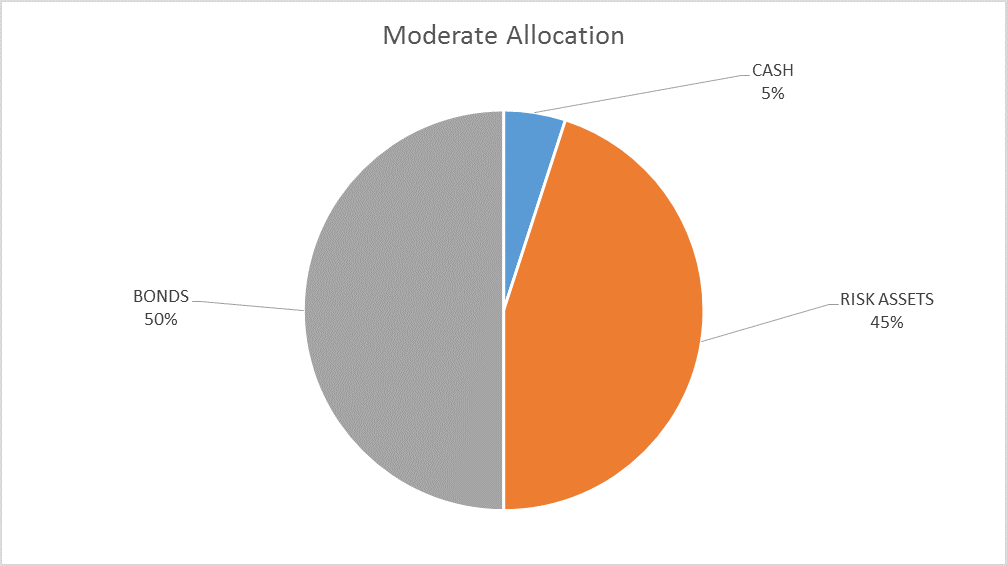

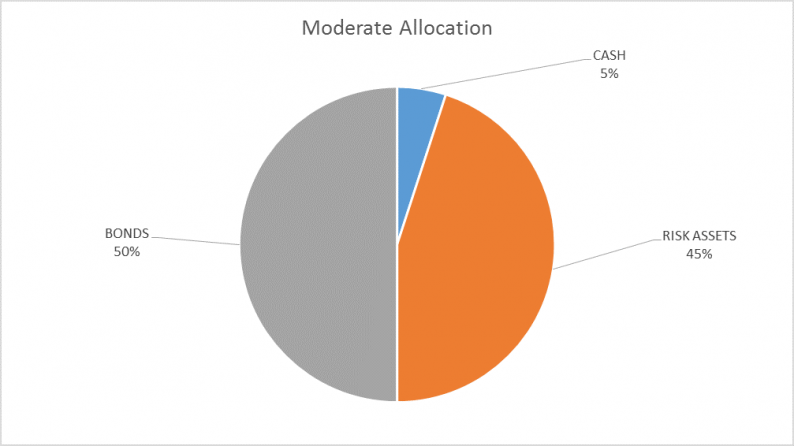

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor, the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise.

No one is investing in a co-working company worth $20 billion. That doesn’t exist,” Neumann says. “Our valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue.

That quote above is the CEO of WeWork, a “technology” company that leases office space. They aren’t leasing office space they own like a REIT but rather space they have leased at bulk rates. All they really are is a property management company with a hipster sheen. They do appear to be a successful property management company but a property management company nonetheless. The industry is not exactly new and the competition will surely respond. In the meantime, WeWork has convinced investors to pay 20 times sales to invest in their “energy and spirituality”.

What is WeWork really worth? I have no idea but I’m pretty sure the property management company should not be worth more than the properties it manages. WeWork has not cornered the market on cool build outs, month to month leases, bundled services (internet, reception, etc.) and Friday beer busts in a dorm-like atmosphere. But none of that matters in the current environment and that is why I felt a need to make a move this month.

Stocks have been expensive for a long time. And as everyone seems eager to point out these days – as if it inoculates them from acting imprudently – valuation is not a good market timing tool. As a client recently pointed out, Alhambra has been saying that stocks are expensive since late 2013 so I’ve obviously proven that statement. I haven’t changed my mind by the way; stocks were expensive at the end of 2013 and they are expensive today. In fact, they are significantly more expensive today than they were then because earnings haven’t change appreciably during that entire time for the S&P 500 as a whole.

Private market valuations, such as for WeWork, Uber, etc., were frothy in 2013/14 as well so that hasn’t really changed. What does seem to have changed though is the attitude of the people investing in and running these “unicorns”. WeWork just announced the purchase of the NYC headquarters of Lord & Taylor for $850 million, a sum that is only about 30% above the value at which it was appraised just last year. It isn’t clear who exactly is buying the building, WeWork or their venture capital backers or both, but it will become WeWork’s headquarters now. I suppose they will surely make better use of it than Hudson Bay, the parent of Lord & Taylor, but one does wonder how and why a money losing company needs to spend $1300/sq. ft. for a Manhattan headquarters. Surely they could have found suitable space in any of the other 50 cities in which they operate at a much cheaper price. But then, that wouldn’t make a splash and keep people paying for their “energy and spirituality”.

WeWork isn’t the only silliness going on in markets. Bitcoin, the intrinsic value of which is objectively zero, is trading over $5700 as I write this although that could easily be $6000 or $7000 or $2000 by the time you read this. And Bitcoin is easily the most legitimate of the cryptocurrencies which are multiplying by the day via ICOs which may or may not entitle you to anything at all. The mania for all things crypto is most easily captured by Overstock.com, which, as the name implies, is a vendor of things no one, or at least not enough someones, wanted. They also have a cryptocurrency trading unit because, well, just because I guess. Well, actually, the best reason to have a cryptocurrency trading unit, even an unprofitable one like Overstock’s, is the impact on the stock price, not the bottom line. Overstock’s most successful product appears to be their own stock which is up 175% – since August.

Leave A Comment