On December 20, 2016, shares of General Electric (NYSE: GE) peaked at a closing value of $32.25 per share. Since then, through the close of trading on Tuesday, November 14, GE’s share price has fallen by nearly 44% to $17.90 per share.

We think that GE’s stock price has further to fall before it bottoms.

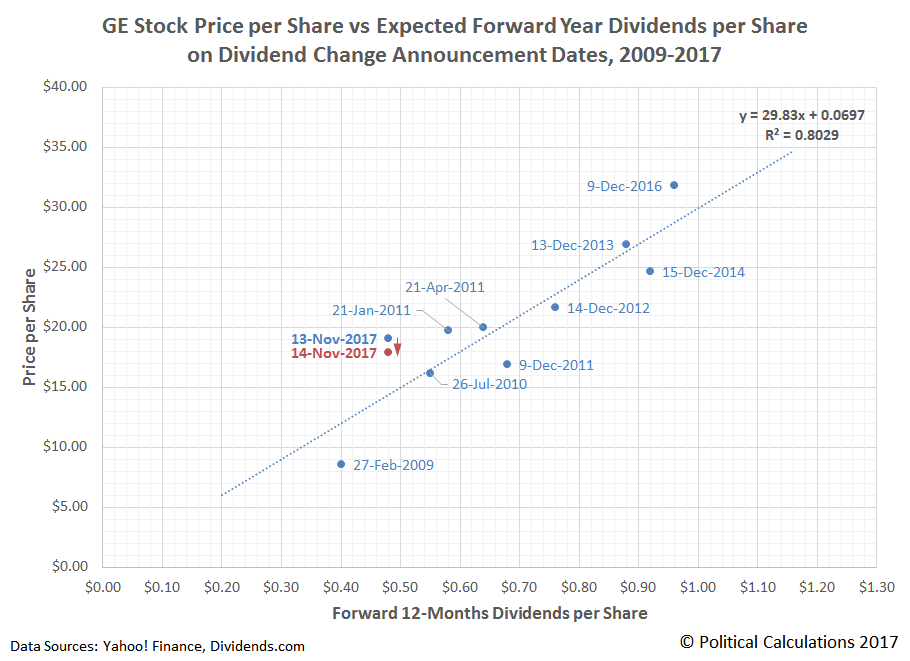

Here’s why. Based on a simple relationship between the company’s share price and its forward year dividends per share, we find that GE’s share price is elevated above the level that investors have valued the company’s shares for its given level of dividends payouts since 2009, when GE last announced a dividend cut.

The relationship in the chart above was developed using the company’s share price on the dates it announced changes in its dividend payouts to the public with and the company actually paid out in dividends during the following 12 month period. The exception is the announcement for November 13, where we’ve projected that the company will sustain its newly lowered dividend payment of $0.12 per share over the next year.

What we find is that the company’s share price when it announced its latest dividend cut on November 13 was elevated well above the trend line established by the relationship between the company’s share price and forward year dividends per share for all its previous dividend change announcements since February 2009.

What that result suggests is that the company’s share price has further to fall. Based on this first cut analysis, we would anticipate GE’s share price continuing to fall to the $14-$16 per share range in the near future.

To build the case that is likely to happen, what we really want is more data points. We’ll revisit this analysis soon where we’ll incorporate data from GE’s dividend declaration dates to build up the sample for our simple linear regression analysis.

GE’s Dividend Change Announcements from 2009 through 2017

Leave A Comment