General Mills, Inc. GIS delivered in-line earnings and revenues in the third quarter of fiscal 2018. Meanwhile, the food giant has lowered its fiscal 2018 profit outlook to reflect higher supply chain costs.

Shares tanked more than 8% in pre-market trading after the earnings release.

In-Line Earnings

General Mills reported third-quarter fiscal 2018 adjusted earnings per share of 79 cents, in line with the Zacks Consensus Estimate. Earnings, however, increased 10% year over year. On a constant currency basis, earnings increased 8% benefiting from lower taxes and average shares outstanding.

Adjusted earnings exclude certain items, influencing comparability of results. Including these items, reported earnings came in at $1.62 per share, reflecting a substantial increase from 61 cents a year ago.

In-Line Sales

Total revenues of $3.882 billion were almost in line with the Zacks Consensus Estimate of $3.886 billion but improved 2.3% year over year, owing to higher sales across the board.

Organically, excluding currency and acquisitions/divestitures, sales increased 1%, same as the preceding quarter.

Price/mix had a 1% positive impact on its quarterly revenues but volumes had a 1% unfavorable impact on sales. Currency had a 2% positive impact on quarterly revenues.

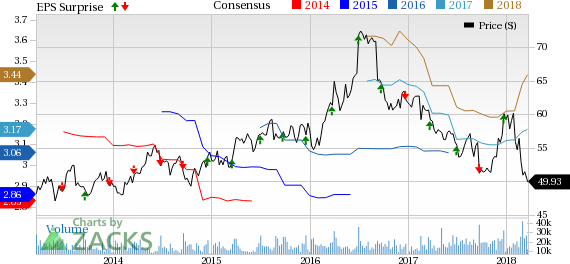

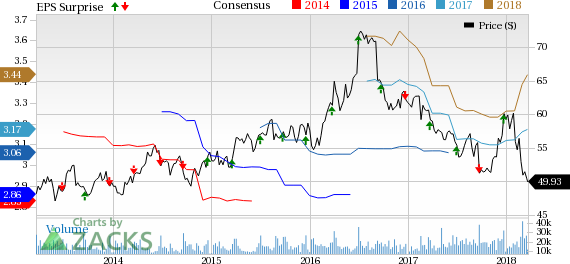

General Mills, Inc. Price, Consensus and EPS Surprise

General Mills, Inc. Price, Consensus and EPS Surprise | General Mills, Inc. Quote

Leave A Comment