The GBP/USD is trading below 1.2900, slightly lower on the day. The US Dollar is trying to recover from the lows. The greenback was hit by some ease in the tensions between the US and China, Trump’s comments against the Fed’s rate hikes, and most lately, Trump’s legal troubles.

The President’s former confidant Michael Cohen agreed to testify against Trump, saying he was directly instructed to pay hush money to one of Trump’s lovers to influence the campaign. Also, former campaign manager Paul Manafort was convicted for tax fraud and faces jail time. As he awaits another trial, Manafort could also turn against his former boss.

The Pound enjoyed the announcement on Tuesday of non-stop Brexit negotiations. Chief EU Negotiator Michel Barnier and UK Brexit Minister Dominic Raab agreed to hold non-stop talks but did not unveil any progress on the thorny topics such as the Irish border and the Customs Unions. Nevertheless, the concerted efforts to avoid a no-deal Brexit sent Sterling higher.

The most significant release of the day comes from the Fed, and this can explain the recent US Dollar recovery. The FOMC Meeting Minutes will likely confirm the Fed’s hawkish stance and their desire to continue raising interest rates, despite Trump’s desire to have lower ones.

GBP/USD Technical Analysis

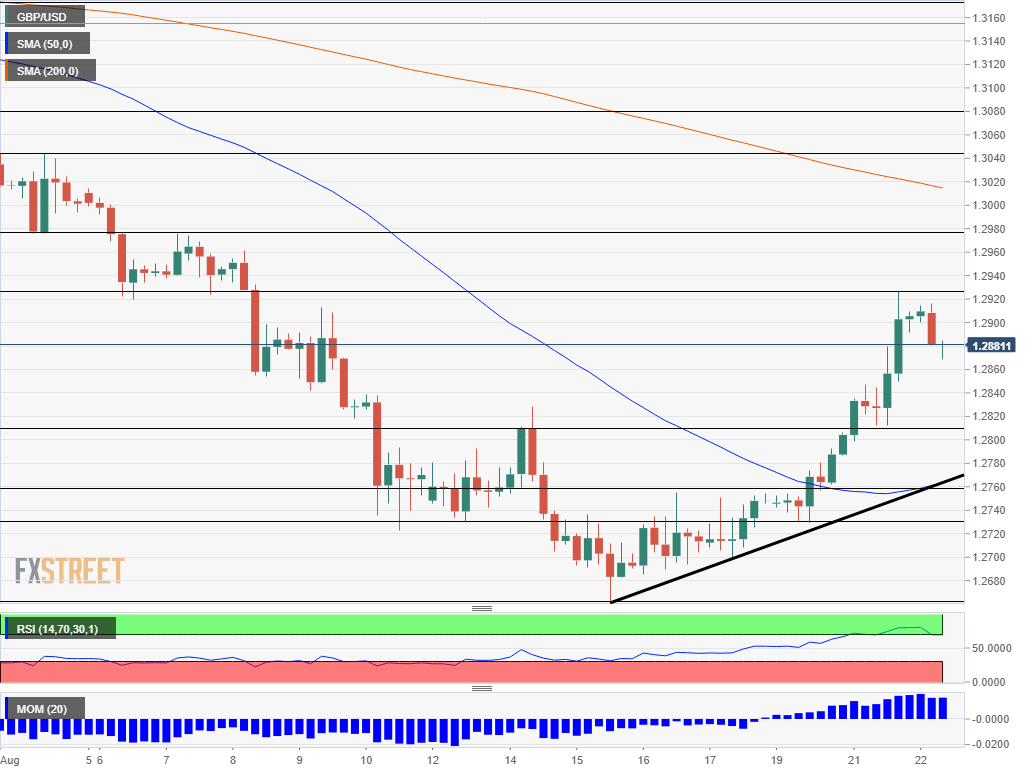

The Relative Strength Index (RSI) on the four-hour chart is now around 70, the level separating between normal and overbought conditions. It had already been on the higher ground, but the recent moves changed it. Cable is between the 50 and 200 Simple Moving Averages.

Looking down, 1.2810 supported the pair on Tuesday and provided immediate support. 1.2760 capped the GBP/USD late last week. Close by, 1.2730 was a short-lived support line early in the week. 1.2662 is the 2018 low.

Leave A Comment