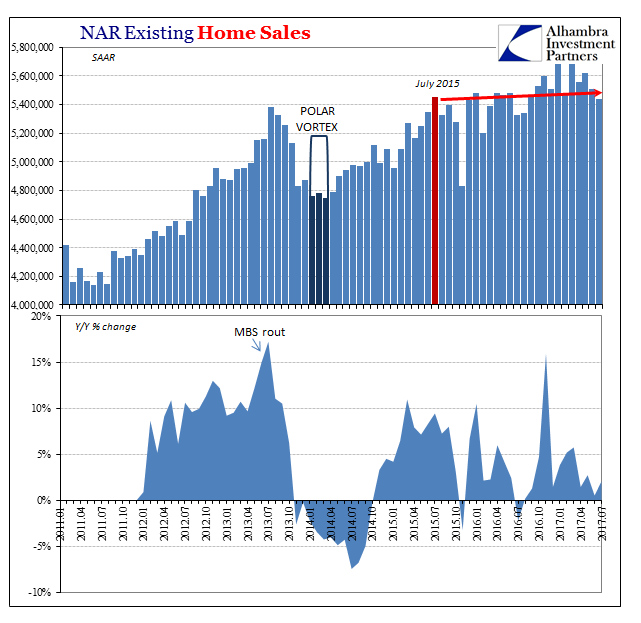

The most recent housing data continues to suggest weakness. The National Association of Realtors (NAR) reports that sales of existing homes were down slightly last month from June. It continues a lower trend dating back to March. Overall, the level of resales is largely flat going back to the summer of 2015.

At a 5.44 million seasonally-adjusted annual rate for July 2017, that is actually slightly less than the 5.45 million (SAAR) estimated for the same month two years earlier. The housing market is not crashing, nor does it appear to be in danger of doing so. But it is also not expanding, either, the latter condition relevant to broader macro analysis beyond real estate.

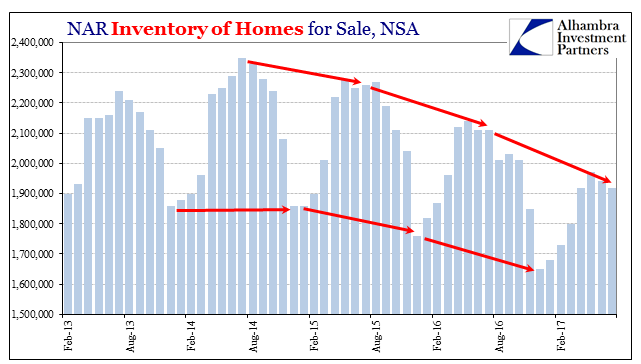

The primary reason seems to be widespread consumer caution. American homeowners do not appear willing to put up their homes for sale despite rising prices. It is practically the antithesis of the housing mania period from just over a decade ago. That may be in part due to a paradigm shift in expectations and behavior (a lot of people learned something from the bust).

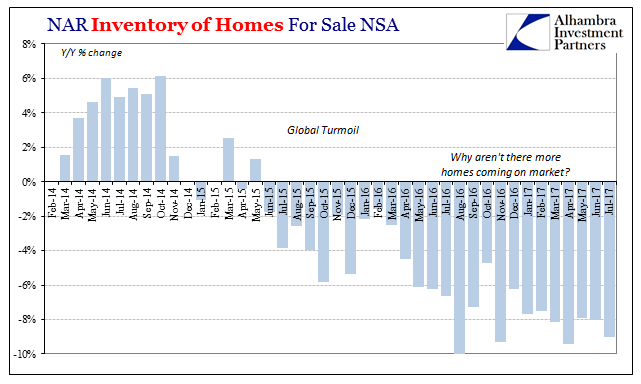

But the shift in inventories is a more recent change. The number of houses available for sale, according to the NAR, began falling in the summer of 2014 – coincident to the appearance of the “rising dollar.”

The peak for inventory in this whole real estate reflation cycle was July 2014. It wasn’t so much the exchange value of the dollar that seems to have influenced prospective property sellers. Rather, it was likely the common interpretation of growing economic uncertainty surrounding it; especially the oil price crash that only economists attempted to treat as a positive.

The global turmoil that followed in 2015 would have confirmed caution, as well as the actual downturn and near-recession related to it.

The end of it almost a year and a half ago has not precipitated renewed enthusiasm, however. As in other economic indications (autos), this restraint/uncertainty/weakness continues well into this year. There is now a growing body of statistical evidence that consumer behavior has turned even more negative.

Leave A Comment