With October, the worst month for stocks since January, now in the history books S&P futures are eager to telegraph that the streak of five consecutive declines – the longest since August 2015 – will end, with a modest gain of 0.3% in overnight trading after U.S. equities ended Monday little changed to cap a third straight monthly decline, coupled with mixed global markets as Asian stocks rose while Europe was pressured again on the back of poor Standard Chartered results which saw the bank miss earnings on a drop in revenue, as the global bond selloff returned after strong Chinese economic data prompted concerns about rising global inflation. Oil failed to rebound after a sharp drop in recent days as hopes of an OPEC deal unwind.

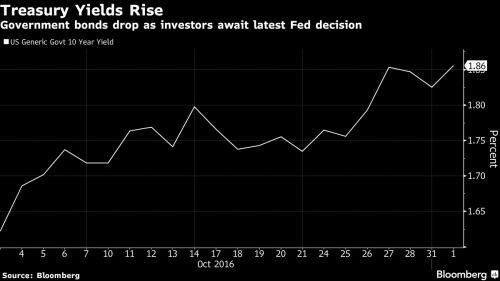

The recent selloff in global bonds resumed amid speculation that major central banks may be moving closer to scaling back their extraordinary stimulus measures as well as strong Chinese PMI reports overnight. Prospects for a pickup in inflation pushed the yield on 10-year Treasury notes to the highest since May relative to those on two-year securities.

Gasoline in New York jumped the most in almost eight years after an explosion and fire in Alabama shut the largest fuel pipeline in the U.S. The Stoxx Europe 600 Index of equities pared gains after banks slid. Australia’s currency strengthened after the central bank refrained from cutting interest rates.

In Overnight news we say both the BOJ and the RBA keep rates unchanged at -0.1% and 1.5% respectively, as expected. The BoJ also held off on expanding stimulus on Tuesday but once again pushed back the timing for hitting its inflation target. The dollar hovered around 104.80 yen. Traders focused on whether the Japanese central bank would keep its November purchases of bonds due in over 10 years at the same level to determine if Kuroda would signal an implicit taper. He did not when earlier today the BOJ announced plans to buy 110b yen of debt due in more than 25 years, and 190b yen for bonds with maturities of 10-to-25 years for its first operation in November, roughly the same as its last market operation in October, when it bought 110.7b yen of debt with more than 25-year maturity, and 191.4b yen for those in the 10-to-25-year bucket.

The Fed begins its two-day meeting today, however, markets see only a small chance that the U.S. Federal Reserve will raise rates when it concludes its meeting on Wednesday, but traders will be scouring its statement for clues on the timing of its next rate hike. Chances of a rate hike in December are around 78%.

The key economic update was China’s October PMI data, which smashed expectations as China’s official factory gauge rose to the highest since July 2014, led by new orders, suggesting the economy’s stabilization continued into the fourth quarter as robust consumption underpins demand driven largely by an unprecedented credit injection which has seen China unleash more than $4.5 trillion in debt in the past year .

Goldman’s break down of the data:

China’s NBS October manufacturing PMI came in at 51.2, the highest level since August 2014. Most of the sub-indexes improved, with the new order sub-index showing a visible uptick to 52.8, from 50.9 in September. The production index was also higher at 53.3, vs 52.8 in September. Inventory indicators went up: Raw material inventory was up to 48.1 from 47.4 in September, and finished goods inventory increased to 46.9 from 46.4 in September. The employment index was higher at 48.8 vs 48.6 in September. The upward trend in inflation indicator continued in October: The input prices index increased to 62.6, the highest level since early 2011. Trade indicators were weaker on the other hand: The export orders index fell to 49.2 from 50.1 in September, and the import index declined to 49.9 from 50.4 previously. The suppliers’ delivery times were up to 50.2 vs. 49.9 in September.

The official non-manufacturing PMI (which covers the construction and service sectors) increased to 54.0 in October from 53.7 in September, supported by a strong service PMI. The service sector PMI improved to 52.6 from 52.3 in September. Construction PMI edged down to 61.8 from 61.9 in September.

The Caixin manufacturing PMI release showed a similar improvement as the official NBS one – the headline index increased to 51.2 in October from 50.1 in September, and both the production and new orders index rebounded strongly.

Economists cheered China’s manufacturing survey data, although some expressed caution that this is as good as it gets as the strong PMI’s will likely make the government more comfortable tightening monetary and property sector policies in Q4.

The UK economy continued to defy naysayers with October manufacturing PMI printing at 54.3, in line with expectations of 54.5, but still the second highest in the past 27 months and refusing to indicate that the post-Brexit economy has fallen off a cliff, supported by ongoing weakness in sterling, and as Markit said, “boding well for Q4 GDP.”

UK #manufacturing PMI fell in Oct but still 2nd highest in past 27 months, boding well for Q4 GDP https://t.co/rG1g5rPnvu pic.twitter.com/LJACEUc21K

— Chris Williamson (@WilliamsonChris) November 1, 2016

European shares were poised to fall for a seventh straight session while the dollar edged lower with investors largely holding back as the contentious U.S. presidential campaign entered its final week. Stronger-than-expected manufacturing data from China underpinned gains in Asian stocks and further stoked inflation expectations that drove a selloff in bonds in recent weeks.

Leave A Comment