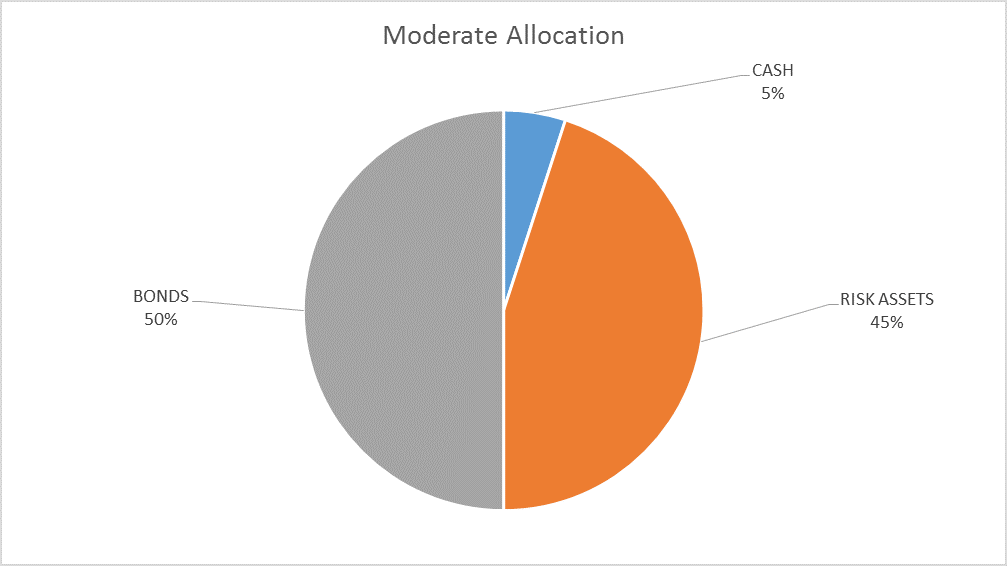

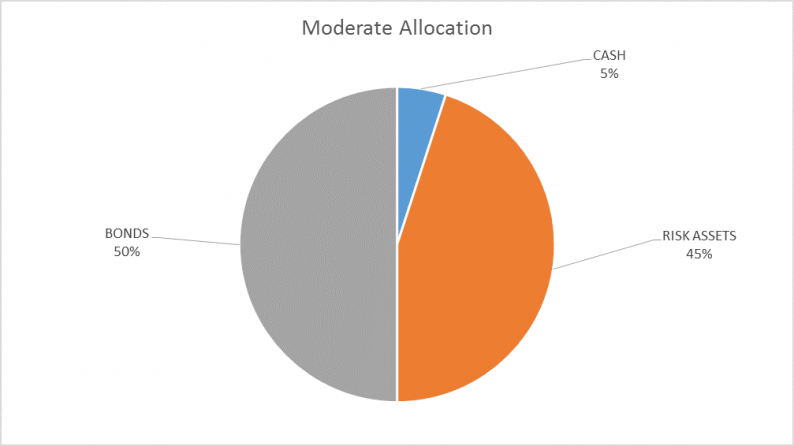

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the recent highs. That, in and of itself, is not sufficient in our process to dictate a change in allocation.

When I last wrote an asset allocation update on January 4, the S&P 500 closed at 2723.99. As I write this late on February 6th, the S&P 500 is trading at 2695.14, a drop of 1.1%. Now, if that was the only information you had, how would you feel about the stock market? Worried? Panicked? Kind of hard to get worked up about isn’t it? Of course, we do have other information and know that the market actually traded in a 280 point range during that time. First a quick 5.5% rally to the top and then an even quicker nearly 10% drop, mostly compressed into two and half trading days. Does that matter? Can you just ignore what happened in between and concentrate on the end result?

Mostly, I think that is pretty good advice. We know from research that the more often people look at their accounts the worse their returns. You can always find something to do with your portfolio – fear and greed are eternal – and checking your account makes it that much more likely that you will. And the more changes you make the more likely it is you’ll make a mistake. Investment advisers have to guard against this more than the average person because it is our job to look at the markets and most of us do it every day. And most of us are still human and susceptible to the same foibles as other investors.

And besides, despite the big numbers, the selloff of the last three days is pretty unremarkable in market history. There are over 100 previous trading days with worse percentage losses than Monday and most of them are forgotten. Remember August 2011? No? The 8th and the 10th of that month were both worse than Monday. That selloff took the S&P all the way down to 1101.54 and the market has only managed a 145% gain since then. In the big picture, those two bad days meant absolutely nothing. Will the last three days be similarly forgotten? Probably….

However, I do think that the events of the last few weeks may be important from a psychological standpoint. Remember, this game we call investing is akin to poker, in that we are playing the other players. John Maynard Keynes said the stock market was like a beauty contest where the judge’s job was not to choose the most attractive contestant but rather to choose the contestant the other judges deemed the most attractive. It sounds similar and it is but getting it right means knowing as much about the judges as the contestants. So the rally and subsequent correction may be important to the future course of the stock market if it affects how other investors perceive the market. With all the easy money trades blowing up recently investors may start actually thinking before they jump into the latest new-fangled investment they don’t understand. Nah, that’s not going to happen.

A big part of the sell off Monday was an unwinding of the short volatility trade that had become ubiquitous. How ubiquitous? In August of last year the New York Times ran an article about Seth Golden, a former Target logistics manager who ran his net worth from $500k to $12 million in five years shorting various volatility linked securities. Stock markets have been remarkably calm this entire bull market and betting that it would stay that way had become the most crowded trade on the street. I hope Mr. Golden put some of that $12 million aside in something safe because the trade came unglued over the last couple of days with the VIX spiking to over 50 from record lows under 10. Being short something that goes up by five times in a few days is a great way to do a round-trip back to Target logistics manager (not that there’s anything wrong with that).

Leave A Comment