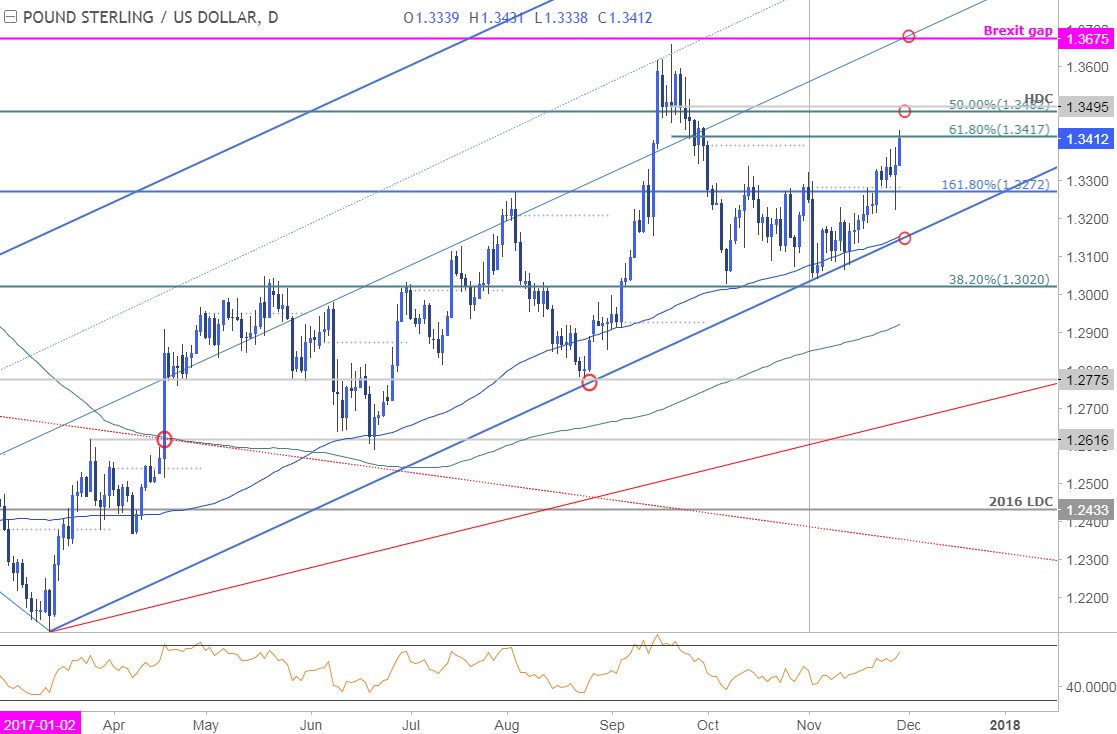

GBP/USD Daily Chart

Technical Outlook: I’ve been tracking this advance in the British Pound for months now with Cable setting the November opening range just above slope support extending off the yearly lows. Earlier this month we highlighted that a breakout was imminent as prices continued to consolidate above this threshold.

The subsequent breach above the monthly open / opening-range highs on 9/22 validated the reversal with prices now eyeing near-term resistance targets at 1.3417 and 1.3482/95. This region is defined by the yearly high-day close and the 50% retracement of the 2016 decline – a breach / close above would be needed to mark resumption of the broader up-trend. Broader bullish invalidation now raised from 1.3020 to ~1.3155 where the 100-day moving average converges on the lower parallel.

GBP/USD 240min Chart

Notes: A closer look at price action shows the pair continuing to trade within the confines of a well-defined ascending channel formation with the upper parallel converging on the 61.8% retracement today at 1.3417. Note that cable is marking slight momentum divergence into these highs and while the monthly opening range break has us looking for a late-month high, we’re heading into the close tomorrow- use caution. The immediate advance may be vulnerable here but the near-term focus remains higher while above the monthly open at 1.3283.

Bottom line: I’ll favor fading weakness while within this formation with a breach above 1.3495 needed fuel the next leg higher in Cable targeting subsequent topside resistance objectives at 1.3543 and the 2017 high / Brexit gap at 1.3658/75. Keep in mind we still have the U.S. Core Personal Consumption Expenditure (PCE) and ISM Manufacturing / Employment on tap into the close of the week.

Leave A Comment