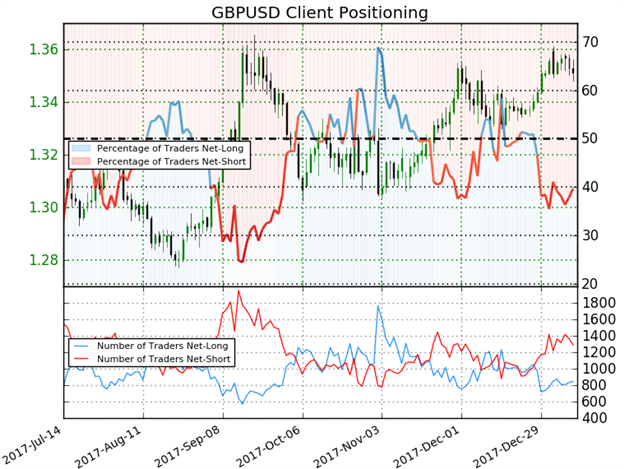

GBP/USD Daily Chart

Technical Outlook: The British Pound has carved out its monthly opening-range just below the 2017 high close at 1.3589 with interim support eyed at the 2018 high-day close at 1.3495. As discussed in this week’s Technical Perspective, seasonal tendencies are pretty heavy for Cable with the daily momentum profile also looking a bit vulnerable here. Ultimately, we’re looking for a break of this range to validate our near-term outlook with the broader bias still weighted to the topside while within this multi-year ascending pitchfork formation / 1.3320.

GBP/USD 240min Chart

Notes: A closer look at price action highlights a proposed pitchfork extending off the highs with price rebounding off the 50-line earlier today. We’ll favor fading strength while below the weekly open at 1.3575with a break below 1.3456 shifting the focus towards confluence support at the median-line / 38.2% retracement at 1.3389.

A breach of the objective weekly opening-range highs / 1.3589 would keep the broader long-bias in play with such a scenario targeting subsequent resistance objectives at the 2017 high at 1.3658 and the Brexit gap at 1.3675. Bottom line: the risk is lower in sterling but ultimately a larger setback would offer more favorable long-entries while within the broader uptrend. Look for a break/close of the monthly opening-range to get things going.

Leave A Comment