Genesis Energy (GEL) is a high yielding Master Limited Partnership, with a long history of steady dividends.

There are currently only ~130 publicly traded MLPs available today.The unique tax structure of MLPs allows these vehicles to return more distributions to shareholders than a corporation could.

And Genesis Energy is no exception.It has a current dividend yield of 9.2%.This is an extremely high yield. Genesis is one of 416 stocks with a 5%+ dividend yield.

Not only that, but Genesis has increased its dividend for 47 quarters in a row. It is one of the highest-yielding Dividend Achievers, a group of stocks with 10+ years of consecutive dividend increases.

Genesis is a rare MLP, because it combines a very high dividend yield, with a high dividend growth rate as well. At the same time, there are some concerns regarding the sustainability of the dividend.

Business Overview

Genesis is a midstream oil and gas energy transportation company. It operates primarily in the Gulf Coast region of the U.S.

Genesis operates four individual segments:

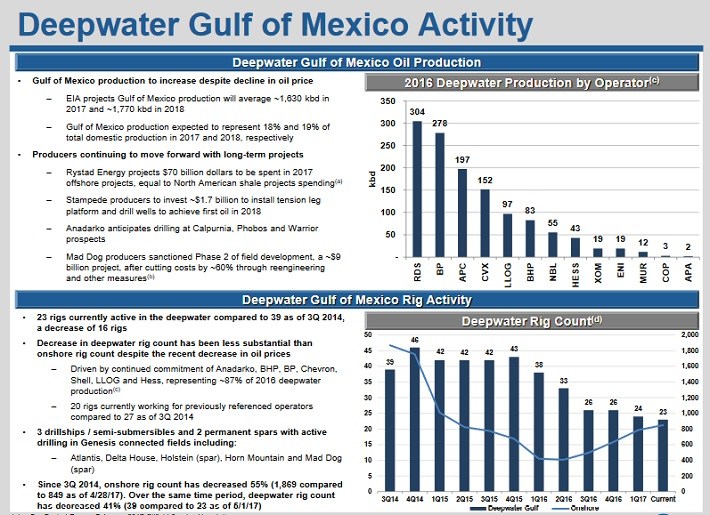

Genesis’ offshore business provides services primarily to deep-water producers in the Gulf of Mexico, where economic fundamentals remain strong.

Gulf production continues to increase, which means demand for Genesis’ services remains steady.

Source: May 2017 Investor Presentation, page 9

The company’s offshore and onshore pipeline businesses, as well as the marine transportation business, have no direct commodity price exposure. This is because Genesis operates primarily fee-based assets.

Genesis performed well in 2016, even with weak commodity prices.

Adjusted EBITDA increased 23% for the year, to $532.2 million, thanks to higher fees and development of new projects.

Genesis is off to a mixed start to 2017, as the company navigates through a period of very high investment.

Leave A Comment