GBP/USD made a move to the upside but eventually ended the week lower. Where next? The first week of April features the all-important purchasing managers’ indices. Here are the key events and an updated technical analysis for GBP/USD.

UK GDP was confirmed at 0.4% q/q and 1.4% y/y. While this was no surprise, the numbers are far worse than those of the US: 2.9% annualized and 2.3% y/y. On Brexit, there were hopes for some kind of a solution on the Irish border, but things are still to be seen. In the US, trade tensions between China and the US eased and this contributed to the stronger dollar.

Updates:

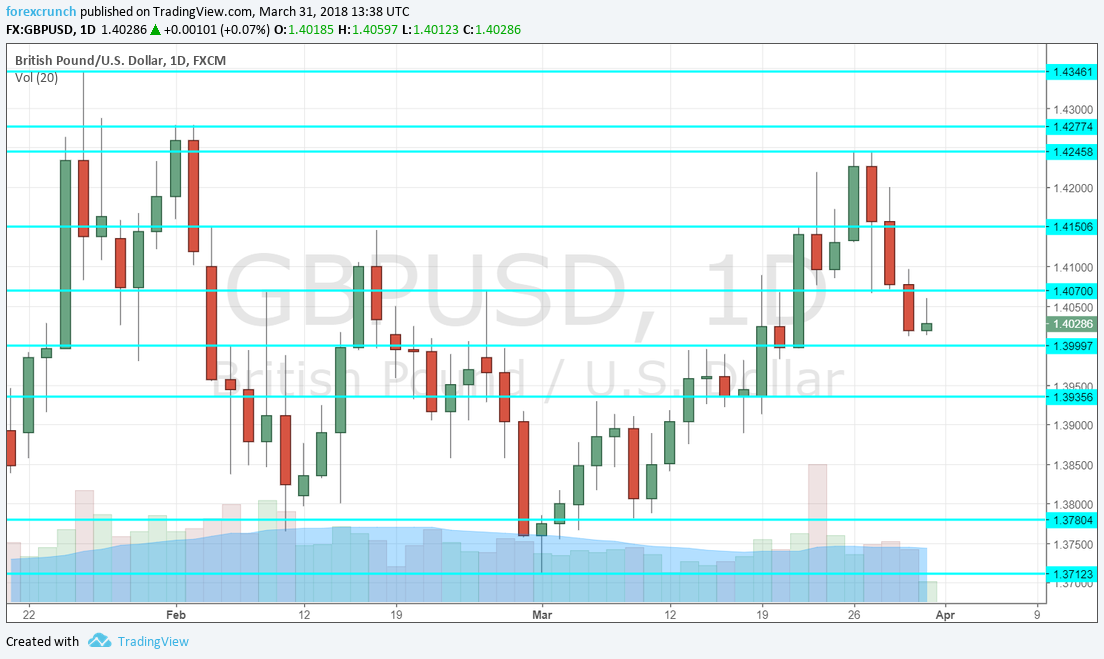

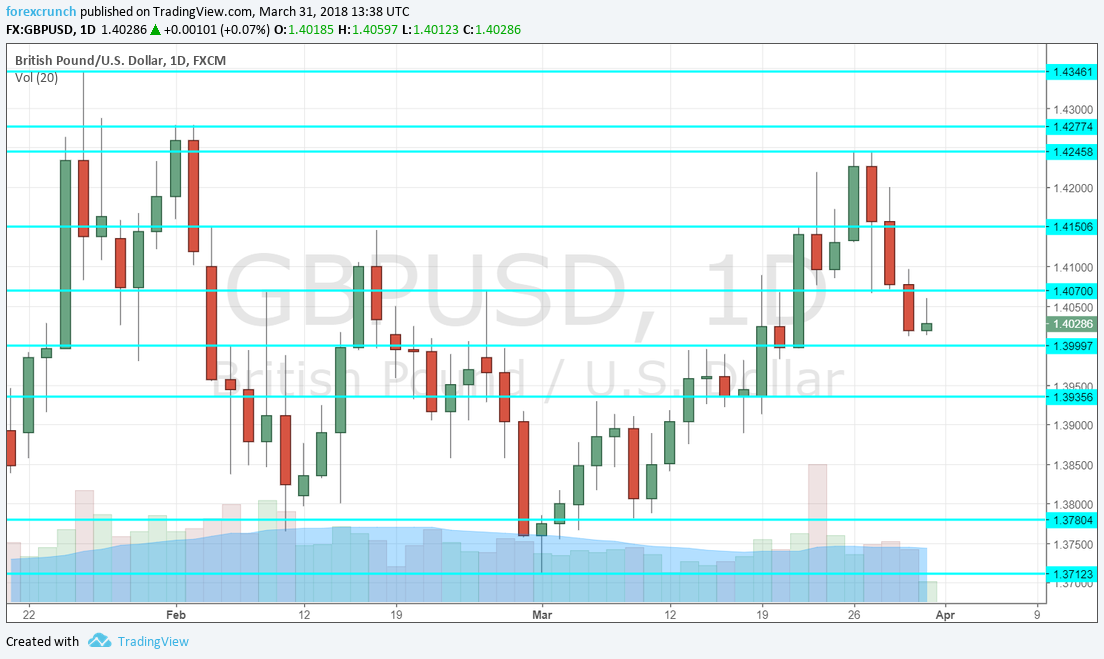

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

Manufacturing PMI: Tuesday, 8:30 The first of Markit’s purchasing managers’ indices will likely have the best score. The manufacturing sector continues enjoying the weaker pound. The score for February stood at 55.2 points and a drop to 54.8 is on the cards.

BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s measure of prices fell by 0.8% in February. This is a low-level indicator of inflation that leads the official release coming out later in the month.

Construction PMI: Wednesday, 8:30. The construction sector is the weakest link. The score of 51.4 points reflects slow growth. A decrease to 51.2 is on the cards now.

UK Services PMI: Thursday, 8:30. As in the US and most developed economies, the services sector is the most important one, and the financial services industry is especially eyed. Markit’s PMIs culminate with this event. After seeing OK growth with 54.5 points in February, a similar score of 54.2 is expected for March.

Housing Equity Withdrawal: Friday, 8:30. The BOE’s gauge of new home secured loans that are not used for home buying or repairs has dropped by 5.9 billion pounds in Q3 2017. The figure for Q4 is expected to show a slide of 6.7 billion.

Mark Carney talks Friday, 15:15. The Governor of the Bank of England will address the International Climate Risk Conference for Supervisors and the focus is on climate change. However, any comments about the global or British economy in his Amsterdam speech may move the pound.

Leave A Comment