GBP/USD

4 hour

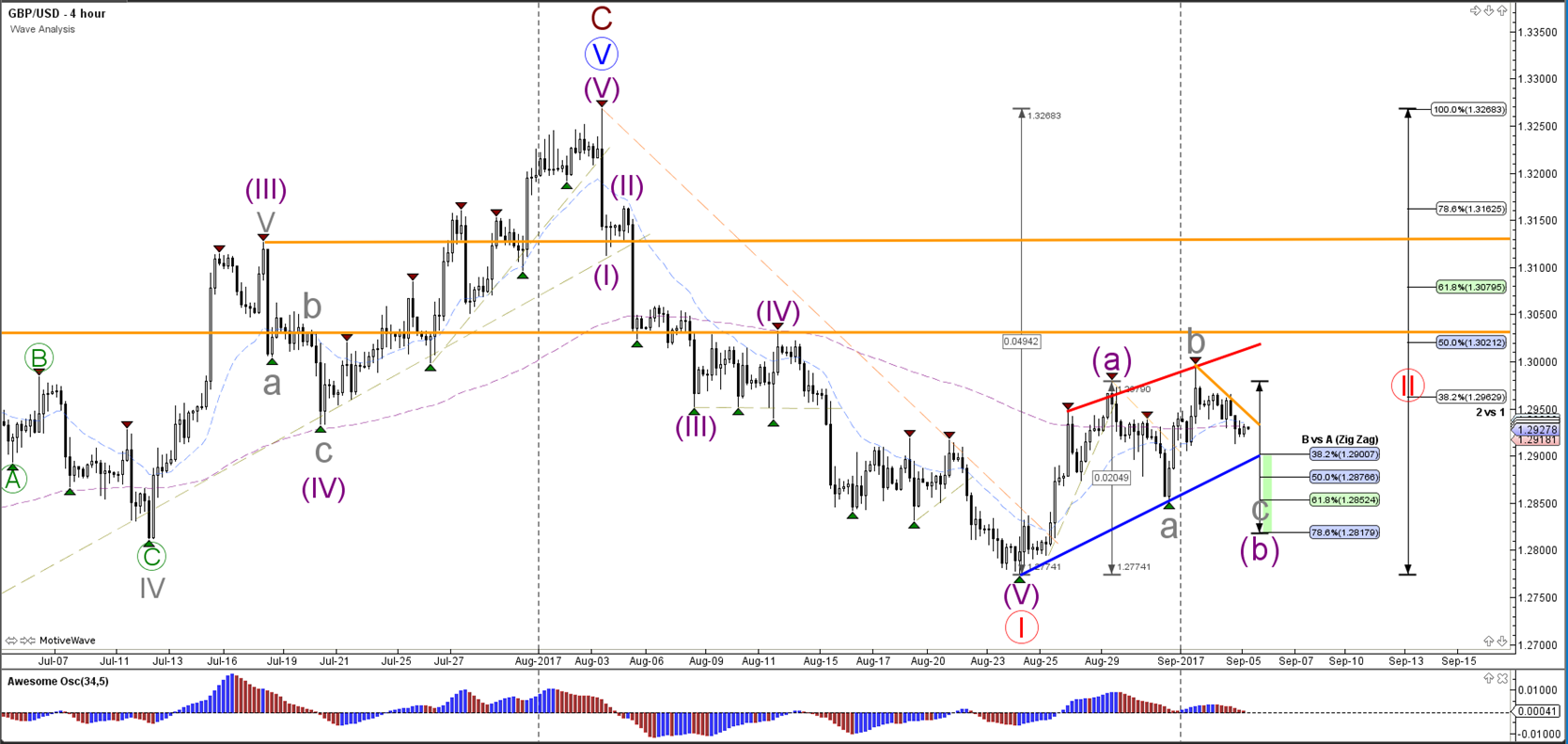

The GBP/USD is building a corrective bullish channel (red/blue lines). The bullish price action is probably part of a wave 2 pattern (red). A break above the resistance (orange) could see price start an impulsive wave C (purple), which challenges the top of the channel as it expands the ABC correction (purple).

1 hour

The GBP/USD is building a bearish correction within the bullish channel which could find support at the Fibonacci levels of wave B vs A. The wave B (purple) is most likely seeing an extension after a clear 5 wave up as wave A (purple). Once wave B is completed, a 5 wave pattern for a wave C is expected.

EUR/USD

4 hour

The EUR/USD is still in a corrective chart pattern, which is indicated by the trend lines (blue/red). A break below the support trend line (blue) could confirm a potential ABC correction (red). The ABC correction (red) is invalidated if price breaks above the 138.2% Fib at 1.2165. A break above the resistance trend line (red) could indicate that there is bullish pressure to test the Fib levels of wave B vs A.

1 hour

The EUR/USD could be building a potential wave 1 and 2 (purple) within wave C (red) and test the Fibonacci levels of wave 2 vs 1 (purple). A break above the 100% Fib level at 1.1980 invalidates it and could indicate that price will challenge higher Fib levels of wave B vs A.

USD/JPY

4 hour

The USD/JPY is close to challenging the support zone (green) again which is a bounce or break spot. A bearish break below the zone indicates a downtrend whereas a bounce could indicate a continuation of wave B (brown).

1 hour

The USD/JPY broke the support trend line (dotted blue) but this could potentially complete the wave C (green), which is confirmed if price manages to break above the resistance trend line (orange).

Leave A Comment