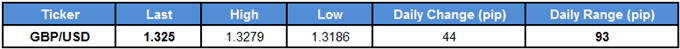

GBP/USD remains bid coming into the last full-week of November, and the pair appears to be on track to test the monthly-high (1.3321) as it extends the bullish sequence from the previous week.

It stands to be an eventful week for the British Pound as Chancellor of the Exchequer Philip Hammond is scheduled to present the updated U.K. budget later this week, but the Parliament testimony with Bank of England (BoE) officials Jon Cunliffe, Ian McCafferty, Michael Saunders and Gertjan Vlieghe may heavily impact the near-term outlook for GBP/USD as the central bank appears to be on course to further normalize monetary policy in 2018. Despite the 7 to 2 split to implement the dovish rate-hike in November, the central bank may follow its current pace of one rate-hike per year as ‘a majority of MPC members had judged that, if the economy continued to follow a path broadly consistent with the prospect of a continued erosion of slack and a gradual rise in underlying inflationary pressure, some withdrawal of monetary stimulus was likely to be appropriate over the coming months in order to return inflation sustainably to target.’

As a result, Governor Mark Carney and Co. may continue to prepare U.K. households and businesses for a gradually rise in the benchmark interest rate, with GBP/USD at risk of staging a more meaningful advance if it snaps the range-bound conditions from earlier this month.

GBP/USD Daily Chart

Leave A Comment