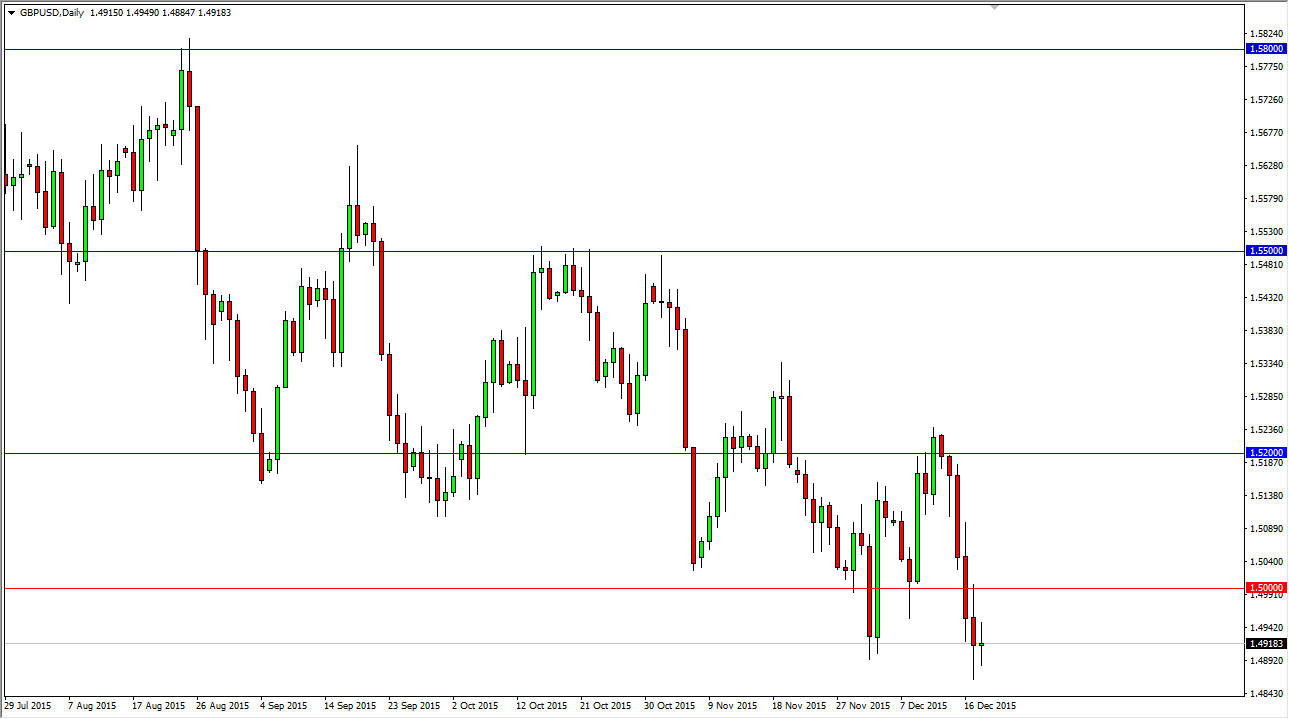

The GBP/USD pair went back and forth during the day on Friday, showing a bit of hesitation to go down to even lower levels. There is a significant amount of support below as far as we can see, especially near the 1.49 level. However, I feel that the market will eventually break down below there, and reach towards the 1.45 handle. At this point in time, break down below the Thursday session would be the reason to start selling again. However, there are other alternatives, such as short-term rallies that show signs of exhaustion. I am especially interested in selling near the 1.50 level, as it is a large, round number.

At this point in time, I believe that the British pound will continue to struggle against the US dollar, not necessarily because of the British economy or even the Pound itself, just the fact that the US dollar is so favored at the moment.

Selling Rallies

I think given the fact that it is late in the year, liquidity will be an issue. Because of this, it is probably only a matter of time before markets move back and forth, and therefore I think short-term rallies will be the way to go as far selling is concerned. It’s difficult to imagine that this is a market that’s going to make a massive move in one direction or the other, just simply because there is going to be a serious lack of liquidity and of course a serious change of attitude.

Because of this, I think that we have to short the market on short-term charts only. I to hate think that any real move probably won’t happen until after the holidays, so therefore I am willing to get involved in this market for little moves time and time again and try to make a decent trade out of several smaller positions.

Leave A Comment