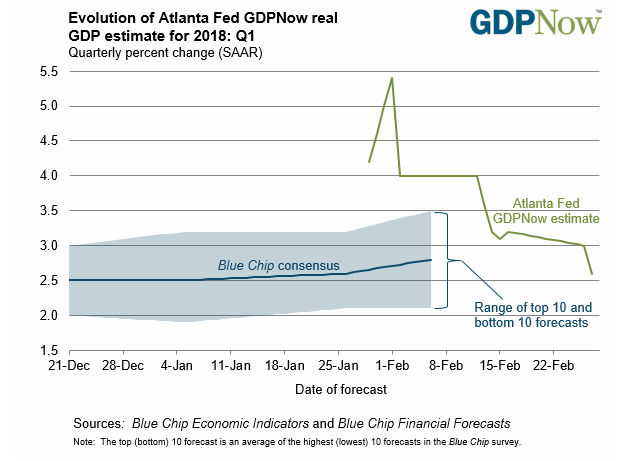

The 1.5% reading for the core PCE, the Federal Reserve’s preferred gauge for inflation, paired with the minor uptick in the ISM Manufacturing survey adds to the mixed data prints coming out of the U.S. economy, with the Atlanta Fed GDPNow estimate now projecting the growth rate to expand an annualized 2.6% during the first three-months of 2018. In turn, a growing number of Fed officials may strike a less-hawkish tone as ‘a few other participants pointed to the record of inflation consistently running below the Committee’s 2 percent objective over recent years and expressed the concern that longer-run inflation expectations may have slipped below levels consistent with that objective.’

With that said, the fresh forecasts coming out of the central bank may continue to show a neutral Fed Funds rate around 2.75% to 3.00%, and the Federal Open Market Committee (FOMC) may run the risk of adopting a slower approach in normalizing monetary policy as inflation continues to run below the 2% target.

In contrast, the Bank of England (BoE) may adopt a more hawkish outlook over the coming months as ‘the Committee judges that, were the economy to evolve broadly in line with the February Inflation Report projections, monetary policy would need to be tightened somewhat earlier and by a somewhat greater extent over the forecast period than anticipated at the time of the November Report.’ As a result, fresh remarks from Governor Mark Carney may curb the recent decline in the British Pound if the central bank head shows a greater willingness to implement higher borrowing-costs sooner rather than later, and the broader shift in GBP/USD may continue to unfold in 2018 as the BoE continues to alter the outlook for monetary policy.

Leave A Comment