Talking Points

GBPAUD Daily

Technical Outlook: GBPAUD turned from a BIG resistance zone last week at 1.6688-1.6721– this region is defined by the 61.8% retracement of the December decline, the August swing low and the 200-day moving average. The pair has been trading within the confines of a broader ascending pitchfork formation extending off the yearly lows with the pullback now testing confluence support just above the 1.65-handle where the 100-day moving average converges on the 50-slope line.

Heading into the start of the week the focus is on this near-term range (1.65-1.67) with our broader outlook weighted to the topside while above 1.6216 (bullish invalidation). A breach higher targets resistance objectives at 1.6846 & 1.69.

GBPAUD 240min

Notes:A closer look at price action highlights a sliding parallel that capped the rally last week with price sitting just above the 50-line into the open of U.S. trade. Intraday momentum continues to hold above 40 and the pair could see some recovery from here near-term first but ultimately I want to be long from lower down.

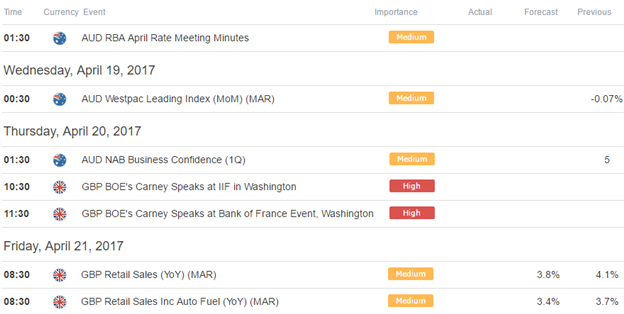

From a trading standpoint, I’d be looking to fade weakness into the lower parallels (1.6409 & 1.6313 areas of interest) with a breach above 1.6720 clearing the way for subsequent topside targets. A quarter of the daily average true range (ATR) yields profit targets of 35-39pips per scalp. Event risk is rather limited from a data standpoint until UK retail sales later in the week with RBA minutes & Carney

Relevant Data Releases

Other Setups in Play:

Leave A Comment