The global economy is poised for economic growth comparable to recent years’ performance, but with a somewhat different texture. European countries will do a bit better, Asian countries not a hair worse, and natural resource-based economies much worse.

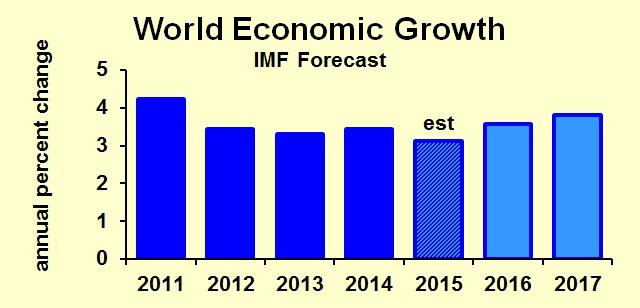

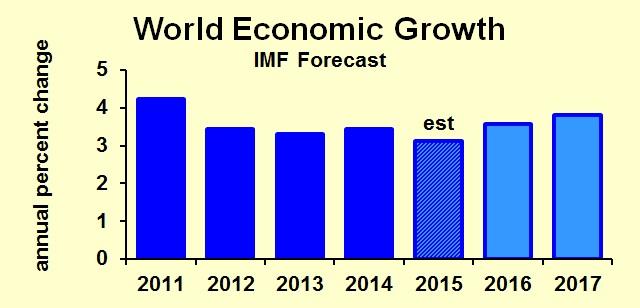

Last month the International Monetary Fund released their World Economic Outlook, which provides a middle-of-the-road starting place for looking at the global economy. The IMF expects the world overall to expand in 2016 by 3.6 percent inflation adjusted, up from this year’s estimated 3.1 percent growth. Both advanced and emerging economies contribute to the improvement.

Europe is slated for moderate growth, 1.9 percent measured by GDP. Given the minimal population growth rate for the Continent, this is pretty decent but not booming. Industrial activity edged down earlier this year but has since recovered most of the lost ground. Although the deal with Greece merely papered over fundamental problems, the major economies will continue unscathed.

Here in North America, look for growth about in pace with last year’s. The United States economic outlook was described in my recent Economic Forecast 2016-2017. Canada will grow a bit more slowly than the U.S. due to its concentration in oil and other commodities. Mexican economic growth is solid, with low inflation and low unemployment. The country’s prospects are good.

Asia is the wild card for the global economic outlook. China in particular is opaque: we don’t really know what’s happening inside that giant economy. The official growth rate of GDP is 6.9 percent, down from 7.0 in previous quarters, but no one trusts the official statistics. We know that U.S. exports to China declined early this year but have looked better in recent months. Consumers are helping the economy, good news given weak capital spending. Elsewhere, Japan has relapsed into recession, though unemployment remains very low. Shrinking population and labor force prevent much growth there. India’s growth remains strong, but capital spending has slackened this year. Consumer spending and low commodity prices are strengths that should enable India to continue its strong expansion.

Leave A Comment