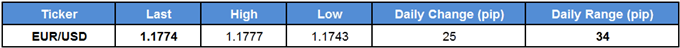

EUR/USD pares the decline from earlier this week, with the exchange rate at risk of facing range-bound conditions ahead of the European Central Bank (ECB) meeting on October 26 as President Mario Draghi and Co. appear to be on course to wind down the asset-purchase program.

The Governing Council is widely expected to move away from its easing-cycle as ‘the continued strong momentum of the euro area economy supported confidence that inflation would gradually reach levels in line with the ECB’s medium-term objective.’ In turn, the central bank may layout a more detailed exit strategy especially as the central bank’s most recent lending survey notes that ‘in terms of the impact of the ECB’s expanded asset purchase programme (APP), euro area BLS banks continued to report a positive impact on their liquidity position and market financing conditions over the past six months.’

In turn, the Euro may face a bullish reaction as the ECB alters the outlook for monetary policy, but market participants may pay increased attention to the future composition of the central bank’s balance sheet as a growing number of Governing Council officials show a greater willingness to extend the quantitative easing (QE) program beyond the December deadline. As a result, a protracted QE program may ultimately drag on EUR/USD with the Federal Reserve largely anticipated to deliver another rate-hike in December.

EUR/USD Daily Chart

Leave A Comment